This is why May has a bad reputation for shares

2nd May 2017 12:44

by Stephen Eckett from ii contributor

Share on

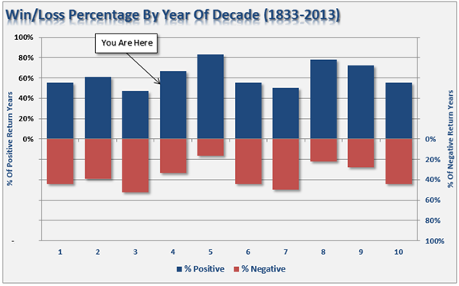

One of the most well-known stockmarket adages is 'sell in May'. And, generally, this is good advice. However, looking at the accompanying chart, you can see that the UK equity market has actually had positive returns in May for the past four years. Admittedly, last year the saw a rise of just 0.2%, but that's still a gain.

In fact, since 1984 an equal proportion of positive and negative returns in May has been seen - there have been positive returns in May in 51% of years. So why does May have a bad reputation for shares, and why is the saying 'sell in May' heeded?

One reason is clear from the chart. Although the proportions of positive and negative returns in May are roughly equal, the positive returns in the month are relatively small, whereas when the market falls in May it can involve quite a large sell-off. Since 1970, the average market return in May has been -0.5%, which is the third-worst record of all months.

Another reason for May's poor reputation is that over the longer-term May marks the start of the underperforming half of the year (May through to October), a period during which share performance tends to be lacklustre. In an average May, the market remains flat for the first two weeks of the month, and then prices drift lower in the second two.

The UK market fairly consistently outperforms the US market in some months, but May isn't one of them. In fact, May is the weakest month of the year for the relative to the S&P 500 index. On average, the UK index underperforms the US index by 1.3 percentage points.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.