Introducing a £100,000 'safety first' portfolio

27th April 2017 09:01

Introducing the first of a new set of four £100,000 portfolios - Capital Conserver.

Rob Morgan is usually something of a 'gung-ho' investor. Still in his 30s, the investment analyst at Charles Stanley Direct has the time - and the risk appetite - to ride out ups and downs in the market for his own investments.

But not everyone can stomach the idea of sending their savings on a rollercoaster ride. We have taken Morgan out of his comfort zone and tasked him with running our cautious Capital Conserver portfolio.

The aim of the portfolio, which started on 1 April, is to grow cash slowly and steadily, with a focus on protecting it from any dips in the market.

Morgan says: "The idea is to be cautious but still generate returns. You can be very safe and put all your money in cash but you won't get a return; to do that you need to take some risk."

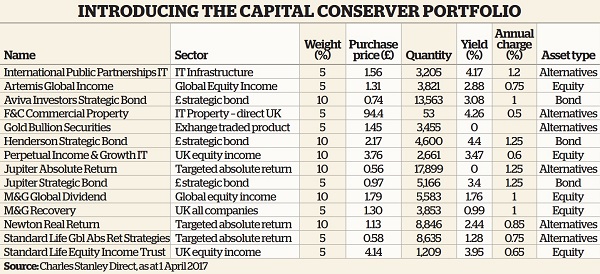

He has split his £100,000 initial investment across 14 holdings with 35% in equities, 25% in bonds and 40% in alternatives.

A main issue for cautious investors at the moment is that traditional safe havens are no longer as safe as they once were, and many are expensive. "Because of that I have stayed away from government bonds, for example, and any areas which don't offer a good return for the risk you are taking," explains Morgan.

"I have focused on trying to spread the money between areas that are not correlated. Although this is not an equity income portfolio, a lot of the investments are income generators or equity income funds, but I see that as a solid foundation for capital growth and we can reinvest that money."

Among those equity income investments are Artemis Global Income and Standard Life Equity Income trust, which each have a weighting of 5% within the portfolio. But much of the income Morgan refers to will come from the alternatives part of the portfolio. "Alternatives, to me, means anything I can find that is genuinely investable, which provides a source of long-term inflation-beating return and is not linked to equities or bonds," he says.

Trust in property

Chief among these holdings is the investment trust. Morgan has opted for a trust rather than a fund to avoid any of the suspension issues that investors in the sector experienced last year.

After the EU referendum in June, fears that the property market would plunge saw many open-ended fund managers bar the exits to their funds to avoid being forced into a fire-sale of their assets if investors rushed to redeem their cash; many took months to reopen their doors. This can't happen with an investment trust - although market jitters can cause its price to plummet.

Morgan says: "We seem to have put that episode behind us now. Property is an attractive sector; yes, there are political risks, but it offers a stable yield - currently 4.26%. This trust is focused on the UK, so it avoids any currency risk you would get from an international property trust." The F&C trust is also not overly concentrated in the City of London, which experts widely expect to bear the brunt of any property price falls should they occur.

Another source of income within the portfolio is , an infrastructure investment trust. With a government investment splurge expected both here and in the US, the sector is becoming increasingly popular as a means of generating income. For that reason, this trust is trading at a premium to the value of its underlying assets, something most investors might usually try to steer clear of.

Morgan says: "Six months ago I might have put more than 5% of the portfolio in the trust, but it's a fashionable area and that means it's at a premium. I generally agree with the idea that you should not invest at a premium, but in this case I think it's justifiable. The trust is well managed and has successfully proved it can grow its income at a time when that is difficult to do." The trust has an international bias, and while some of the projects can be risky, there is a lot of money going into private finance initiatives backed by government at the moment.

A gold bullion exchange traded product accounts for 5% of the portfolio, and is a cheap way to track the commodity price. The yellow metal is a traditional store of value for investors at turbulent times. It is generally considered an insurance policy for any investment portfolio and is good at holding its value over the long term. Morgan says: "This is the part of the portfolio I don't really want to work. If gold is doing well, it probably means everything else isn't."

Flexible bond funds

There are three strategic bond funds within the group, chosen for their flexibility to move around within the asset class. There are also three targeted absolute return funds, accounting for a total of 25% of the portfolio between them. They have been selected for the markedly different approaches each manager takes; , for example, can go long or short on investments, and Morgan says he trusts manager James Clunie to stock-pick his way to consistent returns.

The fund might stand out as an unusual portfolio choice. "That's my wild card," says Morgan. "I wanted some of the portfolio in a special situations type of fund. This one has had a terrible time of late, but I think the environment is right for it to do well now."

The fund has a value approach to investing, picking stocks that look cheap compared to their peers, and which the manager believes are on the brink of a turnaround. Many of the companies are smaller and could be ripe merger and acquisition targets. It's a style that has started to swing back into favour in recent months after being out of favour for years.

Morgan is the first of our four portfolio managers in the spotlight and we will track his progress over the coming months. For now, he is feeling quietly confident: "There's a lot of fear around at the moment, but that often means there are opportunities."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks