A stunning month for aggressive investors

3rd February 2017 16:08

by Lee Wild from interactive investor

Share on

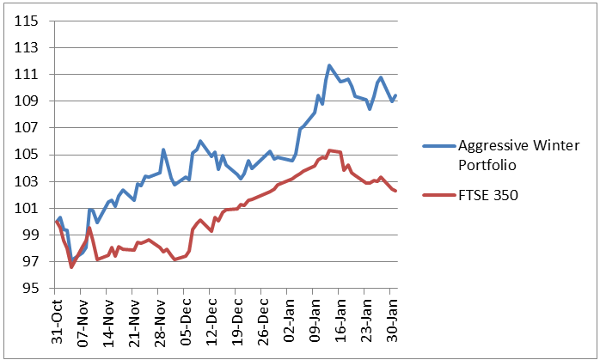

Three months ago, Interactive Investor launched two seasonal portfolios based on the best-performing shares of the past decade. It's the third year we've run them and, despite incredible uncertainty this time, the 2016/17 Aggressive Winter Portfolio is wiping the floor with the benchmark index.

That this basket of shares is outperforming is not a complete surprise. Picking the portfolio was relatively straightforward. Employing the services of Stock Market Almanac author and mathematician, Stephen Eckett, we screened the FTSE 350 for share price performance over the six winter months in each year of the past decade.

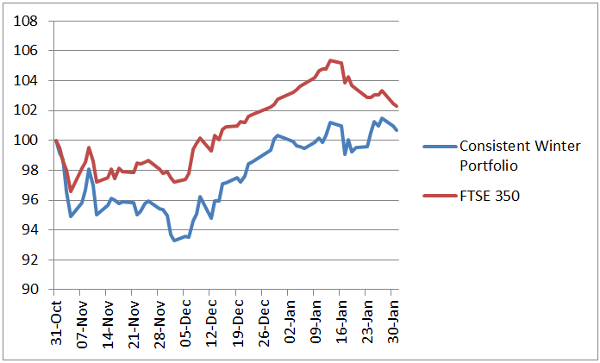

Our so-called Consistent Winter Portfolio contains the five most reliable FTSE 350 companies of the past 10 years - each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Investing in the reliable basket of shares for the past 10 years would have netted an average annual profit of 18%. In return for the obvious increase in risk, the aggressive portfolio has averaged annual profit over the past decade of 32%.

All action in January

Donald Trump's election win in November confounded the experts. Instead of collapse, global equity markets went through the roof and, in January, despite concerns about share valuations and the maverick Trump, both Wall Street and the hit a record high.

Nerves got the better of investors in the second half of last month, however, and share prices pulled back, but not by much. Trump's social policies might leave a nasty taste, but his pro-business approach to politics means any sell-off has been both modest and brief.

Admittedly, our portfolios have had mixed fortunes - the consistent shares are making money and increased in value by 0.36% last month. A total gain of 0.7% is still 1.6 percentage points less than the FTSE 350, however, even after the benchmark index fell 0.43% in January.

Our aggressive portfolio on the other hand has exceeded all expectations. Trump, Brexit, Italy, and unprecedented outperformance over the summer months would make it tougher this year than ever before, right? Not for this handful of high-flyers.

Some big individual performances gave the portfolio a 4.4% gain for the month and an impressive 9.5% since the six-month strategy began. It peaked mid-month with a profit of almost 12%. In comparison, the benchmark is up only 2.3%.

Aggressive Winter Portfolio

Fighting it out for top spot in January was long-time Interactive Investor favourite and Brexit-bashed housebuilder . And it was the high street tracksuits-to-trainers chain that edged it, up 9.2% last month against an 8.9% gain at Wimpey.

After a great Christmas and strong second-half to its financial year, JD said full-year profit will exceed current consensus market expectations of £200 million by up to 15%. The shares jumped 10% on the news and have shown no sign of giving that back.

Wimpey started well in 2017 after Deutsche Bank analysts said the high-yielding shares were a 'buy' and worth 239p. And, with the domestic economy coping well post-EU referendum, the shares are as high as they've been since the June crash.

Bosses also said three weeks ago that underlying operating profit for 2016 would be at the upper end of market consensus estimates for £706-£755 million.

Elsewhere, equipment rental giant and workspace provider (formerly Regus) beat the index, up 1.7% and 1.5% respectively. Even gaming software laggard beat the market with a 0.4% return for the month.

Consistent Winter Portfolio

So, the consistent portfolio had a more modest month after December's corker when it rose 5.6%. But the final number masks some decent individual performances.

Best of the bunch was speciality chemicals company . It was one of those who'd had a great summer, and would struggle to keep up that performance over the six-month strategy.

However, analysts at Barclays published a big note on the company, repeating their 'overweight' rating and £36 price target, implying 8% potential upside.

Ahead of results due later this month, the broker said a forward price/earnings (PE) ratio of less than 20 times makes Croda the cheapest stock in the consumer chemicals sector. That's despite forecasts double-digit operating profit compound annual growth rate through to 2018, plus strong cash generation. That leaves room for special dividends and/or bolt-on acquisitions.

Heat treatment specialist did well, too. It was up over 3% in January, and is still going strong three weeks ahead of results for 2016. Catalytic convertor specialist is also in favour, up 2% ahead of what turned out to be OK third-quarter results this week.

On the downside, Irish building materials success story took a small step back. It's still up 5% for the first three months of the strategy, though, and non-executive director Gillian Platt's decision to spend €33,000 on shares at €33 (£28.44) each is a clear positive.

Finally, caterer fell nearly 6% in the month, although it's worth remembering it had risen 9% in December to within sight of record highs.

Another of the summer stars, and ahead of first-quarter result on 2 February - they turned out to be in line with expectations - Compass is down 5% so far for this year's portfolio.

However, while rising bond yields/inflation continue to make life tough for defensive stocks, analysts at Barclays do like its impressive underlying total shareholder returns of about 12.5%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.