The Land of Rising Dividends in 2017

3rd February 2017 12:25

by Jim Levi from interactive investor

Share on

Our panel of asset allocation experts are not always ahead of the curve, but they were bullish about equities and bearish about government bonds ahead of Donald Trump's surprise victory in the US presidential election in November.

Their optimism was fully justified in the wake of Trump's triumph, as equity markets ended 2016 on an exuberant note while rising US interest rates knocked back bond prices.

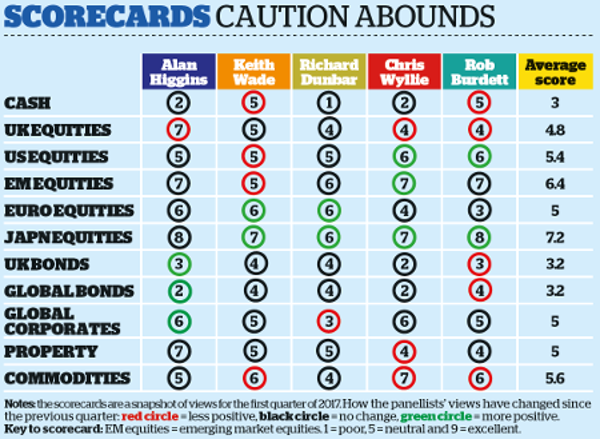

Where four of the panel fell down was in their failure to anticipate that the already highly rated US stockmarket would lead other markets higher. In giving the US a neutral score of 5, they all proved too cautious. Only Keith Wade, head of global strategy at Schroders, raised his score from 5 to 7.

Now Wade is in position to take profits, lowering his score back to a 5 again, while two of our panellists are trying to play catch-up.

Key questions for 2017

Chris Wyllie, chief investment officer of Connor Broadley, and Rob Burdett, co-head of multi-manager funds at F&C Investments both raised their scores to 6 when, some might say, they should have been doing what Wade is doing.

Let's face it, the year just past has been a very strange one for financial markets, which have proved amazingly resilient to political shocks.

"It took the market three days to recover from Brexit, three hours to recover from Trump and three minutes to recover from the exit of Matteo Renzi as Italy's prime minister," as Burdett puts it.

"We do not know the future," Wade ruefully admits, "though we are paid to try to anticipate it. But I sometimes wonder, if we did know the future would it really help us make good investment decisions?"

He reckons that had he known beforehand that Britain would vote for Brexit and Donald Trump was going to the White House, "I very much doubt I would have positioned myself for equities to end the year on a buoyant note and for US shares to end the year at new peaks with the dollar at its strongest since 2003. Many predicted a Trump victory would mean meltdown for Wall Street".

If we did know the future, would it really help us make good investment decisions?

Alan Higgins, chief investment officer at Coutts, agrees: "Markets have humbled me many times. So I try to stick to the basics by upgrading a sector on a fall and downgrading on a rise."

Richard Dunbar, deputy head of global strategy at Aberdeen Asset Management, has his own approach to minimising risk. He rarely moves any of his scores more than one point above or below neutral.

This approach will not set pulses racing, but Dunbar believes a profitable and sensible strategy is "to operate a balanced portfolio that does not go overboard with any one bright idea".

"The fact is that some risk assets, like US equities, have done well, while some risk-free assets have also done well, and I can see a case for both bonds and equities," he says. So we find his current score of 4 for UK and global bonds is the same as his score for UK equities.

The key question for 2017 is whether the dollar and US equities will stay strong. All our panellists struggle with high US valuations. "The world and his wife are still underweight in US equities," claims Burdett, "and I myself thought the US market would weaken in the second half of last year."

Burdett and Wyllie's decision to raise their US equities score from 5 to 6 is supported by a survey from Bank of America Merrill Lynch in the wake of Trump's victory, showing fund managers more bullish on America's growth outlook than at any time since March 2015.

Trumponomics to spur growth

"US markets seem more ready to accept the idea that Trump will be good for growth," says Wyllie. "That may help explain why US equities have been leading the way higher. Fund managers on this side of the Atlantic seem much less convinced."

Wade's research team at Schroders support this view, and indeed have upgraded their total global growth forecast for the first time in nearly two years - expecting a 2.8% upturn this year (2017) and 3% next (2018).

Since the low point a year ago, the main US indices are up between 25 and 30% to record levels

However, Wade is sceptical about some aspects of Trumponomics. "The current optimism is getting a bit ahead of itself. It will be difficult for him to create 25 million jobs when there are only eight million unemployed in the US," he points out.

So he expects inflationary pressures to increase and interest rates in the US to rise steadily throughout the next two years. "Also, the strong dollar is likely to put a squeeze on earnings in US corporates," he adds.

Higgins sees "more of a risk from Brexit than from a Donald Trump presidency". He observes that Trump "is very pro-business, pro-tax cuts, and that is very pro equity markets. But we still struggle with the expensiveness of US equities."

All the post-Trump euphoria causes Dunbar to recall the state of equity markets just a year ago.

"In the space of six weeks there had been a swing from universal optimism to universal pessimism as markets feared recession in America and the sky falling in on China," he says. "It was without any real evidence to back it up. Now I wonder if the universal optimism is justified?"

The market seems to think so. Since the low point a year ago, the main US indices are up between 25 and 30% to record levels.

Japan: Land of the Rising Dividends

If the panel struggles to find value in the US, there is much more enthusiasm for other equity markets. Japanese equities in particular attract much attention. It has been rare to find such enthusiasm for one sector as the panel now feels for Japanese equities.

After his recent visit to Tokyo, Wade raised his score from 5 to 7 and Wyllie has followed suit. Long-time enthusiast Burdett has tweaked up from 7 to 8. The region's average score is now an exceptional 7.2.

"The problem was the currency, which has now weakened, and the authorities keep undermining it through quantitative easing," says Wyllie. "You have to watch the currency, as it can be volatile and if you get it wrong it can be the road to nowhere."

Alan Higgins is happy to keep his score at 8, given that the Bank of Japan and the big local pension funds are big supporters of the stockmarket.

Wade, who popped into the Bank of Japan on his recent visit to Tokyo, says the central bank "still has some way to go in terms of stimulating the economy, where it has made it clear it is willing to see inflation go to 2%. It is nowhere near that level yet".

Japan could still keep up a progressive dividend policy even if earnings were to fall

Burdett believes Japan could still keep up a progressive dividend policy even if earnings were to fall. "We are in fact expecting earnings to rise," he says.

"In contrast, in other equity markets we think dividend growth will require very active management." Not for nothing is Japan being dubbed the Land of the Rising Dividends.

Almost as high are the scores panellists give for emerging markets, even though the strength of the dollar tends to suck funds out of those markets and into the US.

Burdett sticks with a score of 7. "It has not worked for us yet but they should benefit from rising global growth and higher commodity prices," he admits.

"The oil price has more than doubled since its 2016 low and this has turned Brazil and Russia into the two best-performing markets," says Wyllie. "My view is that the long bear trend in emerging markets is only now just turning round."

Wade had a grand tour of Asian capitals - taking in Beijing, Tokyo and Seoul - just before Christmas, and is the only panellist now to downgrade his emerging markets score, from 7 to 5. He remains concerned about a shock devaluation of the Chinese currency.

"Donald Trump's policy on China may trigger it, but I think he will take his time imposing new tariffs on China," he says. Higgins acknowledges this risk but keeps his score at 7. "These markets remain cheap," he says.

European equities edge up

The average score for European equities has edged up from 4.4 to 5. But there is more disagreement between panel members on this sector. Dunbar has raised his score here from 5 to 6. He makes light of the crisis in Italian politics.

"There have been 64 governments in Italy since the war - so the situation now is fairly normal," he says. "Meanwhile various forms of quantitative easing are pumping money into the eurozone economy. There are always good companies to buy in the European arena."

Wade supports him, raising his European equities score from 4 to 6 on the same belief that all the stimuli being applied will work through to growth and higher corporate earnings.

But Burdett remains underweight here, as does Wyllie. Burdett says: "The risk of a far right victory in elections in France and Holland is being taken a little bit too complacently by stockmarkets."

It is difficult to be underweight UK if you are positive overall on equity markets

Like continental Europe, UK markets are disputed territory among the panel members. Only Higgins remains bullish. "The UK stockmarket - especially the FTSE 100 - has done well during 2016, rising 27% from its low point in February last year," he says.

"Some 70% of revenues of these top 100 companies come from overseas; but some 40% of the revenues of companies in the FTSE 250 also come from overseas, and we find companies in this index attractive. From their post-Brexit low point in June they have recovered 18.5%."

Nonetheless, he is taking some profits and lowering his score from 8 to 7.

Three other panel members are underweight, with both Wyllie and Burdett lowering their scores from 5 to 4. But Wade argues it is difficult to be underweight UK if you are positive overall on equity markets, and keeps his score at 5.

Both UK and global government bonds remain out of favour, with average scores in both sectors sticking at 3.2. With yields rising, Higgins has raised his scores here by one point but remains underweight, while Burdett has lowered his scores by the same amount.

Corporate bonds gain an overall neutral score, but Dunbar has sold down this sector to fund his bigger exposure in European equities.

There has been little change in scores for the property sector, where pre-Brexit confidence has been eroded. Only Higgins remains overweight because the sector provides "an attractive income stream".

In the view of Dunbar, the sector is in "a bit of a no-man's land at the moment. But you can still find high-quality buildings with decent tenants yielding 5%".

While Wyllie has edged up his commodities score, both Burdett and Wade have lowered theirs. Wyllie feels the long bear market in commodities is finally over and raises his score from 5 to 7.

"Within the commodities complex, gold is a good hedge against whatever Trump might do while real yields remain negative - and that is usually when gold does well."

However, Burdett is inclined to trim his score, as he thinks the recent rise in the oil price may now have run its course.

Pannelist profiles

Rob Burdett is co-head of multi-manager at F&C Investments. The F&C multi-manager team collectively manages more than £21 billion in assets.

Chris Wyllie is chief investment officer at Connor Broadley, a financial planning and investment management firm with £350 million under management.

Richard Dunbar is deputy head of global strategy at Aberdeen Asset Management. The company has £330 billion under management.

Keith Wade is chief economist and strategist at Schroders. The asset management company has £271 billion under management.

Alan Higgins is chief investment officer at Coutts, the private banking arm of RBS, which has £14 billion of assets under management.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.