11 shares to beat record-breaking FTSE 250

25th April 2017 13:43

The FTSE 250 is back on form. The UK's mid-cap index just hit a record high for a second day at 19,647, taking the rally since Prime Minister Theresa May announced a snap general election on 8 June to 1.9%. In truth, it isn't a surprise-we pointed out last week that a stronger pound since is positive for domestic-focused companies.

Despite sterling's crash after the Brexit vote in June, the FTSE 250 has still outperformed the international FTSE 100 both since the EU referendum and year-to-date-significantly in the latter case. So far in 2017, it's returned 8.5%, compared to just 2% for the blue-chip index.

While upcoming Brexit negotiations could offset any positive general election benefit for sterling in the coming months, few see this as a problem for mid-caps. Some fund managers recommend targeting firms with international sales, with Neptune's Mark Martin favouring companies like and , whose costs are in sterling, but who export around the world.

Mike Prentis, manager of the BlackRock Smaller Companies investment trust, points out that many UK-listed, mid-cap industrial firms have recently fared well as export markets strengthen on the back of weaker sterling and strengthening GDP growth in markets such as the USA and China. "We have seen good trading updates from internationally exposed industrial companies in recent days," he explains.

UBS's star mid-cap portfolio

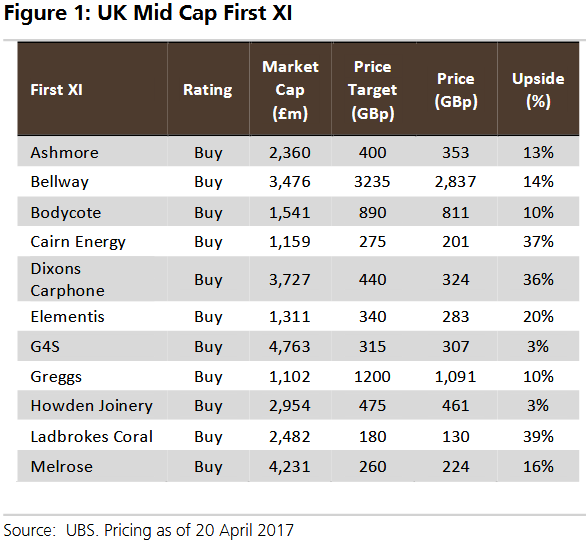

With that in mind, broker UBS has just updated performance figures for its recently-created UK Mid Cap Top Picks First XI portfolio - the high-conviction ideas across its UK research team. And it's great news, with the 11 companies already generating a 16.5% profit since its December launch. The FTSE 250 is up 10% and its large-cap counterpart less than 5%.

Behind the outperformance are names like , , , , , and . But it's security services firm (up 37% since inception) and computer security company (36%) that have done best.

UBS analysts doubt the UK general election will have an actual impact on consumer trends due to the Conservatives' strong lead in the polls and the shortened campaign period.

"History also shows no consistent FTSE 250 performance pattern around elections, although on balance the FTSE 250 has tended to outperform the FTSE 100," they say. Mid-cap earnings per share (EPS) growth is likely continue to lag the blue-chips, although only by 8% to 11%. And, while UBS analysts see more upside in large caps, the FTSE 250 currently trades on a price/earnings (PE) ratio below its historic average.

Reassessing the First XI constituents, UBS announces a trio of changes.

Out goes miner . Despite a modest 3% gain since inception, the shares are down 23% since the portfolio's February update, having lost a fifth of its value in less than a day early March after uncertainty around the gold concentrate export ban in Tanzania.

Meanwhile, UBS trousers handsome profits both at Sophos and greetings card chain (+21%).

They make way for oil company , electricals chain and speciality chemicals group - the first two currently have potential upside of over a third, according to UBS analysts, while the latter is tipped to rise by 15%.

"We like Cairn for exposure to a well-balanced E&P story with multiple near-term catalysts to grow net asset value (NAV) and narrow today's wide discount to NAV," says analyst Joseph Head. His 275p price target would see shares hitting levels not seen since early 2014, and he clearly thinks the stock is a steal after falling 16% year-to-date.

Risk/reward looks compelling, adds Head, pointing out that current NAV ascribes no value to Cairn India and undervalues Senegal barrels.

Dixons Carphone is also in the red in 2017, down 9%, but a base case target price of 440p implies 40% upside potential with its presence in the Nordic countries and its connected world services business expected to more than offset a predicted "modest decline" in UK profitability due to Brexit.

"Although FX inflation may be an issue, we believe Dixons Carphone is better placed than competitors to pass this on to consumers," analyst Andrew Hughes said. "Negative wage growth and slower GDP may weigh, but forecasts have been lowered to take this into account.

"Trading on sub 10 times calculated 2017 PE, there is significant upside potential if prices are passed onto the consumer, the electricals cycle turns or the expected slowdown is not as severe as expected."

Elementis has fared better than the previous two, rising 14% year-to-date. Since the EU referendum, the stock has risen 67%, with analyst Andrew Stott setting a 12-month target of 340p, a record high.

After a bullish trading update Tuesday, Elementis shares rose 5% to a two-year best of 318p. This morning, Stott reiterated his target, arguing that a 15% discount to peers was "unjustified given strong trading, the de-risking of the chromium business and enhanced platform afforded by the personal care acquisition".

That discount has now narrowed to around 7% and Stott says his target would give Elementis a forecast 2018 earnings multiple of 18 times, "broadly in line with the peer group average of 19 times".

In the interests of completeness, and continuing the football theme, UBS announces three "impact subs-property company , bashed-up estate agent and miner .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks