AIM's biggest stars since Trump's election win

5th May 2017 14:55

by David Brenchley from interactive investor

Share on

It's a well-worn investment phrase that, over the longer-term, investing in smaller companies is more profitable than buying larger-cap counterparts. The reason for this tends to be that they have more room to expand and are more focused on growth – very few pay dividends of any significance.

However, when uncertainty increases and markets fall, investors tend to dump more risky small-caps and keep their steadier blue-chips.

There can have been no greater surprise than Donald Trump's victory in the US presidential election. But excitement around pro-business Trump's aggressive growth policies has had quite the opposite effect on investor sentiment.

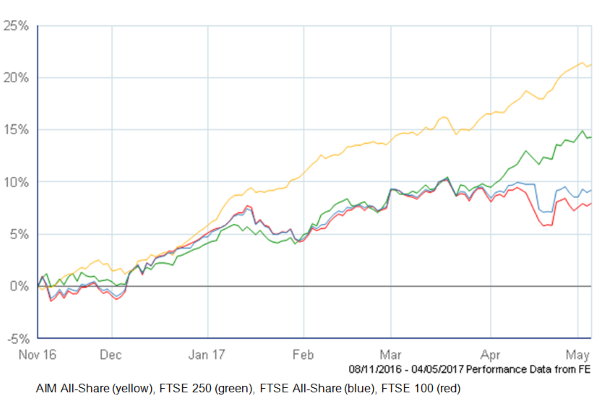

Indeed, global stockmarkets had an incredible run, until mid-January that was, since when the going has been much harder and unpredictable. True, the FTSE 250 mid-cap index has rediscovered momentum, but one market has been rising rapidly throughout.

Considering the intro to this article, then, it was no surprise to find out that, in the UK at least, the Alternative Investment Market (AIM) has been the best-performing index since close of play on 8 November.

AIM's gain of 22% compares to the FTSE 100, the index of large, mainly overseas-focused, companies, which is up a paltry 6%. The FTSE 250 and the FTSE All Share, meanwhile, sit somewhere in between the two at 12.4% and 7.3% respectively.

And a cursory glance of the best-performing funds in the Investment Association universe, via Trustnet, backs up the whole smaller company outperformance theory – over six months, the top 10 are all UK smaller company focused vehicles.

Of course, there are hundreds of companies in the small-cap universe, and a scan of the AIM All Share since Trump's victory shows there 420 companies beating the FTSE 100 in that time period.

However, many AIM stocks will be too spicy for some investors. But even if you prefer to invest only in larger growth stocks, there has been plenty of opportunity over the past six months.

In the table below, we've taken the biggest AIM-listed companies by market capitalisation and ordered them by performance since close of play on 8 November 2016. Every one of the 10 largest has smashed the FTSE 100, and you have to scroll down to at number 20 to find the first laggard.

| Rank | Company | Ticker | Market cap (£m) | Performance (%) | Sector |

|---|---|---|---|---|---|

| 1 | Purplebricks | PURP | 917 | +220 | Real Estate Investment & Services |

| 2 | SolGold | SOLG | 639 | +96 | Mining |

| 3 | Hurricane Energy | HUR | 780 | +94 | Oil & Gas Producers |

| 4 | Burford Capital | BUR | 1,567 | +63 | Financial Services |

| 5 | boohoo.com | BOO | 2,072 | +61 | General Retailers |

| 6 | Dart Group | DTG | 916 | +59 | Travel & Leisure |

| 7 | Hutchison China Meditech | HCM | 1,773 | +56 | Pharmaceuticals & Biotechnology |

| 8 | Fevertree Drinks | FEVR | 1,852 | +49 | Beverages |

| 9 | CVS Group | CVSG | 818 | +49 | General Retailers |

| 10 | Scapa Group | SCPA | 611 | +48 | Chemicals |

| Source: Sharepad. *Performance data 08/11/2016-04/05/2017 | |||||

We've already covered a few of the top performers recently, most notably (up a mammoth 650% since 8 November), (410%), (260%) and (220%).

After a strong full-year trading update, analysts reckon PurpleBricks' run is not over yet. An investment in the online estate agent at IPO 17 months ago would already have netted you gains of 237% - and Investec's Steve Liechti reckons the stock can surge further still, to 366p.

"Purplebricks has demonstrated the UK business model works, while early success in Australia highlights ability to execute and international customer appeal," he says.

There are a few AIM stocks that would have made you even richer had you bought into them at flotation. Clearly, the one that sticks out is , up 1,134% since its November 2014 stockmarket debut.

Another we have covered before is , a company that supplies "software robots" to big companies to enable them to automate their more routine back-office clerical tasks. Up almost ninefold since floating on the London Stock Exchange in March 2016, the firm is up an eye-popping 130% since November.

is another that has more than doubled in that time, though from a lower base. The semiconductor firm reported record revenues, profits and cash generation at its final results back in March, leading our stockpicker Edmond Jackson to ask whether the share could re-rate.

It's slipped back slightly since, but Edmond has called the firm up on a couple of occasions, when at 23p and 40p, and he reckons "IQE's story remains promising".

Meanwhile , the carpet maker, has made a remarkable post-Brexit vote recovery, more than doubling from its 204p low at the beginning of July. Since the election of president Trump, its shares have surged 74%, helped by a cracking full-year trading update early in April.

The firm said pre-tax profits comfortably beat expectations and it will continue to pursue acquisition opportunities. At the time, finnCap analyst Roger Tejwani correctly called the shares up 10% to 500p.

Then trading at 455p and on 15.5 times consensus earnings for full-year 2018, Tejwani reckoned it was "good value" for a company expected to generate three-year earnings per share compound annual growth rates of 30%.

Turns out finnCap is a long-time fan of the company, tipping them up at the beginning of the year as a stock to follow in 2017. With the shares then trading around 360p, its target price was 440p, so a good call all round from the broker.

Another company that was on finnCap's radar back then was , after it had made "huge operational progress" in 2016.

Then trading at around 50p, finnCap reckoned the shares could be worth 90p somewhere down the line. It's up by more than a third since then at 62p. And optimism has swelled, too, with the broker now tipping the shares, already 63% higher since Trump took over, up to 130p.

And it would be remiss of us not to mention , the global finance firm focused on law whose shares are up 61% in the past six months.

Heavily backed by our own stock picker Edmond Jackson for some years, most recently after full-year results in March, the shares still look strong. For the longer run, it looks "onwards and upwards" for Burford, says Edmond.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.