Double celebration for surging WH Smith

25th January 2017 12:15

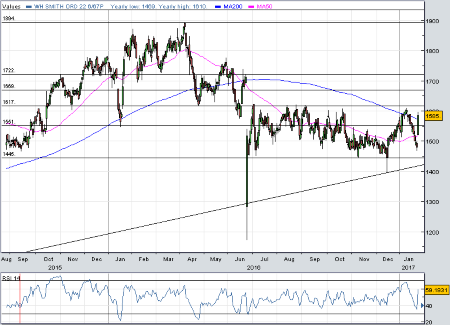

We haven't heard much from since final results in October. Numbers then failed to ignite much interest, and the share price has traded largely between £13 and £16 since the Brexit vote. But, after crowing that it will make more than expected this year, investors rushed to stock up on shares in the high street newsagent Wednesday, sending the price up as much as 8%.

Beat current estimates and Smiths can plan a double celebration to coincide with the 225th anniversary since Henry Walton Smith set up the business in 1792. It's a great story, and so is a first-half trading update.

In the 21 weeks to 21 January, like-for-like revenue from its more profitable travel division jumped by 5% as stores in airport lounges did a roaring trade over Christmas. Actual revenue was up 10%, with the weak pound worth 3% of that as international business keeps growing.

It's why group like-for-like sales are up 1% since the August year-end and total sales are 2% better.

Of course, the high street has changed beyond all recognition since Smiths became the world's first chain store. It's no longer driving the business, and the past few years have been more about damage limitation.

Still, the division grew trading profit by 5% last year to £62 million despite a 2% decline in like-for-like sales. So, a 3% drop in sales in the 21 weeks is not a disaster and better than many in the City had feared. It's also worth remembering last year was especially strong as adults went crazy for colouring books, or 'colour therapy' as Smiths calls it.

Chief executive Stephen Clarke reports strong demand for new seasonal stationery ranges and spoof humour books, like the new Ladybird series including my favourite How it works: The Wife. Despite his youthful appearance, Clarke is a high street veteran and has been successfully slashing costs at the unit, so gross margin is up year-on-year.

"As a result of the performance in Travel we expect group profit growth for the year to be slightly ahead of plan," he told shareholders Wednesday. "While there is some uncertainty in the broader economic environment, we remain confident that the group is well positioned for the year ahead as we continue to focus on profitable growth, cash generation and investing in new opportunities."

Based on these numbers, and given management's obvious confidence in the typically stronger second-half, consensus market estimates for profit of about £136 million this year have to rise. According to Investec's Kate Calvert, her own forecast for £139.7 million and earnings per share (EPS) of 102p is nearer the mark. Look for £148 million and 111p in 2018.

Using those figures, Smiths currently trades on 15 times earnings estimates for calendar year 2017. That's roughly in line with the sector, and gives room for further upside, argues Haitong Securities analyst Tony Shiret.

"The one-year, one third underperformance of the market has in our view been overly aggressive," he says. Excited by possible updates on the travel division alongside interim results on Wednesday 12 April, he rates the shares a 'hold' with fair value estimate of 1,680p.

Calvert thinks the shares are about the right price, but likes a dividend yield of well over 3%. "Valuation currently reflects the group's growth potential," she says, "but we see SMWH as a very well run, defensive, highly cash generative company, with attractive structural growth opportunities in Travel. 'Hold' retained."

After trailing the wider market badly for the past 12 months, old concerns about valuation can be put to one side. There's lots to like, and April's interims promise much. However, those results will need to be good if Smiths is to make a move above 1,600p stick.

It's also worth keeping an eye on that potentially problematic inflation figure, and technical support which has tended to kick in at between 1,445p and 1,470p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks