Insider: Are these big sales a warning sign?

17th February 2017 12:18

by Lee Wild from interactive investor

Share on

Investors look at director dealing activity for clues as to sentiment within the firm. And they're right to given these insiders know the operational side of the business better than anyone. If they feel thigs are up with events, sometimes they sell shares.

They're not always right, of course. They know the business, but rarely have much of a clue about the share price. In fact, when I ask company executives what they think of share price performance, they'll either say they don't watch it, or shrug and admit they're bemused.

Like most of us, this means their timing isn't always spot on. There's also the very real possibility that personal circumstances trigger most sell orders - a new yacht, kid's school fees, or the big house in Virginia Water are not cheap!

This week, we've spotted five chunky director sales of note. Each company has had a good run and is close to a high of one sort or another. But is it reason to panic?

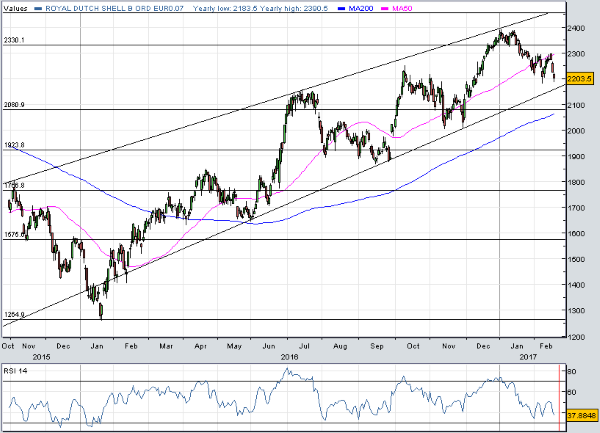

Good leaver sells Royal Dutch Shell

"Never sell Shell," say the clever clogs in the City. It's not necessarily something I subscribe to, and neither does finance director Simon Henry by the look of things.

Two weeks after fourth-quarter and final results, chief number cruncher enjoyed a million-pound payday - £1.14 million to be precise - after selling 50,000 shares at 2,285p.

Financial results were mixed, but investors are in half-glass-full mode with Shell right now, as its $30 billion asset disposal programme makes progress and in anticipation of further BG Group benefits.

And, perhaps crucially here, 34-year Shell veteran and strategist retires next month after almost eight years as CFO. Henry caused a bit of a stink in December when he bagged £1 million after selling 50,000 shares at 2,163p, just a fortnight before handing in his resignation.

There are plenty of analyst calling oil prices up to $60 a barrel and Shell shares up to £25.

A Paragon of virtue

Specialist mortgage lender is on a roll. Business is good and the share price has executed a classic v-shaped recovery following a miserable nine-months leading up to last summer's Brexit vote.

Last month, and ahead of half-year results at the end of May, the company said each of its operating divisions had made progress during the first quarter, and that full-year results should meet expectations.

Crucially, Paragon's buy-to-let pipeline was stronger than expected at £640 million, which "bodes well for the year as a whole," said chief executive Nigel Terrington.

There are obvious concerns around buy-to-let given tougher regulation, removal of tax breaks and increased stamp duty on second homes. But these numbers are reassuring and reflect clever forward planning.

"The combination of gathering momentum in lending and reducing funding costs should support profit growth into the rest of the year," said UBS analyst Ivan Jevremovic a few weeks back, although the share price has since met his price target of 425p.

And Paragon shares have almost doubled since July, back to prices last seen in 2015. They still trade on a single-digit PE, but recovery stocks can meet resistance on the approach to previous highs – investors who bought then are just relieved to get their money back.

And non-executive director Alan Fletcher has taken the opportunity to offload 19,993 shares at 441.3p. He pockets £88,000 for his trouble. It would be no surprise to see a pause around these levels.

High fives at SThree

Recruiter easily beat full-year expectations last month with adjusted pre-tax profit of £40.8 million. The shares have done well since last October and are now back in touch with pre-EU referendum levels.

Up 38% and, as with Paragon, near previous highs where prices can stall, SThree's Steve Quinn has decided to take some money off the table, trousering £162,000 for his 50,000 shares at 324p.

Quinn, who runs the Americas business, follows chief executive Gary Elden who sold 120,000 SThree shares earlier this month at 317.6p.

Elden looks to have quite a good record when it comes to trading his own book. However, you have to look closely to get the full story. Seems Elden typically sells a bunch of shares following annual results published each January to settle his tax affairs.

He sold 150,000 at 338p in early 2015 and over 157,000 at around 374p the year before. He's been lucky, too, in that during recent years SThree shares have tended to peak at around this time of year.

It's also worth remembering that Elden still has plenty of skin in the game. Elden owns millions of SThree shares and regularly receives far more than he sells that as part of the annual under the Long Term Incentive Plan.

Currently, SThree trades on around 15 times forward earnings and yields 4.5%. Numis Securities analyst Steve Woolf thinks the shares are worth 320p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.