10 UK shares that pass Warren Buffett's tests

3rd February 2017 16:36

by Kyle Caldwell from interactive investor

Share on

Looking for reliable investment ideas for your ISA? Stocks to tuck away in the knowledge that the quality and strength of the businesses should serve you well over the long term?

If so, where better to start than with the approaches of the investment gurus who have made names for themselves - not to mention a great deal of money - as the world's most revered investors?

In the February issue of Money Observer, our sister publication, we ran through the investment philosophies of four of the greatest heavyweights - Warren Buffett, Sir John Templeton, Jim Slater and Peter Lynch - while with the help of Stockopedia, a data website for self-directed investors, we identify a selection of UK-listed shares likely to attract each guru today.

Next week we will reveal the shares that fit the bill for Templeton, Slater and Lynch, but today we focus our attention solely on Buffett, arguably the most famous investor of all who remains one of the most closely watched investors in the world.

Warren Buffett

There are various attributes Buffett looks for, but his basic approach is to sniff out companies that he thinks can consistently increase their intrinsic value and sustain a high return on equity over the long term, and then not to overpay for them.

To find companies well-placed to keep competitors at arm's length in the decades to come, Buffett looks for businesses with strong economic "moats".

The quality growth names to which he is naturally drawn possess some sort of competitive edge, such as being armed with intangible assets or selling a product or service bought repeatedly by a loyal customer base.

Additionally, he wants to own shares in businesses that are price-makers able to dictate what they charge for their product, rather than price-takers lacking the market share to influence the price.

Morningstar, the data company, explains that pricing power also applies when it is too expensive or troublesome to stop using a company's products. Gas and electricity suppliers, for example, benefit from this sticky money effect, as customers cannot be bothered to switch.

Another attribute that can give a company an economic moat is the so-called "network" effect. According to Alex Morozov, European director of equity research at Morningstar, the term describes the phenomenon whereby goods and services become more valuable when more people use them.

Morozov names US-listed as an example: as MasterCard grows customer numbers, more and more stores have to accept MasterCard as a form of payment.

"There's a finite life for excess returns, as in the background there are always new firms trying to unseat the more established names. Companies that have a wide moat should in theory continue to earn excess returns for a long time, but there are of course no guarantees," adds Morozov.

Examples of businesses that have in the past enjoyed wide moats but no longer do so today include , the photography firm that missed the shift to digital. Another stock to suffer a similar fall from grace is mobile phone provider Nokia.

Which UK shares would Buffett buy?

Which UK shares would Buffett buy?

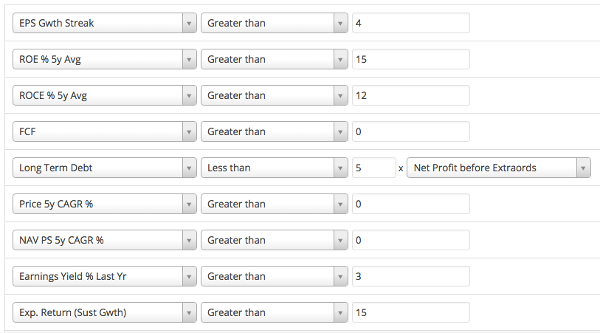

Stockopedia devised a share screen using the various moat attributes to identify 10 UK-listed shares that Warren Buffett would potentially buy today, and that are trading on reasonable valuations.

The shares, listed in full in the table, include household names such as and .

The latter suffered a sharp share price fall at the start of January on the back of its warning of lower-than-expected profits for the year ahead, but scored favourably on the Buffett-inspired screen, which places a particular emphasis on a high return on equity.

Ben Hobson of Stockopedia adds: "In essence, Buffett's main focus is on quality and consistency.

"He is not just looking for great profitability; instead he is looking for a long, strong track-record of earnings growth and cracking returns that point to firms with a durable competitive advantage.

"Some shares identified by the screen are small, others are large, but they are generally all good and potentially great businesses."

Funds that follow Buffett's approach

Certain funds aim to replicate the success of each guru. Some are even designed on their investment approaches and philosophies.

When it comes to Warren Buffett, the is the stand-out example. Manager Keith Ashworth-Lord focuses on comprehensible business models, unleveraged balance sheets and strong cash flow.

Other fund managers who follow Buffett's wisdom include Nick Train, manager of , and Terry Smith, who heads up the . Both managers aim for a low turnover and to buy businesses they can hold forever.

For passive fans there's an exchange traded fund listed in the US that tracks a basket of shares considered to have wide moats.

The costs 0.49% and has generated returns of 67% over the past three years. Among the top 10 holdings are Walt Disney and Procter & Gamble.

Screen rules

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.