Share of the week: Tweet triggers rally

27th January 2017 15:47

by Lee Wild from interactive investor

Share on

"January has been a record-breaking month for valuations & instructions, so if there's a right time to start your property search, it's now!"

That was how online estate agent chose to tell everyone that business is booming. Twitter may not be conventional, but it is effective!

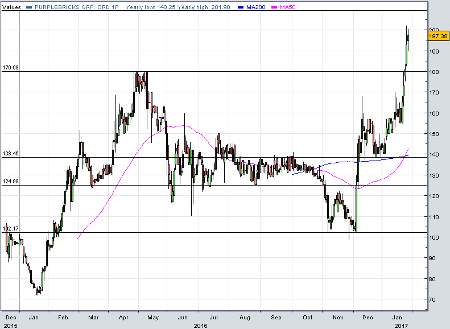

It helped trigger a rally in the share price to give Purplebricks a gain of 27% this week. And it's only seven weeks since interim results when chief executive Michael Bruce talked of "a confident outlook for the future".

"We have momentum, a superior, low fixed cost flexible business model and a strong balance sheet, which we will leverage further in the early part of the busier spring market so as to build on our success to date," he explained at the time.

Since then, Purplebricks shares have almost doubled, up from 103p to a peak of 201.9p Thursday.

Of course, the government's decision to abolish tenant fees for letting in its Autumn Statement in November was good for Purplebricks. The firm said it does not expect the decision to have "any meaningful impact on the business".

That's why its shares have thrashed the opposition since 23 November. has slumped 29%, 15% and closest peer is flat.

After a "disappointing" year for his Woodford Patient Capital trust, star fund manager Neil Woodford has something to cheer about. He's owned a big stake in Purplebricks since it floated in December 2015, and watched the price sink to a low of 72p a year ago.

"A very strong set of interim results, however, has drawn the market's attention back to the company's rapid growth and its exciting long-term prospects," said Woodford in an update last week.

"It continues to attract an increasing number of customers in the UK and, with the strategic and successful launch of its branch in Australia, Purplebrick's disruptive and competitive business model is beginning to demonstrate its international viability."

Well done, too, to both Bruce and chairman Paul Pindar. We highlighted a year ago how the canny dealmakers hoovered up shares at just 78p during the stockmarket crash. Clearly, a pair to follow.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.