Article 50 triggers uncertainty and risk, but there's a way to profit

28th March 2017 13:09

by Nick Leung from ii contributor

Share on

Theresa May will shortly begin Brexit negotiations with a long list of demands in her hands. Her priorities include the creation of a new trade deal, retaking control over immigration, and restoring British law-making sovereignty.

But, while the government remains hopeful for a favourable deal, UK domestic assets remain most at risk from the macroeconomic uncertainty ahead. More insulated from these risks are ironically, broad UK equity exposures - dividends in particular.

Paving the way for hard Brexit

With the Dutch elections having passed, and with France, Germany and Italy all facing elections over the coming 18 months, the EU may adopt an increasingly hardline stance so as to avoid appearing weak.

By implication, EU officials will not allow the UK to cherry-pick proposals, for fear of emboldening populist rhetoric elsewhere in Europe. This means that securing favourable terms on most, if not all, of the government's current Brexit objectives will be near impossible. Unless it recalibrates demands accordingly, the UK faces the prospect of being offered a bad deal - or even no deal.

In this regard, pressure for May to reconsider the UK's Brexit objectives will come solely from home, but it is unlikely to come from pro-EU or conservative Brexiters from within May's own party. The recent dismissal of Lord Heseltine - a Tory peer dissenter and government adviser - underscores May's commitment to keeping party discipline in line, and any hint of Tory rebellion is set to be firmly crushed.

At this point, pressure from the opposition represents the only realistic challenge to May's Brexit ideology. As things stand, the Scottish Nationals pose a greater threat than the Labour party, with the prospect of a second referendum on Scottish independence offering yet more unwelcome uncertainty for the government to ponder.

A simultaneous break-up of the Union on multiple fronts, or at least the potential of it, could spell the final death knell for the government's push for a clean break with the EU.

Austerity set to continue amidst Brexit uncertainty

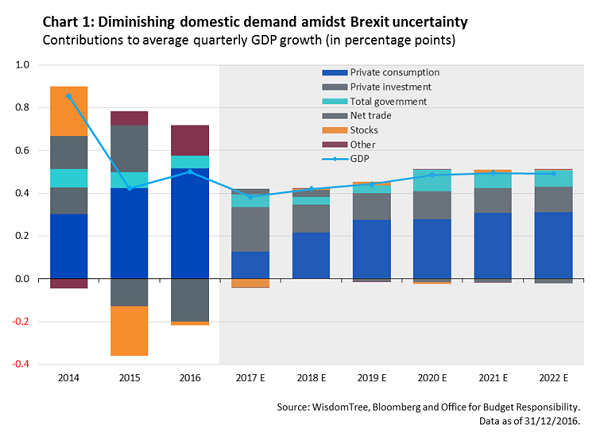

In light of the upcoming political risk, the economic risks facing the UK economy in coming years are also skewed to the downside. The Office for Budget Responsibility (OBR) forecasts UK GDP to slow in 2017, primarily as a result of falling domestic demand (comprised of household consumption, private investment and government spending), with total quarterly contributions to GDP expected to drop by 0.1% in 2017 (represented by blue shaded section in Figure 1), equivalent to over 0.4% a year on an annualised basis.

Facing a slowing economy, the chancellor has given little away with respect to upcoming economic strategy, with the Spring Budget offering no hints of a pre-Brexit boost in spending.

By contrast, the government reaffirmed its commitment to austerity, pledging to maintain deficit reduction targets well over the course of the current parliament. I think this suggests that no adjustment to fiscal policy is planned, and austerity is set to continue amidst Brexit uncertainty.

However, the OBR's base scenario implies a soft Brexit scenario where trade deteriorates gradually over 10 years, and with no consideration for a final Brexit bill. This therefore represents a more upbeat scenario for the UK with milder economic consequences. Since the potential for a hard Brexit cannot be ruled out, the risk of significant disruptions to the UK economy remain. Against such a backdrop, the possibility for austerity to be relaxed could increase.

Such a move would undoubtedly push the deadline for eliminating the deficit well into the next parliament, as well as undermining UK chancellor Philip Hammond's fiscal stance. But in the absence of any obvious drivers of growth, less austerity for longer could be necessary to counteract weaker domestic demand.

Signs of weakness in household consumption are already emerging, with January YoY retail sales growth at its lowest since 2013. Private investment also looks vulnerable, with UK mid/small caps set to face a triple squeeze from higher import costs, higher wages and higher business rates.

Alongside a broader and deeper economic slowdown, supported by softer PMI numbers coming into 2017, the chancellor could be called upon to loosen purse strings rather than tighten them.

Asset allocation: bullish UK exporters, bearish domestic UK equities and gilts

The pursuit of May's Brexit ideology will intensify macroeconomic pressures for the UK over the near term. Further sterling weakness arising from trade uncertainty will weigh on the safe haven of UK gilts. A strong push for Scottish independence could also present an additional source of concern for UK gilt investors.

Against this vulnerable macro backdrop, investors may consider diversifying their UK equity allocations. In particular, baskets of UK dividend-payers with high exposures to UK multinationals could provide better opportunities, with the fall in the pound boosting overseas earnings.

All data is sourced from WisdomTree and Bloomberg, unless otherwise stated.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.