Woodford says equity asset class not broken

10th February 2017 13:07

Financial markets are giving mixed signals. Major Wall Street indices trade at record highs, London is less than 100 points off a new best, European bourses look solid, and a reflationary economic recovery gets column inches. However, ultra-low sovereign bond yields imply bond markets fear continued economic stagnation. Now, Neil Woodford's team discuss whether equities are overvalued and if a stockmarket correction is due.

Eschewing short-term predictions, Mitchell Fraser-Jones, who works alongside star manager Woodford at the eponymous fund, believes that the UK stockmarket can deliver attractive returns from here.

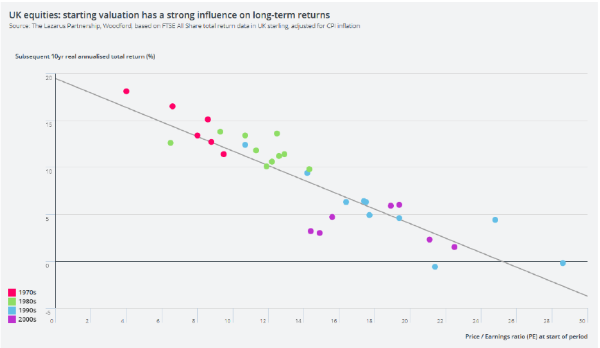

The chart below illustrates the point. It plots the closing price/earnings (PE) value of the market every year since 1974, against the real annualised total return investors would have received over the next 10 years.

Buying in the 1970s and early-80s, when times were tough and PEs low, would have resulted in a real return of 18% per annum over the following 10 years, says Fraser-Jones:

"A key feature of the chart is the strong correlation of the plots around the line of best fit. Clearly, there is no guarantee that future data will mirror the past exactly but the relationship between starting valuation and subsequent long-term returns is a very strong one that is likely to hold."

Currently, the UK market trades on about 15 times forecast earnings for this year. That implies a real annualised total return of about 8% over the next decade, according to the Woodford man:

"This isn't bad, in our view, especially when compared to the likely returns available from other asset classes."

Following a disappointing year for the fund - missing out on the commodity rally meant it seriously lagged the wider market – Woodford's team remains cautious about medium-term prospects for the global economy. They also admit that "market returns may well disappoint from here".

However, while the correlation is not perfect, the fund manager is confident the relationship between valuation and subsequent returns will hold.

Thankfully, it does not believe "the equity asset class is broken".

Long-term returns in the UK should still be "attractive", it says, and, as during the dotcom bubble, genuinely active fund managers can "add substantial long-term value".

"The broad market valuation is always an average of cheap and expensive stocks," writes Fraser-Jones. "Our investment approach aims to avoid the overvalued stocks and focus the portfolios towards the most attractive investment opportunities, wherever we find them.

"As such, we remain confident in the UK equity asset class but believe we can do even better than the market and deliver very attractive returns in the long run."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks