The investment trusts I've been buying and selling

27th January 2017 15:00

by Andrew Pitts from interactive investor

Share on

Like many investors, I used the opportunity of some lazy days over the festive break to take a close look at my SIPP and ISA portfolios.

I wanted to check whether some of the decisions I've made over the past year or so - particularly during the second half of 2016 - had been beneficial or detrimental to my net worth.

My portfolio, comprised primarily of investment trusts plus a smattering of open-ended funds and exchange traded products, would probably make little sense to a professional portfolio constructor such as you might engage through a wealth management or decent financial advisory firm.

Fortunately, however, the structure still makes sense to me after my annual review. I employ three strategies, in descending order of importance.

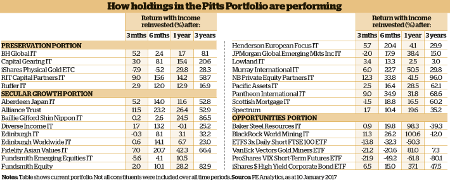

The first is long-term wealth preservation, followed by long-term secular growth and short-to-medium term opportunistic ideas.

Preservation plays

This portion of the portfolio is invested in multi-asset funds and trusts that have a decent long-term growth record, while aiming to limit volatility in periods of market stress.

These are, in descending order based on the amount invested, , , and trusts, and the open-ended fund managed by Troy Asset Management.

These account for around 20% of the total portfolio value and have served me well over the year.

Capital Gearing was the most recent addition in early 2016 and has since risen by 15%, while long-term holding Spectrum has been even more rewarding this year.

The percentage weighting in "preservation" rises to more than a quarter of my portfolio when my holding in the iShares Physical Gold ETF is counted. It's a long-term choice that I added to late last year in expectation of higher global inflation.

Secular growth slice

The long-term secular growth portion accounts for another 25%. I have been relieved to see reasonably substantial holdings in Asia and emerging market-oriented trusts return to favour over the past year.

gained 50% (although I did take some profits here), and gains - though not quite of that magnitude - were also generated from investment trusts , and .

Despite banking some gains from my holding in the latter's stablemate, Fundsmith Equity, in the third quarter, its 83% rise since I bought the fund means it remains the largest individual holding in my portfolio.

I have faith in manager Terry Smith's sensible and easily understandable investment strategy

That's a position I'm happy with, as I have faith in manager Terry Smith's sensible and easily understandable investment strategy.

Having taken profits and more from my holding in earlier in the year, I decided to reinvest again towards the end of 2016 and have since been well rewarded.

However, in the knowledge that market timing is extremely difficult to get right, I've resolved to leave this holding alone now and accept that its performance will be volatile.

I'll be doing the same with Baillie Gifford-managed stablemate after taking profits earlier in the year.

I had considered crystallising some of the exceptional gains from a few long-term holdings in Japan trusts and , but I will resist for now.

In isolation they are not large holdings, and I take comfort in favourable comments from some respected fund managers who believe Japanese equities look comparatively undervalued from a global perspective.

I've also recently invested in , which has recovered well under a new manager.

Among my UK holdings, I banked gains in before the EU referendum and left my long-term original investment in place.

Europe continues to be under-represented in my portfolio

I had been waiting for an opportunity to invest in , and the post-referendum fallout provided that opportunity, for a 22% gain to date.

I'll be holding that for a while, along with a recent purchase of fellow equity income trust , whose manager James Henderson is rediscovering the form that has contributed to a stellar long-term record.

I have similar respect for his colleague John Bennett at Henderson Global Investors, whose trust also has a strong long-term record.

Europe continues to be under-represented in my portfolio (justifiably, I believe), but I consider this and stablemate among the best options to consider, as well as and the currently underperforming trusts.

I will also be sticking with my two private equity holdings, and trusts, but with the latter I have decided to bank the high half-yearly dividends rather than reinvest them.

Opportunistic picks

These currently account for around 15% of the portfolio. Some of them have been less than successful over the past few years. For some time I was "catching a falling knife" with the likes of and trusts.

Thankfully, their share prices have more than doubled over the past year, which has helped cap losses, and I'll continue to hold them on expected commodity market buoyancy.

As Wall Street and London hit fresh all-time highs, UK and US markets look priced for perfection

But I have hit the 'sell' button on , happy with the 30% gain since buying in late 2015 in the expectation of corporate action and better management but now underwhelmed by the board's decision to farm out management to a panel chosen by consultancy Willis Towers Watson.

I will also likely sell a recently purchased high-yield bond ETF - - which has gained almost 10%, good for a bond fund in today's febrile climate I reckon.

As well as topping up on physical gold in December, I placed a shorter-term bet on gold-mining companies via the VanEck Vectors Gold Miners A Shares ETF. I am already considering taking some profits and leaving the original outlay invested, as it is up 11% in less than a month.

My biggest mistake over the year? Believing that buying ETFs that track the Vix index - Wall Street's fear gauge - in the expectation of extended volatility in the wake of both the EU referendum and the US presidential election would provide protection.

It hasn't, and neither has a leveraged bet on shorting the FTSE 100 via . But losses have been more than covered by gains elsewhere, and these plucked turkeys may sprout new feathers in the year ahead.

As Wall Street and London hit fresh all-time highs, UK and US markets look priced for perfection. Should that prove not to be the case (which I continue to expect), I will start putting the largest portion of my portfolio - a 35% weighting in cash - back to work.

On the watchlist

Eastern Europe is one area I have had little exposure to for the past few years, but rising commodity prices are helping fuel growth in the region and investor interest is being rekindled.

Previously, I had invested in , but I feel a wider remit would be more appropriate via trust, which is managed by the respected Sam Vecht.

Biotechnology is another area that interests me, given the rapid pace of medical innovation and because some of the froth has been wiped off valuations.

If you want to beat the US market, you need to choose a fund that invests outside of the mainstream

trust hides its light under a bushel, but its performance stacks up well against funds such as and . It is also on a decent discount to net asset value and, unusually for a trust such as this, it distributes income.

I'm a strong believer that if you want to beat the US market, you need to choose a fund that invests outside of the mainstream. Although US markets look fully valued, I have a couple of funds on my watchlist.

One is the little-known VT , which has a large position in community banks that have soared since Donald Trump's election.

Another is the geared ordinary shares of micro-cap specialist , which has most of its assets, including real estate, in the US.

However, as this is a small split-capital trust, I'll be paying close attention to the entitlements of other share classes, the dealing spread and the trust's underlying charges, which look excessively hedge fund-like.

Other trusts I'm watching include , and, following a failure to act on my own tip to secure a bargain in the post-Brexit vote August issue, .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.