Glencore re-rating has further to run

7th February 2017 15:04

by Harriet Mann from interactive investor

Share on

You'd think the threat of an interest rate rise would have investors running from heavily indebted copper miner and commodities trader . But, as commodity prices and higher yields move arm-in-arm, Glencore's cash taps look firmly turned on. Ahead of its full-year results later this month, some in the City can't get enough.

Late last year, Glencore said it expected to make $14 billion cash profit in 2017, with $6.5 billion of free cash flow (FCF). It's not been a smooth ride, but stronger spot prices over the past three months mean UBS estimates Glencore's forward free cash flow yield has already jumped from 12.7% to 13.9% - that's $600 million of extra cash in 2017.

Use the broker's more bullish price forecasts and Glencore could generate $7.5 billion FCF this financial year for a 14.7% yield. Over at Barclays, the team pencils in a 14.1% yield for this year, rising to 16.6% in 2018.

Since the election of Donald Trump in November, US bond yields have risen sharply in the belief that the new President's pro-business policies will drive economic growth and inflation and trigger further interest rate rises. There is a long-established correlation between bond yields and commodity prices.

Of course, a rate rise could weigh on the miner with its debt burden, but Barclays is confident the blue-chip is in a good position. It will generate higher interest income from its $15 billion of Readily Marketable Inventories (RMIs), although any benefit will be paid in higher profit and loss (P&L) interest. That's because the RMI's are funded by 100% floating rate debt. However, it does charge higher interest on cash loaned out to customers without access to conventional sources.

Tier 1 businesses

"It is difficult to argue the industrial and marketing assets are anything other than tier 1 businesses in our view, the balance sheet is deleveraging at speed and will carry far more conventional ratios relative to history, and its latent growth potential is best in class," explains Barclays analyst Ian Rossouw. "The valuation metrics speak for themselves," he adds. "As perceptions shift on these issues, we expect a progressive re-rating."

Glencore will beat expectations when it releases full-year results on 23 February, reckons UBS's Miles Allsop. The analyst thinks underlying cash profit will reach $10 billion, as Glencore raked in $153 billion of revenue throughout the year. This should swing pre-tax profit to $1.5 billion from an $8 billion loss last year, giving earnings per share of 14.1 cents.

After raising $2.5 billion in 2015 to help slash debt, Barclays isn't too concerned by Glencore's balance sheet and believes it will be unleveraged (ex-RMIs) by 2019, although, in reality, surplus cash will likely be spent on higher dividends and M&A.

Debt, according to UBS, is likely to have shrunk to $15.9 billion in 2016 ex-RMIs from $26 billion in 2015.

If spot commodity prices are stable until results day, the miner could lift 2017 guidance for free cash flow and earnings before interest, tax, depreciation and amortisation (EBITDA/cash profit) by 5-10%. For now, Allsop expects EBITDA of $15.3 billion, pre-tax profit of $7.9 billion and 38.5 cents of EPS.

The analyst explains: "We have a 'buy' rating on Glencore as we believe its valuation is attractive, it offers leverage to commodities which have the most attractive fundamentals (Copper/Zinc), and it should deliver material volume growth from latent capacity; we expect the share to re-rate as returns step up from 2018."

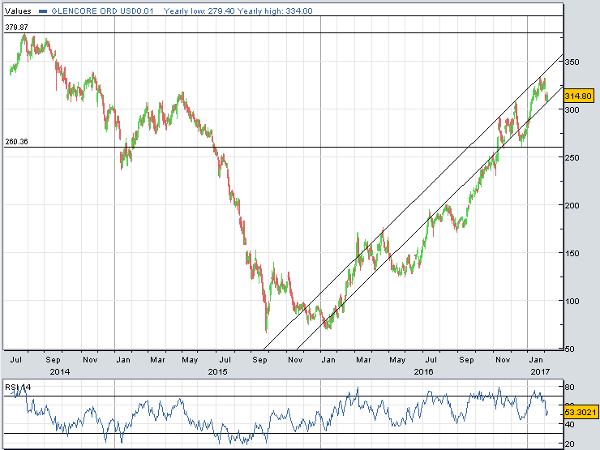

Glencore certainly had the wind behind it through 2016, jumping three-fold over the 12 months. The new year got off to a great start, too, with the shares changing hands for 315p Tuesday.

Both analysts reckon there is still plenty of upside, with Barclays' slapping a bullish 390p target price on the shares, implying 23% potential upside. UBS has a slightly more conservative 330p target.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.