10 great stocks that meet Jim Slater’s Zulu strategy rules

15th March 2017 12:35

by Ben Hobson from Stockopedia

Share on

While the UK is one of the world's major financial centres, it's fair to say we're a bit short of home-grown stock pickers that really capture the imagination of the investing public. One of the few characters to manage it was the late Jim Slater. In his lifetime he went from City dealmaker to investing guru - and the growth strategy he used still reaps impressive returns.

In 1992, Slater wrote what's seen by many as a rulebook for finding great growth shares at reasonable prices. The Zulu Principle became popular because Slater offered a compelling case for growth investing, but also clearly understood the challenges faced by many private investors.

The book was inspired and partly researched by Slater's son, Mark, who still uses his father's Zulu principles at his fund management firm, Slater Investments.

Central to Slater's growth strategy is a focus on investing in companies that are poised to deliver impressive earnings growth, but can still be bought at a reasonable price. These are typically small, profitable stocks with robust cashflows, low debt and share prices that are already rising.

Slater was keen to find firms with strong competitive advantages, offering new products or services that were steered by effective and enthusiastic management.

One of his most distinctive tools for picking these Zulu shares is something called the price-earnings growth factor, or PEG. He saw this as a crucial measure of whether a stock offered an attractive trade-off between price and growth.

The PEG is worked out by dividing forecast price-to-earnings ratio (PE) by the expected rate of earnings-per-share growth (G). As Slater saw it, stocks with a PEG of less than 1 had higher growth rates than their PE ratios and were thus 'cheap for their growth'. For instance, a stock on a forecast PE of 20 but expected to grow at 25% would have a PEG of 0.8.

A strategy that models Slater's rules has generated a 26% return over the past year, and 62% over two years, easily outpacing the market.

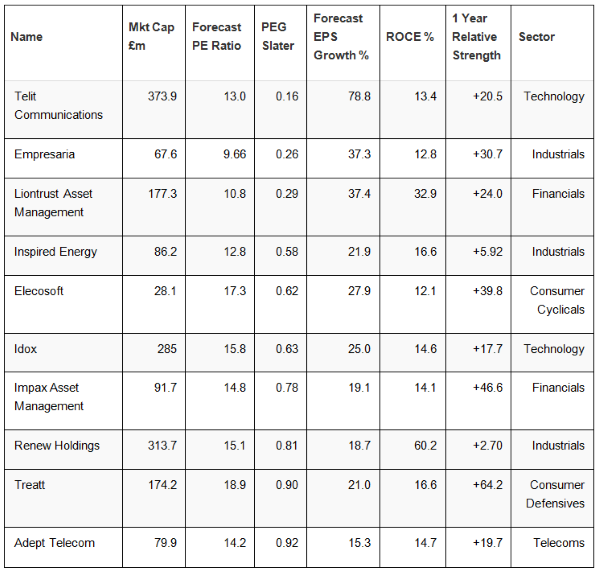

With those rules in mind, we've created a list of stocks that currently fit with Slater's strategy. Among the rules, companies need to have a PEG below 1.0, a PE ratio below 20, a return-on-capital-employed greater than 12% and earnings that are expected to grow by at least 15%. Importantly, the shares also need to have positive relative strength against the market over the past year.

Topping this Slater-inspired list is , a specialist in communications and navigation systems, which has seen very strong performance in its shares recently. That's followed by recruitment firm , and fund manager, .

Among the others are a number that have long fitted the kind of growth profile that the Zulu strategy looks for. They include software group , , engineering contractor , flavour and fragrance manufacturer, , and .

Learning the lessons from Slater's growth strategy

Over the past two years, a Slater-inspired focus on earnings growth in smaller stocks with reasonable prices, has been a very powerful approach to the market. Good quality growth shares offer great potential for profitable returns and excitement for investors, and Slater's Zulu Principle has proved adept at finding them.

Despite periods of market uncertainty his stock picking rules have still managed to highlight a number of top performers. That effectiveness, and Slater's enduring appeal, will ensure that he remains a favourite amongst UK investors.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser