Fund briefing: Contrarian funds

9th February 2017 10:29

by Rob Griffin from interactive investor

Share on

Brave investors wanting to make higher-than-expected returns are naturally drawn to contrarian funds. But it's not a stance for the faint-hearted.

Managers of these funds have a reputation for ignoring consensus views and drawing their own conclusions. And while there is the potential for them to reap handsome rewards by going against the crowd, it is equally possible for them to be horrendously wrong and lose money.

A successful contrarian investor is not a gambler. It is someone who doesn't follow the general consensus because they either disagree with the view or feel it's been exaggerated.

This is especially relevant given many investors adopt a herd mentality. A contrarian fund manager, therefore, will use their knowledge and experience to buy unloved companies and industry sectors that are being shunned by the rest of the market. By adopting this approach, they stand to make strong returns when these positions outperform.

US equities

They may also take different macro-economic views in terms of the outlook for growth, inflation or interest rates. Patrick Connolly, a certified financial planner with Chase de Vere, says: "Many investors are positive about US equities and see the election of Donald Trump as good news for the US economy. However, a contrarian manager might not buy into the US growth story - or may see value in beaten up sectors."

The performance of contrarian funds can also be quite volatile. As a result, they can often be seen at the top or bottom of fund performance tables.

Investing in such a fund, therefore, requires patience.

"A contrarian approach can only work where you have good quality fund managers who are given the flexibility to back their own judgement and time to ride out any periods of underperformance," adds Mr Connolly.

Being contrarian requires a lot of conviction with performance often coming in fits and starts.

"Contrarian investing requires a lot of research, expertise and time to be successful, so it's not suitable for the short term," adds Adrian Lowcock, investment director at Architas. "Sometimes investors do not have the patience to wait for contrarian managers to deliver on their investments."

However, it is important not to be contrarian just for the sake of it because there will be times when the consensus view is correct, points out Mr Lowcock. "The biggest risk to adopting a contrarian approach is getting the call wrong and missing out on a market rally," he says. "By repeatedly doing this, you would seriously damage your wealth. Successful investors can't be contrarian all the time."

Where to find contrarian funds

There is not a specific sector catering for contrarian funds. It is all down to the approach of individual managers, which means suitable funds for those wanting such an approach can be found in a wide variety of sectors.

Darius McDermott, managing director of Chelsea Financial Services, likes the Schroder Recovery Fund, which invests in companies that have suffered a major profit or share price setback but have good long-term prospects, alongside Jupiter UK Special Situations.

Pointing out that a contrarian style will go through bad periods, he says that investors will need to hold throughout a cycle in order to properly benefit. A prime example, he believes, came back in 2015. " was near the bottom of its sector in terms of performance, but by 2016 it was the second best fund in the sector as miners experienced a bounce and banks started to come off their lows," he says.

It is also possible to be contrarian by selecting funds that invest in sectors that are out of favour. In today's investment climate, Mr Lowcock suggests contrarian investors look at defensive assets such as gold.

Plus he thinks alternative income assets, including infrastructure and commercial property, could provide security to income seekers with inflation returning.

One fund he cites is . "The manager, Evy Hambro, focuses on investing in a risk-controlled manager with a preference for medium- and smaller-sized gold miners with high earnings growth," he says.

Although conceding that this focus means the fund is more vulnerable to weakness in the market, Mr Lowcock says that Mr Hambro is experienced and well resourced, with a team known for carrying out rigorous analysis.

Mr Lowcock also likes , a member of our sister website Moneywise's First 50 Funds for beginners, managed by Iain Stewart. "His first priority is capital protection and then he looks to deliver returns of 4% above cash per annum over the longer term," Mr Lowcock explains. "Mr Stewart runs an unconstrained and flexible approach which identifies opportunities."

How much should you hold in contrarian funds?

There is a place for contrarian investments in an investor's overall portfolio - but only as a smaller addition and not a core holding, warns Mr McDermott. "Investors need to understand that contrarian investing may be very uncomfortable at times," he says. "It can be a very volatile ride, and investors in this area need to be willing to go where others fear to go."

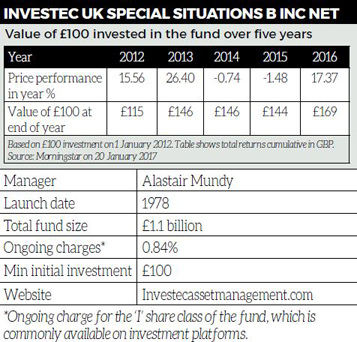

Fund to watch: Investec UK Special Situations

Alastair Mundy's fund aims to provide an income and grow the value of your investment over time. It seeks to achieve this by favouring shares in undervalued, out-of favour companies with strong balance sheets.

The fund sources its investments predominantly from the largest 350 companies listed on the London Stock Exchange, while making sure that the portfolio is diversified by industry and sector. At the last count, it had 51 holdings, which is a more concentrated approach to investing than some other rival funds.

To stand a chance of being included in the portfolio, a stock must have fallen by at least 50% - relative to the market - over the past five years. Those chosen will generally be held for four to five years in order to maximise their recovery potential. According to the most recent fund fact sheet, its largest positions are (7%), (7%), (6%), (6%) and (4%).

The most prominent sectors, meanwhile, are financials (29%), consumer services (18%), industrials (15%), oil & gas (9%) and health care (7%). There is also exposure to utilities, consumer goods, basic materials, technology and telecoms. Investec suggests that this fund may be suitable as a core UK equity holding if it is in an overall portfolio where it can be blended with other equity funds that adopt different investment styles.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.