Four new share picks for February

1st February 2017 12:10

by Lee Wild from interactive investor

Share on

January was clearly a month of two halves. A Trump rally, inspired by the billionaire president's pro-business rhetoric, spilled over into 2017, driving both the and small-cap indices to record highs mid-month. But investors are not so keen on his politics, particularly his immigration ban, and large-caps have had a miserable couple of weeks.

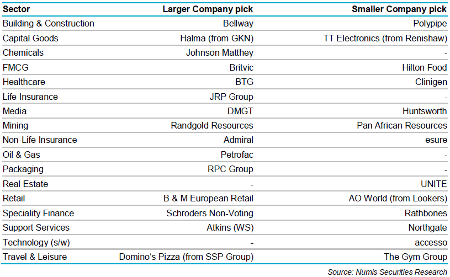

It's why a pair of successful portfolios run by City analysts at Numis Securities has undergone some changes in preparation for a potentially volatile February.

Numis's large-cap portfolio of stocks worth over £1.4 billion delivered a total return of minus 0.9% in January up to the close of business Friday. That lagged the FTSE 350, which rose 0.6% for the month, although the portfolio is still 35% ahead of the benchmark index since it was set up at the beginning of 2013.

The broker's small-cap portfolio of stocks worth less than £1.4 billion did much better. A total return last month of 4.2% was more than double the 1.8% generated by the benchmark index - the Numis Smaller Companies + AIM index. It's now 15% ahead since 2013.

These are not shorter-term trading tips, rather a one-year view of the portfolio's constituents, but Numis analyst Will Wallis has made two swaps in each portfolio this month.

In the smaller company portfolio, electronic components and sensors group kicks out highly-rated precision engineer LSE:RSW:Renishaw, while web-based white goods retailer replaces car dealer .

In the big boys portfolio, - the maker of smoke detectors and automatic door sensors, and an Interactive Investor favourite - gets the nod. Making way is LSE:GKN:GKN, the £6 billion car parts and aerospace supplier.

And Numis fancies something different in its lunchbox this month, placing an order for in favour of , which runs food outlets in airports, train stations and motorway services.

Here's what Numis thinks of the new additions:

TT Electronics

Its markets have been more difficult than expected, but results on 9 March are tipped to confirm another year of progress in terms of underlying numbers at TT. A weak pound will deliver benefits, too.

"A return to internal growth combined with the move to higher value proprietary technology should see improved earnings growth and valuation," writes Numis analyst David Larkam, who slaps a 185p price target on the shares.

AO World

It's almost two years since AO World floated, and it's not been easy. However, analyst Andrew Wade thinks the company is firmly back on the front foot in the UK, and that the shares could be worth 250p.

"We expect continued market share gains in the UK and a growing contribution from category expansion," says Wade. He values the UK business at about £600 million versus a current market capitalisation of £670 million.

"On this basis, we see significant upside as AO replicates its outstanding proposition-led model across Europe."

Halma

Halma is an acquisitive business, which aids diversification. It's a super-reliable dividend payer, too, having increased the payout by 5% or more each year for the past 37 years.

Numis's Nick James thinks he's spotted a "rare buying opportunity", pricing the shares at 1,160p versus 926p currently. Earnings have grown at 12% compound annual growth rate (CAGR) over the past decade, and generating 34% of revenue in the US positions it well for a "Trump boom". Sterling weakness aids its exporting businesses, too.

"This upside combined with the potential for more acquisitions leaves room for further upgrades. We believe the pull back in the stock (caused by a hiccup in recent acquisitions) represents a very attractive entry point."

Domino's Pizza

Interest in Domino's Pizza has picked up since a capital markets day in November. Analyst Richard Stuber certainly has "renewed confidence" in the company's rollout ability (7% CAGR) and opportunity to drive like-for-like sales.

An "attractive" asset-light model generates a return on invested capital (ROIC) of over 50%. "We believe the market is yet to fully reflect the value for its international operations," adds Stuber, who also bets that final results on 9 March will support his 'buy' recommendation and 446p price target.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.