America versus China: A changing of the guard

25th January 2017 12:35

by Jan Dehn from ii contributor

Share on

It has been on the cards since 2008/09. China has been preparing for it for years with aggressive reforms, even at the expense of slower growth.

The US and other developed economies have been drifting inexorably towards it on a wave of myopia, neglect of reforms, debt issuance and, lately, a lurch towards economic nationalism.

And so we have finally arrived at the inevitable turning point, when China formally took over the mantle from America as the world's undisputed leader on economic issues.

Revealing a shocking degree of economic illiteracy, US president Donald Trump claimed in his inaugural speech that "protection will lead to great strength and prosperity".

America's economic abdication

His bleak, defensive and atypically American vision of pessimism and defeatism was a de facto abdication of America's erstwhile role as undisputed global leader on economic issues.

By contrast, Chinese president Xi Jinping's message at Davos spelled out a positive and ambitious agenda of openness and support for globalisation with the words: "Protection is like locking yourself in a dark room."

The irony of the contrasting positions adopted by Xi and Trump was not lost on the press: here was the leader of Communist China standing up for free markets, while the leader of the free worl' proposes to turn his country's businesses into the equivalent of protected French farmers. In reality, however, China has been liberalising its economy for decades.

The hand-over of global economic leadership will severely challenge the finance industry, which is usually desperate to be seen to be on the side of power. The US economy is still bigger than China's, and global financial markets are far more invested in the US than in China.

The finance industry now finds itself in the uncomfortable position of having to justify the usual bullish stance on the US despite the fact that even half-educated economists can tell you that the policies under consideration by the Trump administration will have a negative impact on the economy.

We think it is a fool's game to try to suck up to policymakers if their policies are bad. Far more businesses will lose than gain.

In the 1970s, the US tried in vain to protect a car industry that produced enormous gas-guzzling vehicles against imports of smaller, more fuel-efficient and ultimately more sophisticated Japanese vehicles.

"Eat your Japanese car", said the bumper stickers, yet today we all drive smaller, better, more economical cars. In retrospect, it is clear that Japan was not to blame.

The Japanese cars were just better. Imports were not the problem either. After all, they just provided consumers with the goods they really wanted.

Protecting dying industries can save jobs in the short term, but protectionism becomes ridiculous in the longer term. For example, suppose the good people of the Stone Age had insisted on defending the flint-axe industry as the Bronze Age beckoned.

China's relentless reform

It is obvious that no amount of protection would have saved the flint-axe industry as times and technology moved on. It is the same situation today: American industry today needs to man up or shut down, not be kept alive by artificial means at huge cost to the rest of the economy.

Clearly, China and the US are setting out on paths that will accelerate China's economic hegemony, while the US is now directly undermining its own economic future.

China's path is one of relentless reform, while America's is one of relentless stimulus. China is opening up as America is closing. Investors and the rest of the world should take notice of these contrasting developments.

Leadership is not free. Leadership requires bravery. Leadership demands the strength to hold firm to principles that are known to be right, even in the face of populism.

China has displayed precisely these characteristics in recent years, when, to the puzzlement of many, China has insisted on reforming even at the expense of a slowdown in growth. Perhaps now China's path will begin to make sense to the China-detractors.

The truth is that China astutely recognised that 2008/09 was a debt crisis in the Western world, and that the widely adopted policy response - yet more fiscal spending and money-printing rather than tackling the underlying problems of excess debt and declining productivity - would ultimately lead to a more hostile environment for Chinese exports.

Indeed, regardless of whether the hostility was due to diminishing demand in the West, weaker currencies due to quantitative easing and inflation, or protectionism à la Trump, China's critical insight was that American policy would ultimately seek to pass the cost of its own policy mistakes onto foreigners.

This insight prompted China to commence an enormous reform effort to try to rotate its economy's growth drivers away from exports towards consumption, even if this required extremely tough reforms.

China has therefore pushed ahead relentlessly with interest rate liberalisation, price liberalisation, painful productivity-enhancing reforms and capital account liberalisation. And the reforms will continue.

This is an opportunity for China detractors to stop and reflect anew: China was early and absolutely right in expecting hostility from the West and China was prudent to start to prepare early.

China to overtake the US by 2027

Unlike Mexico, which continued to cling onto the flawed notion that the US would always be a force for economic good - and is now paying a heavy price for its naïveté - China read the economic tealeaves exactly right and is far better prepared as a result.

There is no doubt that global economic leadership will now gravitate to the East. In addition to exercising leadership of key economic issues, China is well underway to becoming a true economic giant.

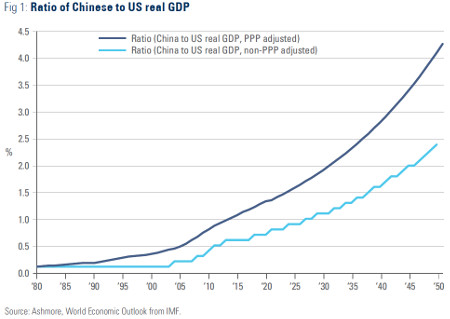

Based on the International Monetary Fund's forecasts for Chinese and US medium-term real GDP growth rates of 6 and 2% respectively, we estimate that China's economy will overtake the US economy within 10 years (by 2027).

Using PPP-adjusted per capita GDP and scaling up by the ratio of the Chinese population to the US population, we estimate that China's economy will be 4.1 times larger than the US economy by 2050, and even without PPP-adjustment China's economy will still be 2.4 times larger by 2050.

The rise of China will have many profound implications. The world's currency and bond markets like to benchmark themselves against the largest markets.

One obvious implication is therefore that CNY and the Chinese government bond market will replace the dollar and the US Treasury market as the world's main benchmarks for FX and fixed income.

While China's rise to unassailable economic and financial supremacy will be impressive in their own right, we think it is the rise of China as a consumer nation that will really take the biscuit. China's savings rate is likely to decline from 49% today towards single digits by the middle of the century.

This means that China will experience the largest consumption boom the world has ever seen, as consumption rises even faster than GDP. If America turns in on itself in some forlorn effort to cling on to former glories, the once legendary US consumer will be far less impressive in the future.

All this matters so much because global trade relationships are strategic in nature. It takes years of building trust to create truly deep and lasting trading relationships.

From the very highest level of executive power, the pathways for these two nations have now been laid bare for all to see. China is going to win and is inviting the rest of the world to ride along.

Jan Dehn is head of research at Ashmore.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.