These two income stocks keep dividends flowing

24th February 2017 08:57

Whatever you think about his politics, Donald Trump's election has so far been a boon for investors. The market rally that began in the wake of his shock US presidential win pushed the UK stockmarket to a record high in the early weeks of January.

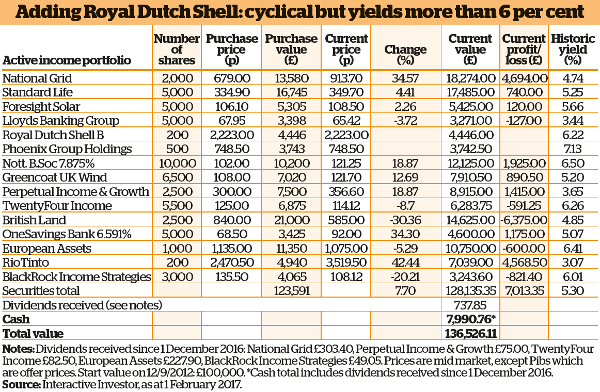

The Active Income portfolio has delivered a 2.7% return over the past two months. This was considerably less than the overall 5.1% return from the FTSE All-Share index.

As we explained in the last update, that reflects an investor shift away from stable dividend-paying defensive stocks into economically sensitive cyclicals.

Portfolio additions

It is not that a portfolio holding a fair smattering of defensive stocks can't deliver a positive return, just that its capital return may be lower than that of the overall market.

And let's not forget that the income return is likely to be significantly higher: over the past two months the portfolio has generated dividends of £737.85.

Few industries are as cyclical as the oil and gas sector, where share prices rose significantly last year due to a partial recovery in oil prices.

Yet UK oil majors and still yield more than 6%. Out of the two, I'm plumping for Royal Dutch Shell 'B' shares - the share class that is not subject to Dutch withholding tax.

The oil and gas giant's share price has risen by 44% over the past 12 months. Do I wish I had invested a year ago, when Shell's yield topped 8%?

Of course, but even today the shares are yielding around 6.2%. On 2 February, the day after I invested, the oil giant unveiled a mixed set of results, missing profit and earnings forecasts.

Is Shell about to trim its world-beating dividend?

However, cash flow was significantly better than expected and the company seems to be progressing well with its asset disposal programme.

The company is not in a great state, and we certainly can't count on the oil price bouncing back in the near future, but the business seems to be improving.

, which has also been added to the portfolio, is a very different beast. Currently yielding 5.86%, the company relies on acquiring closed life and pension funds to grow its business.

In 2016, Phoenix purchased the legacy pension businesses of Axa Wealth and Abbey Life. Analysts at Deutsche Bank are among those who believe the group is in a strong position to snap up another closed book of policies this year. We're buying on that hope.

Funds review

It seems more than about time to review the investment fund holdings within the portfolio. They have been some of the biggest disappointments, in capital growth terms.

, known as Pigit for short, has been one of our better performers since purchase. However, its recent performance relative to the benchmark has been weak.

Fund manager Mark Barnett attributes this to having nothing in the mining sector and no holdings in UK banks or Royal Dutch Shell.

However, given that Pigit provides diversity to a portfolio that includes , and now Royal Dutch Shell, it stays.

I'm also content to stick with and for similar reasons. They provide diversity and an appealing regular stream of income.

A question mark hangs over BlackRock Income Strategies trust, where the mandate has been taken over by Aberdeen. The commitment to dividend payouts, which previously ensured a yield of around 6%, will be dropped as part of the move.

As part of a general overhaul of our sister website Money Observer's portfolios, we have decided to wind up the Active Income portfolio. This will be the last update. It has been a pleasure running the portfolio, and thank you for following its progress. Best of luck with your investing.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks