10 top stocks hitting new highs as ISA deadline approaches

5th April 2017 13:56

by Ben Hobson from Stockopedia

Share on

The UK's main stockmarket indices all hit record highs in March. Even the smaller-cap Alternative Investment Market reached levels not seen for six years. An upbeat economic climate, low interest rates and weak sterling are boosting share prices - but that leaves investors facing difficult choices. After all, who really wants to buy stocks that are hitting new highs?

We've explored the intriguing dilemma posed by the 52-week high in this column before. But with no sign of an imminent change in market sentiment, it's likely that we'll be seeing more shares breaking their own records in the coming months.

52-week highs are some of the most accessible - and interesting - data about stock prices. Newspapers and websites routinely publish this information, and it's an immediate pointer to popular companies. But does the usefulness end there?

Not at all, according to researchers. In fact, the emotional and behavioural responses that the 52-week high provokes from investors are widely credited as a major contributor to price momentum. In other words, it's plausible - and it's been shown in research - that shares at 52-week highs often travel higher in the months to come.

Part of the reason is that investors are initially hesitant to buy stocks at 52-week highs, even if they've recently issued good news. The high price acts like a ceiling, and it only breaks down over time as the market gradually accepts that the stock warrants a higher price. So it's the slow responsiveness of most investors that actually causes the positive momentum.

In fact, one study by an academic called Jason Birru took this a step further. He agreed that the 52-week high creates a psychological barrier in the minds of investors. And he found that both investors and analysts simply stopped believing that a stock hitting new highs would rise further. They became less objective, under-reacted to news about it and were ultimately more inclined to sell it.

Building a stronger momentum strategy

Momentum is one of the most powerful drivers of investment returns in the stockmarket. But on its own it can leave investors exposed to sudden reversals. Momentum can break down very quickly if sentiment towards a stock suddenly changes.

To tackle this problem, some professional money managers combine momentum with other factors, such as company quality. This can ease the risk of sudden drawdowns by focusing on stocks that are not only fast-moving, but also have the financial quality to justify their popularity. This blend of factors is a hallmark of successful investors like William O'Neil and Richard Driehaus.

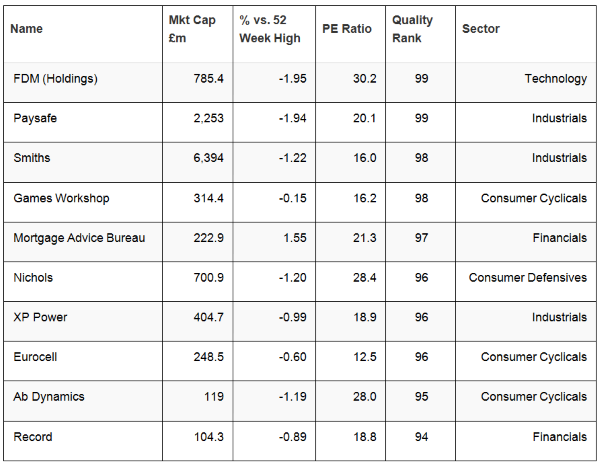

With this in mind, we've put some rules together for this week's screen that match stocks that are trading close to their 52-week highs, but also have strong signs of quality. The quality aspect of the screen uses a QualityRank, which takes several measures of stability and cash flow generation, safety and improving financial health. Each stock is ranked in the market from zero (poor quality) to 100 (high quality).

Heading the list is IT services group , which has seen very strong momentum in its price since late last year. It pairs that with very strong quality metrics and high profitability driven by strong margins and returns on capital.

Next is (formerly Optimal Payments), the digital payments specialist, and that's followed by the largest stock here, , which is a technology and engineering group. Most of the others fall into the small-cap bracket, including , , and .

Overcoming a fear of heights

The 52-week high is a constant source of interest for investors, yet many feel deeply uneasy about the prospect of buying shares that have soared in price. New highs provoke feelings of disbelief, loss aversion and distort expectations about where prices will move next.

Yet evidence shows that this hesitancy in investors is actually a driver of momentum as prices take their time to adjust. Blending the 52 week high with company quality is one way of getting more comfortable with this strategy. Doing that will focus on stocks that are more likely to justify their new highs and may be better-protected from the risk of sudden changes in sentiment.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.