Buy, hold or sell: Liontrust UK Special Situations

23rd February 2017 10:00

by David Brenchley from interactive investor

Share on

The , launched in November 2005, is run by Anthony Cross and Julian Fosh.

The fund has returned nearly 200% over the 10 years to 9 January 2017 and just over 100% over five years.

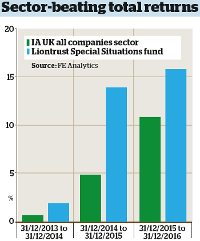

Having underperformed back in 2013 and only narrowly outperformed in 2014, the following year was much more successful for the fund: it achieved a return of 13.9% in 2015, compared with the Investment Association UK all companies sector's 4.9%.

Its 10% weighting towards oil and gas companies such as and , the fund's second and third largest holdings respectively, helped it achieve a 15.8% return and further sector outperformance in 2016.

BUY: DOTDIGITAL (LON:DOTD)

It was added to the Special Situations fund recently in the mid-50p range. Early in 2017 it reached a 52-week high, and currently trades at 62p.

Dotdigital operates in a growing market. Its dotmailer platform, which Cross describes as a "nice product", is used by companies and marketing professionals to run and deliver email campaigns.

The firm ticks all three boxes in Liontrust's "economic advantage" investment philosophy: it has strong intellectual property in dotmailer and robust distribution channels, it is attractively cash-generative, and it "has a high return on capital".

One further feature Cross looks for in smaller companies (which make up around a fifth of the fund) in particular is a good level of director ownership, and Dotdigital fits the bill here too.

He concludes: "Dotdigital has an established position in the UK, and it is moving into the US and elsewhere on the back of the growth of internet retailing and the digital economy."

HOLD: RENISHAW (LON:RSW)

Another company held in the UK Smaller Companies fund before graduating to the Special Situations portfolio is engineering group , described by Cross as "a UK success in manufacturing".

The Special Situations fund bought into the business at around £8 and the share price has since rocketed to around £26.50 currently.

Renishaw is an expert at precision measurement in manufacturing and additive manufacturing, also known as 3D printing, which Cross says is an exciting growth area. He points out that as a big exporter of goods, Renishaw benefited from sterling weakness in 2016.

Cross says the firm's management is long term in its thinking, which can be a drawback in that the company can be cyclical and its share price prone to bouts of volatility as a result.

However, he adds: "Renishaw is a great example of a company with strong intellectual property and a big distribution network."

SELL: NCC GROUP (LON:NCC)

IT services business was added into the Liontrust Special Situations portfolio in July 2013 at around 120p. It specialises in cyber security and software escrow, which are both "attractive" markets.

Cross says NCC is another niche business producing a high return on capital; it too has strong intellectual property and solid distribution networks.

However, the company has recently been aggressively acquisitive - it bought UK rival Accumuli and Dutch intelligence provider Fox Group for a combined £150 million in 2015 - and the fund began reducing its holding in mid to late 2016, selling at more than 300p at that point.

The managers' exit accelerated when NCC's shares were hit hard in late October, after the firm reported contract delays because of the impact of the Brexit vote in the referendum on EU membership.

The share price closed on 19 October at 345p, but by the end of that month it was 45% down at 190p. Cross says most of the fund's selling was done at the 220p mark, between those two dates.

The "economic advantage" process prioritises companies where recurring business accounts for at least 70% of its annual turnover, Cross says, so a business where contracts are stalling for reasons beyond its control becomes less attractive.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.