Two fund tips for China's Year of the Rooster

31st January 2017 09:10

Chinese New Year began on 28 January, with celebrations for the Year of the Rooster continuing into February.

People born under this zodiac are said to be hardworking, confident and popular. Is this a good sign for Chinese equities? Before we crow too loudly, there are a few things to keep in mind.

Investors could be forgiven for seeking a bit of celestial guidance when it comes to China, given its ups and downs over the past year. Last January, China's stocks were plummeting amid fears of devaluing currency, high company debt levels and slowing economic growth.

Lo and behold, though, the market staged a comeback and ended the year up 20% in sterling terms. The curious thing is that none of investors' concerns have really gone away. Instead, the Chinese government stepped in, encouraging state-owned banks to issue yet more loans to boost the economy.

While this has worked in the short term, it doesn't provide the best platform for future growth. What is more, these old state-owned businesses comprise a hefty part of China's stock market and loading them up with bad debts isn't doing them any favours.

With a strong US dollar after Donald Trump's election, investors are withdrawing their money to re-invest it in places such as the US, where they believe they have the potential to get better returns for less risk. If (or when) the US raises interest rates again, the dollar could go higher still, making China even less attractive.

Trump's protectionist trade stance is also worrying, given how much of China's growth over the past decade has come from cheap exports. That said, there may be a silver lining for China here. Trump recently announced he would not proceed with the Trans-Pacific Partnership – a 12-country agreement that placed the US as the central trade power in the Asia region and of which China was not part.

China has wasted no time since in promoting its own Regional Comprehensive Economic Partnership, which is a proposed trade deal between south east Asian countries.

Also, on the plus side, it's easy to forget the sheer size of China's population – around 1.4 billion, so more than four times the size of the US. As China's middle class expands, the potential for consumer spending growth is enormous.

If you're investing for your long-term future, you probably want some exposure. But you need to choose wisely.

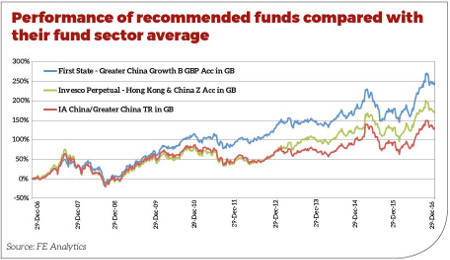

My two picks are the fund and the fund, both of which have soundly beaten their peers over the past decade, as you can see in the chart above.

Demand for the First State fund has been so fierce since its launch in 2003 that it closed to new investors for four years, re-opening in February 2016.

Its manager, Martin Lau, invests broadly in 'greater China', taking a heavy weighting to Taiwan in particular. This gives his fund defensive characteristics that many China funds don't have.

The Invesco fund has fewer holdings. It just invests in Hong Kong and China, and is well placed to benefit from demographics, given it has over 50% in the consumer discretionary and staples sectors.

It mostly avoids financials and energy stocks, making it a solid play on the 'new China' rather than the 'old'.

Darius McDermott is the managing director of Chelsea Financial Services and FundCalibre.

This article was first published by our sister magazine Moneywise, available online here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks