42 ways you could have doubled your money in 2017

21st April 2017 17:04

by David Brenchley from interactive investor

Share on

After all the excitement of the FTSE 100 making a string of record highs year-to-date, Theresa May's decision to call a "snap" general election on 8 June knocked the stuffing out of the blue-chip index.

As we pointed out yesterday, the index's glut of big overseas earners means it has an inverse relationship with sterling. And, with the pound strengthening from historically low levels to $1.29 briefly, the FTSE 100 is now showing a small loss for the year.

Looking further afield, the FTSE All Share is just 1% up in 2017 so far, but the more domestically focused FTSE 250 index is still trading near record levels, 7.5% in the past four months. You could have had a gain of just over 4% from both the average UK equity income and UK all companies fund.

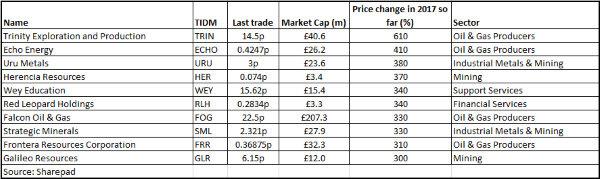

However, we knew you could do much better than that, so, with the help of data service Sharepad, we trawled the market to see how investors could have banked a fortune in 2017.

We found an incredible 42 companies have at least doubled their share price in the past 16 weeks – the first FTSE 100 stock on the list is housebuilder Taylor Wimpey at 220! Admittedly, there are some real tiddlers here, shares that only investors comfortable dealing in the subterranean world of 1-5p stocks would dare to tread.

That said, a handful of this year's best performers – shares up 200-300% - were worth just 3-5p a few months ago, and look far less shabby now.

Indeed, , on the verge of being wound up just nine months ago after trading in its shares was suspended due to severe debts, is one of the stars.

Once shareholders approved a restructuring, including tackling that debt, Trinity shares were back up and trading on 11 January and have since rocketed from around 4p to just over 14p, valuing the business at £40 million. In March, they nudged 19p!

Strip out the sub-5p stocks and Trinity, which wasn't trading as the year began, and is currently the most lucrative investment of 2017.

The lightly-traded shares, which we covered shortly after IPO in 2015, kicked off 2017 at 3.5p, but by this week had changed hands for as much as 17.4p, a gain of almost 400%.

Interest really picked up following a bullish trading update at the end of February. The UK's only fully online interactive independent secondary school estimated that turnover jumped by 65% in the six months to 28 February 2017, and that profit would be "significantly better" than the previous year.

Chairman David Massie also agreed to have his annual salary of £33,000 for the year to 31 August 2017 paid in shares. Students on the roll are at record levels, and results have since confirmed a maiden profit and better than expected net cash of £1 million.

Elsewhere, , a £200 million oil explorer, more than tripled in a matter of days midway through February to 17.5p after the discovery of a "material gas resource" in the area of its Northern Territory reserve in Australia.

As our oil expert Malcolm Graham-Wood pointed out at the time, the problem is that the Northern Territory government has a moratorium on fraccing in the area, meaning not much can happen for the time being.

A hint from Australia's deputy Prime Minister suggested that ban could be lifted last month, triggering a further rally to just shy of 30p. It's a potential "game changer", according to Malcy, so further positive news for the company could see it shoot up this list in time.

There are, however, even larger firms in the list, including one of AIM's major success stories of recent years, online estate agent , which has been backed by feted fund manager Neil Woodford. The £825 million firm is the second largest holding in the Woodford Patient Capital trust.

Purplebricks debuted on the stockmarket on 17 December 2015 with an opening price of 106p and has almost tripled in price since. In fact, it traded at a high of 367p early last month.

So far this year it's more than doubled in value and, in his latest portfolio review, Woodford praised the firm's "disruptive business model", which is helping it diversify internationally by launching in Australia and the US.

And Investec analyst Steve Liechti it a big fan, betting that branching out Stateside, as well as a recent £50 million fundraise, will be so material to the firm that he has doubled his price target to 366p.

It's been the third best-performing holding in Woodford's trust portfolio, offsetting some dismal performances from some early-stage healthcare holdings like and , and a crash at .

As shares have slipped from a high of 350p in early March, canny director Nick Discombe pocketed £4.8 million after selling 1.6 million shares in the company at £3 a pop.

is not as large-cap as it was following a terrible three-year run, sinking from highs late in 2013 of £15.50 to a low of just 70p at the beginning of 2016. However, its recovery accelerated at the turn of this year, climbing 55% in a week after reporting total bookings of $15.5 million, up 72% year-on-year. Having rocketed as much as 173% this year, current gains sit at 92%.

Among the other larger companies in the list of 42 are E&P firm , up 130%, and biotech , up 100%.

Of course, smaller companies tend to grow quicker than their larger counterparts so the top of the list is littered with AIM stocks. In contrast to that 4.2% gain from UK equity income funds, just focusing on the IA's UK smaller company sector would have seen you almost triple your gains at 11%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.