10 most highly geared investment trusts

10th May 2017 09:04

Polonius told his son Laertes in Hamlet to 'Neither a borrower nor a lender be'. The first part of that advice is certainly not something the investment trust industry has taken to heart; indeed, the very fact that closed-ended trusts are able and willing to take on debt - which is off-limits to open-ended trusts - is regarded as one of the sector's unique selling points.

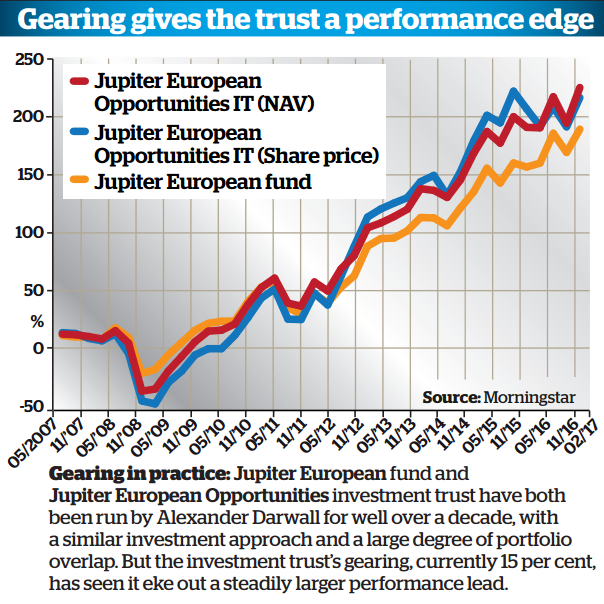

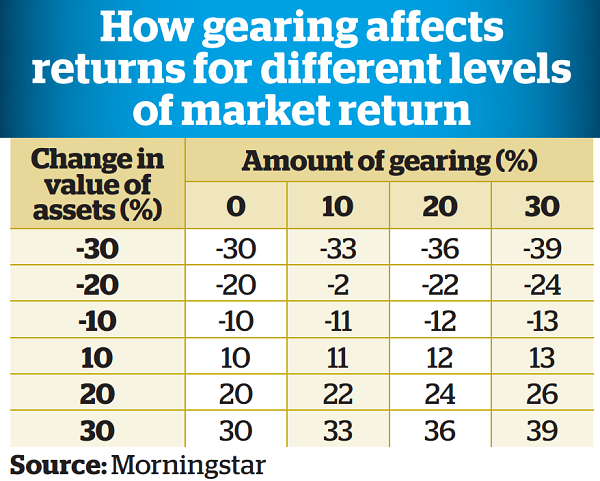

With good reason. The effect of gearing, as investment trust borrowing is known, is to soup up investment returns when the value of the trust's underlying assets is increasing. The downside is that losses will be exaggerated by gearing too.

For exactly this reason, Alan Brierley, director of investment trust research at Canaccord Genuity, argues: "The use of gearing to enhance returns over the long term is a key advantage for investment trusts; if an investment trust fails to fully utilise inherent competitive advantages, it begs the obvious question of why not simply be open-ended?"

Extra complexity

Nevertheless, the presence of gearing, or even its potential presence, on an investment trust balance sheet sometimes unnerves investors and even financial advisers; research published by the Association of Investment Companies (AIC) in November 2016 found 40% of advisers regarded gearing as a barrier to investment in the sector. They're uncomfortable with the extra complexity it creates - as well as the increased risk that goes hand in hand with the potential for greater reward.

It's therefore important that investment trust investors get to grips with the basics. Not all investment trusts use gearing, but the aim in borrowing money is to enhance shareholder returns; the manager may use the debt raised to invest in a short-term opportunity or to consistently support a long-term view, but either way they are able to back their judgement without selling existing investments.

"Gearing over the long-term has contributed to the strong performance of investment companies as markets have risen," says the AIC's Annabel Brodie-Smith. "But it's important to understand how it works."

Imagine, for example, a trust with assets worth £50 million and a bank loan of £10 million that it has fully invested. Now imagine that the value of the assets rises by 10%: the trust is now worth £66 million, or £56 million after repayment of the bank loan. It's made a 12% gain, even though the market only moved by 10%.

The risk is that assets fall in value rather than rise. In this example, a 10% drop in the market would have seen the trust's assets fall in value to £54 million, or £44 million after the loan. The latter figure represents a 12% loss - worse than the market performance.

Gearing is expressed in terms of the trust's borrowing as a percentage of its assets - in this case, the trust would be said to be 20% geared. In practice, however, things can get a little more complex, since the trust manager has the option of holding some or all of the borrowing raised in cash, rather than investing it - if, for example, the current investment view is cautious or defensive.

Imagine, for example, that our £50 million trust chose only to deploy £5 million of its loan. If it then experienced a 10% market fall, its £55 million of invested assets would fall in value to £49.5 million, but including the rest of the loan, the trust would now be worth £54.5 million. Taking the £10 million of debt out of the calculation, the trust is now down to £44.5 million - a loss of 11%, rather than the 12% suffered under full investment.

For this reason, the distinction between gross and net gearing is important. The former takes no account of cash, but the latter does, and therefore gives a more accurate measure of the trust's true level of exposure to gearing. In the example above, the trust with only £5 million of its £10 million loan deployed would be said to be 10% geared.

Bear in mind, too, that investment trusts gear up in different ways. One option is to take on debt, typically at a fixed cost, through financing facilities such as bank loans or debentures. But 'structural gearing' can sometimes prove cheaper and more tax-efficient. Split-capital investment trusts have more than one class of shares offering exposure to the same pool of underlying assets.

Some share classes get a greater share of income and gains than others, but only after the latter have been paid a minimum level of returns. In the former category, stock such as highly geared ordinary shares is geared because holders of the latter share classes, such as zero dividend preference shares, must be repaid before returns are calculated.

Debt cost lock-in

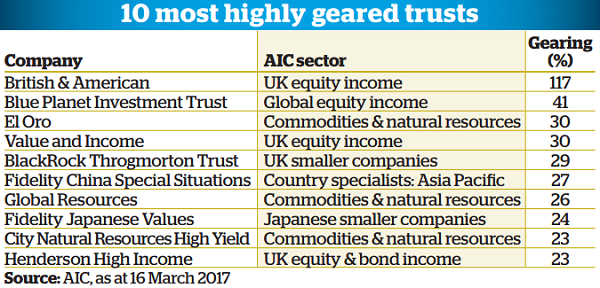

So much for the theory. What are investment trusts doing in practice? "We estimate that 47% of investment trusts provide geared exposure at present, with an average level equivalent to 6%," says Simon Elliott, an investment trust analyst at Winterflood Securities.

"Most of this will be through short-term bank facilities, often in the same currency as the underlying assets, thereby providing a degree of currency hedging; in addition, a small number of investment trusts have long-term fixed debt, including debentures."

Therein lies a dilemma for investment trusts - and for investors. Long-term debt facilities provide certainty that finance will be available when needed, and the trust has an upfront view of the cost of that finance. However, locking into that cost at the wrong moment can prove to be an expensive mistake.

This is what happened with a number of investment trusts that took on very long-term loans during the mid-1990s, when interest rates were in double digits.

The lesson is an important one, for the examples above don't include the cost of gearing. If you're borrowing money, you'll need to earn a return on the debt that at least matches the interest you're paying on it.

For this reason, a string of investment trusts have sought to refinance long-term debt over the past couple of years, now that interest rates stand at rock-bottom lows. Henderson Smaller Companies (HSL), for example, replaced a £20 million debt facility costing 10.5% with £30 million worth of 20-year unsecured loan notes paying interest of 3.33%. Foreign & Colonial (FRCL), which had just repaid a long-term loan costing 11.25%, took on £75 million of debt costing 3.04%.

If getting rid of hugely expensive debt seems like a no-brainer, should more investment trusts be rushing to gear up for the long term at these very low prices? Not necessarily, argues Charles Cade, head of investment trust research at Numis Securities.

"In general, we believe that it is preferable for managers to use gearing on a flexible, opportunistic basis, rather than for a trust to be saddled with structural gearing throughout the market cycle," he says, pointing out that short-term debt is also very cheap right now. "Nevertheless, we feel that there is now an argument for investment trust boards to consider taking out long-term debt for a proportion of a trust's potential gearing."

Some investment trusts are going in a different direction. For example, in March, Polar Capital Global Healthcare Trust (PCGH) announced an issue of zero dividend preference shares, which will provide it with gearing over the next seven years before the trust is due to be wound up in 2025.

"The scarcity of zeros and the capital gains tax advantages now make them a viable alternative to private debt placements, particularly for smaller trusts," explains Cade.

Overall, however, investment trusts aren't taking on significantly more debt, despite the rising stock markets of recent months, and the widespread availability of cheap finance. Some sectors - notably property, where gearing helps with liquidity issues - do have high average levels of gearing. But in most cases, borrowing levels are much more modest; across the investment trust sector as a whole, that average gearing figure of 6% is slightly down on last year.

Investment trust managers are conscious that there is a fine line to tread. On the one hand, their ability to take on gearing is a point of differentiation; on the other, gearing exposes investors to additional risk, so a degree of prudence will always be important.

Still, it's important that investors in any investment trust understand what their potential exposure to gearing could be. Money Observer's investment trust data shows the current level of gearing of every investment trust, as well as the high and low points of each over the past three years. In addition, trusts typically have a board-led policy on gearing - with maximum and minimum levels that can't be exceeded by managers.

Check before you invest.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks