Medica flies 35% on market debut

21st March 2017 13:19

by David Brenchley from interactive investor

Share on

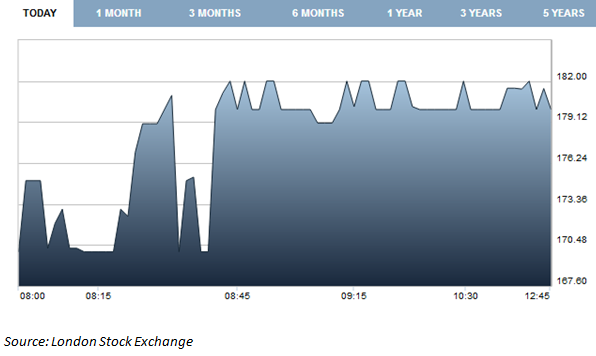

Newly-listed made a flying start to its life on the London main market on Tuesday, seeing its share price surge 35% from an IPO price of 135p to a high of 183p three-quarters of an hour after opening for business.

The UK market leader in teleradiology provision opened this morning at 170p and swung between there and the 183p mark in the first hour of trading before settling at 180p at midday.

The East Sussex-based firm, which provides outsourced interpretation and reporting of MRI scans, CT scans and x-ray images to hospital radiology departments, raised £121 million at IPO, giving it a market capitalisation of £150 million.

Its previous majority shareholder, CBPE Nominees - who acquired the company from Nuffield Health in 2013 - has reduced its stake from 82.5% to 11.1%, while chief executive John Graham has gone from 7.2% to 3.25%.

Medica made an adjusted operating profit of just over £6 million in the nine months ended 30 September 2016.

It boasts of being highly cash generative with high levels of repeat revenues - 77% of revenue in the financial year ended 31 December 2015 was derived from customers who had been with the group for more than three years.

It says it will "adopt a progressive dividend policy" and "seek to maximise shareholder value and reflect its strong earnings potential and cash flow characteristics, while allowing it to retain sufficient capital to fund ongoing operating requirements and to invest in the group's long-term growth".

Graham, who has been with the company since July 2011, joined from Allied Respiratory, a subsidiary of Allied Healthcare, where he oversaw the sale of the firm to Air Liquide.

At announcement of the IPO, he said: "The listing provides an opportunity for Medica to extend its healthcare offering into new areas by leveraging the company's key skill sets of high-quality clinical governance and utilising technology to increase efficiency.

"Medica has a strong track record of delivering sustainable organic growth which has allowed us to invest heavily in building a scalable platform, positioning the business to continue to grow by introducing additional services to benefit our clients."

Statistics from the Royal College of Radiologists (RCR) show that the number of MRI and CT scans in England both saw compound annual growth rates between 2003 and 2014 of 12.3% and 10.1% respectively, and the RCR forecasts similar figures for the following nine-year period.

The country's ageing population has helped this trend, the company says, as well as the move to a seven-day NHS. Currently all of Medica's revenues are derived from NHS trusts, although part of its growth strategy includes securing business from both private hospital groups and independent diagnostic imaging companies.

Further, there is a recognised shortage in the number of consultant radiologists in the UK to meet the rising demand. Medica allows hospitals to transmit the diagnostic images to a remote radiologist, based from either their own home or one of Medica's dedicated reporting centres, for them to report on. This means hospitals have access to trained specialists 24/7.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.