How dividend king HSBC will profit from rate rise

16th February 2017 11:30

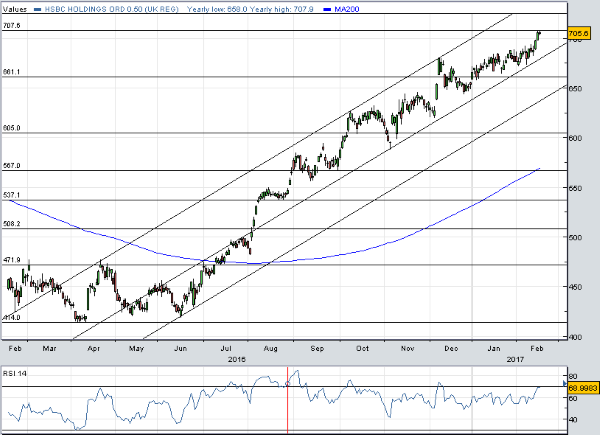

Which is the best-performing bank share of the past eight months, has easily beaten rivals in the aftermath of the Brexit vote, is fast approaching its post-financial crisis high set in 2013, and offers the highest dividend yield in the sector? Answer: .

Trading at 419p mid-June 2016, the share price today came within a fraction of 708p, a 69% profit. It hasn't been that high since November 2013. Six months before that they'd peaked at 772p.

Fellow Far East lender and recovery play is up 51% over the same period, 36%, 11% and down 2%.

Despite the incredible rally, HSBC still offers the biggest yield of all the UK-listed banks. If, as expected, it announces a payout of 51 US cents (40.8p) alongside next Tuesday's full-year results, investors will be able to lock in a 5.9% yield. Only Lloyds is anywhere near.

But how come HSBC is hot property now?

Since that strong second half of 2012 and great start to 2013, HSBC's share price had been in decline. It bottomed out in April last year at 414p, a seven-year low, or the worst since early 2009 when recovery from the credit crunch had only just begun.

This time last year, shortly after ending speculation it would relocate its Canary Wharf HQ to the Far East, HSBC announced fourth-quarter results which missed City forecasts by miles.

Costs have been an issue, too, and plenty doubted HSBC's ability to maintain the payout, which hit 8% last year. However, retain the payout it has, and decent income and UK exposure is attractive to investors.

According to Deutsche Bank analyst David Lock, the recent share re-rating can be explained largely by expectations that the Hong Kong Interbank Offer Rate (HIBOR) moves up steadily by about 150 basis points over the next three years.

This is down to the likely uptrend in US interest rates. Most of the sensitivity to higher rates lies in Asia, explains Lock, where HSBC's Hong Kong balances are over three times the $300 billion of assets in the US. "To understand HSBC group's US rate leverage you really have to look east from London not west.".

Using HSBC's projections and making his own tweaks, Lock estimates that a 100 basis point increase in rates would deliver a $2 billion, or 15% boost to group net profit.

"If we place this on 10 times earnings it is equivalent to roughly 12% of market cap," says Lock. "Overall our forecasts rise 5-10% on higher net interest income (NII)."

Upgrades

Given these predictions, Lock raises his price target by 81p, or 14%, to 660p, although he'll need more convincing to upgrade his rating from 'hold' given "limited catalysts".

Lock values HSBC by using an average of a sum-of-the-parts valuation and dividend discount model. At current prices, the shares trade on 1.2 times tangible net asset value (TNAV), 11.8 times earnings per share (EPS) estimates for 2018 for a return on equity of 10%.

Deutsche Bank thinks HSBC made $13.2 billion in 2016 and will increase that to $18.4 billion this year. That gives adjusted EPS of $0.64, rising to $0.71 in 2017. Look for a dividend of $0.51, offering a prospective yield of 5.9%.

For the fourth quarter look for underlying profit before tax of $3.7 billion, although Lock warns that "the number of FX movements in the quarter could mean a messy set of numbers".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks