13 shares for the future

7th April 2017 15:49

by Richard Beddard from interactive investor

Share on

A handful of new names are among the highest ranked by my Decision Engine, which is newly powered by sigmoid curves.

It turns out that Kraft Heinz isn't alone in eyeing up . In addition to traders who have bid the shares up to £39.50, a price that values the enterprise at €161 billion or a mighty 25 times adjusted profit in the year to December 2016, my humble Decision Engine rated it 7/10.

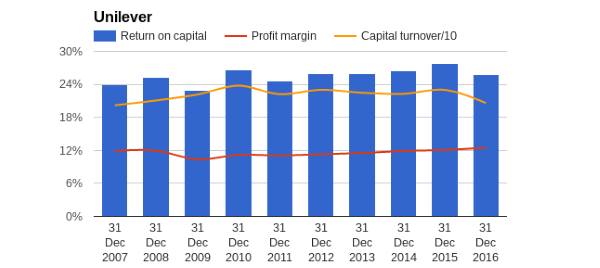

This was a cause of some consternation. Of course, the Decision Engine sees what everyone else sees: this.

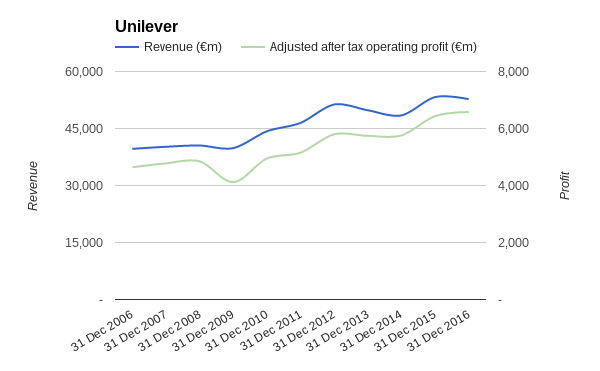

High, stable, enduring returns on capital. Monotonous isn't it? But Unilever is already valued highly by the market, and all that profitability has not grown revenue or profit very much in recent years:

Paul Polman, Unilever's chief executive, joined in January 2009. A year later he unveiled the "Compass" strategy intended to double revenue from €40 billion to €80 billion, and the "Sustainable Living Plan" that would halve the environmental impact of manufacturing and sourcing raw materials, and improve the health and wellbeing of customers, employees and people employed by suppliers by 2020. Last year, the environmental impact goal was pushed back to 2030.

Although the two plans were often conflated by the press, creating the expectation that revenue would be €80 billion by 2020, I don't think there ever was an explicit deadline. If there was, anyone who believed it then is likely to be disappointed as 2020 approaches.

Revenue increased from just below €40 billion to just over €51 billion between 2009 and 2012, but in the company's results for the year to December 2016, a year in which revenue fell 1%, it had achieved only €1.5 billion more. Profit growth has broadly tracked revenue growth.

With profitability so high, why hasn't revenue grown more?

The company says these are difficult times characterised by sluggish consumer demand and more competition from innovative local firms. To keep up with trends, Unilever says it has disposed of €2.8 billion of revenue in 'non-strategic', aka slower growing, businesses and replaced it with €4 billion revenue from faster growing acquisitions over the last eight years.

The numbers seem impressive, but the new businesses will have to grow a lot, if they are to make much of an impact. Unilever earns more than €50 billion in revenues a year.

I wish I could give you a definitive answer about revenue growth, but the size of Unilever intimidates me and may defy further analysis. The point of this tale is to explain why Unilever is now ranked 6/10, outside the 'buy' zone, instead of 7/10.

The recommendation of a share valued at 25 times adjusted profit rattled me, because the purpose of the Decision Engine is to show me shares I would be prepared to invest in when I'm sober. I synthesise what I know about shares into five independent factors, each worth two points out of ten, and let the Engine rank them dispassionately, preventing me from getting over-excited about any particular aspect, for example Pollman's leadership, or Unilever's phenomenal record of profitability.

Rightly or wrongly, I go off a share pretty quickly above 20 times adjusted profit, equivalent to an earnings yield of 5%, and I prefer to buy good stable businesses on earnings yields closer to 8% (12.5 times adjusted profit).

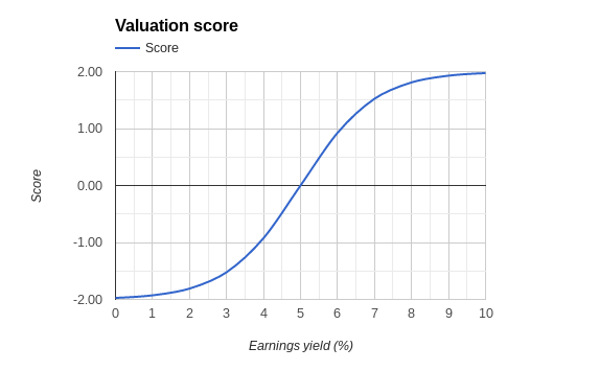

Because I lashed the Decision Engine together using maths I could understand, the relationship between valuation and how I scored the company's valuation would be a straight line if you plotted it on a graph.

A share with an earnings yield of 10 scored 2, a share with an earnings yield of 5 scored 0 and a share with an earnings yield of 0 scored -2. While, unlike the other four factors, companies were penalised with negative valuation scores, the slope of the line didn't accurately model my disdain for shares with earnings yields below 5%. With its earnings yield of 4%, Unilever was barely penalised.

I needed an equation to calculate the valuation score of a share, that, if plotted, would look like a warped 'S', rather than a straight line. It turned out to be this:

Those of you with a higher level of maths will probably be holding your heads in your hands at this point, but it took my mates with maths degrees quite a while to work out what it was, once I had WhatsApped them a photo of the curve I wanted drawn on a sheet of paper.

It's a sigmoid curve*, albeit scaled and shifted. As you can see, shares on earnings yields of seven to ten are scored pretty highly by the function that draws this curve, while shares on earnings yields of less than three receive close to the minimum score. In between, the gradient of the curve steepens dramatically, which means Unilever, on an earnings yield of 4%, scores -1. Previously it scored little more than zero.

In theory, if a share scores a perfect eight on the other four criteria it could still score more than seven out of ten and make the recommended list with an outrageously low earnings yield of 4% (valuing it at 25 times adjusted profit).

Perhaps that's fair enough, if I truly feel I have a really good understanding of the business, if its record of profitability is exemplary, if it's adaptable and resilient, and if it's managed equitably for the long-term.

I have doubts about Unilever's adaptability, though, or at least about whether I can ascertain that the third biggest company listed on the London Stock Exchange can churn its brands to achieve higher growth in an era when the really big consumer brands may become less ubiquitous.

Now the Decision Engine is powered by sigmoid curves, Unilever is out of harm's way.

Meanwhile, I've added Anpario and Judges Scientific after their recent results. You can read about Judges Scientific in last week's article**. You can expect to read about Anpario shortly. Portmeirion and Howden Joinery are also likely to receive more attention from me, because they, Anpario and Judges, are the only companies in the list I have yet to add to the Share Sleuth Portfolio, a model portfolio I run for our sister magazine Money Observer.***

Thirteen shares for the future:

| Score | Name | Description |

|---|---|---|

| 9 | Dewhurst | Manufactures components for lifts, keypads and railway rolling-stock, particularly pushbuttons. |

| 9 | Castings | Manufactures cast iron parts for heavy trucks and cars, components for engines, gearboxes and differentials for example. |

| 9 | Science | Advises and does research and product development for customers in medical, industrial, consumer and energy industries. |

| 8 | Solid State | Manufactures and distributes specialist electronic components and computer systems, often used in harsh environments. |

| 8 | Portmeirion | Manufactures tableware. Owns Portmeirion, Spode and Royal Worcester brands as well scented candle maker Wax Lyrical. |

| 8 | Next | Retails clothes and homeware. |

| 8 | XP Power | Designs, manufactures and distributes power adapters for industrial and healthcare equipment. |

| 7 | Howden Joinery | Manufactures kitchen cabinets and supplies complete kitchens to small builders. |

| 7 | Vp | Rents out specialist equipment and tools to construction, engineering, transport, oil and gas and events businesses, and individuals. |

| 7 | Judges Scientific | Acquires small businesses that manufacture scientific instruments and operates them. |

| 7 | Anpario | Manufactures natural animal feed additives that promote animal growth by improving animal health. |

| 7 | Victrex | Manufactures PEEK, a tough and light polymer, and components made from the material. |

| 7 | Colefax | Designs and distributes wallpaper and fabric to decorators. Also decorates houses, trades antiques, manufactures furniture. |

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.