Downing targets 15% annual returns with micro-cap investment trust launch

20th March 2017 14:08

by David Brenchley from interactive investor

Share on

Venture capital trust (VCT) provider Downing is launching its first investment trust aimed at the UK micro-cap space and targeting annual returns of a whopping 15%.

The Downing Strategic Micro-Cap Investment Trust, due to begin trading on 9 May, will be run by highly-regarded manager Judith MacKenzie and will have a similar investment process to her current open-ended fund, MI Downing UK Micro-Cap Growth.

The trust, which hopes to raise £100 million at IPO, plans to have a more concentrated portfolio featuring 12-18 companies with market capitalisations of less than £150 million. It will take 'strategic positions' of between 3-25% in each firm. Downing says it will mitigate risk by carrying out extensive due diligence, coupled with pro-active engagement with the management of investee companies.

Ben Yearsley, investment director at adviser Wealth Club, says this concentration is closer to the private equity, or even VCT world, than a typical investment trust. If the right companies are chosen, he says, this will help magnify gains. Choose the wrong ones, though, and losses will have a bigger impact on the overall portfolio.

However, he explains: "Judith MacKenzie has an excellent record in managing this type of investment, managing an existing micro-cap fund, which will have some commonality with this trust and also managing AIM listed stocks in the Downing One VCT.

"I think it was 2014 when Judith's existing fund was the top performer of all UK funds – about 500 in total."

We'll get the full investment policy in a prospectus expected to be published in late March, but Downing says its team will look to be activist in its approach, employing 'various strategic mechanisms' including restructuring boards, aligning incentive packages, recapitalising and funding acquisitions for growth and/or synergies.

MacKenzie, who joined Downing in 2009, will be assisted by Alyx Wood, James Lynch and Nicholas Hawthorn. She says the closed-ended structure will enable the company to align the interests and investment horizons of both investor and the fund manager.

She adds that there are attractive investment opportunities for experienced, long-term investment managers who carry out detailed due diligence and who can devote time to understanding a business, its markets and its management team.

"Our investment process should enable the trust to mitigate much of the perceived 'risk' in quoted smaller companies," she says.

"Companies with a market cap of under £150 million – and particularly those under £50 million - lack analyst coverage and institutional attention which drives pricing inefficiency and, therefore, attractive valuations.

"There is a wider universe of micro-cap companies, therefore we believe there is a wider opportunity compared to those companies with larger market capitalisations, as micro-cap companies tend to be better value."

Yearsley says investment trusts are ideally suited to investing in a private equity style as it allows the manager to truly back the underlying companies for the medium to long term, safe in the knowledge that their capital isn't going to be taken away at the wrong time in the cycle through investor redemptions as could be the case with open-ended funds.

"Larger stakes in companies can be bought, helping ensure better access to management and influence over the future direction of the business," he adds. "You do need to be a patient investor, though, as private equity isn't typically a quick turnaround story."

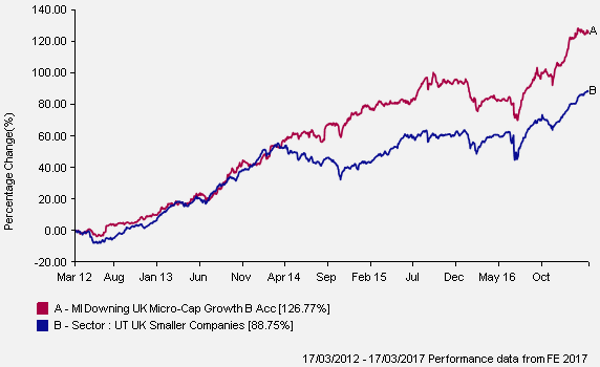

The 15% per annum target will be assessed over a term of between three to seven years, and MacKenzie is clearly capable of achieving it, having produced annual returns of 14.6% since Downing took over the open-ended fund's mandate from Electra Private Equity in February 2011.

Downing UK Micro Cap Growth is a first-quartile performer over five years, having returned 126.8% compared to the Investment Association's UK smaller companies sector's 88.8%.

Its current top five holdings include a 7.4% stake in engineer , which is its biggest position. Others include computer training company , sports nutrition firm , TV and cloud solutions provider and gas and electricity meters operator .

The Downing Strategic Micro Cap Investment Trust will feature in the Association of Investment Companies' UK smaller companies sector and charge an annual management fee of 1% of net assets. It will not charge a performance fee. It will have the ability to buy back up to 14.99% of issued share capital.

"Buy if you are a long-term, patient investor," Yearsley concludes, "the micro-cap space is cheap and often ignored so bargains can be found."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.