Mark Slater on Brexit bargains and why Lloyds is a 'buy'

16th May 2017 09:20

by Kyle Caldwell from interactive investor

Share on

For those who earn their living in the opinion polling industry, 2016 will forever be etched in the memory as a year to forget. It was also a period the vast majority of fund managers will been keen to put behind them - nine in 10 UK actively managed funds (87%) underperformed over the year, figures from index provider S&P Dow Jones indices show.

Many were wrong-footed by both polls and bookmakers pointing to a victory for the 'Remain' campaign. But this was not the only mistake made - investors were also taken by surprise in regard to the reaction of the financial markets.

Brexit fallout hits domestic-focused firms

For Mark Slater, manager of the Slater Income, Slater Growth and Slater Recovery funds, on the whole the bloodbath that initially played out was "completely irrational" that "defied logic".

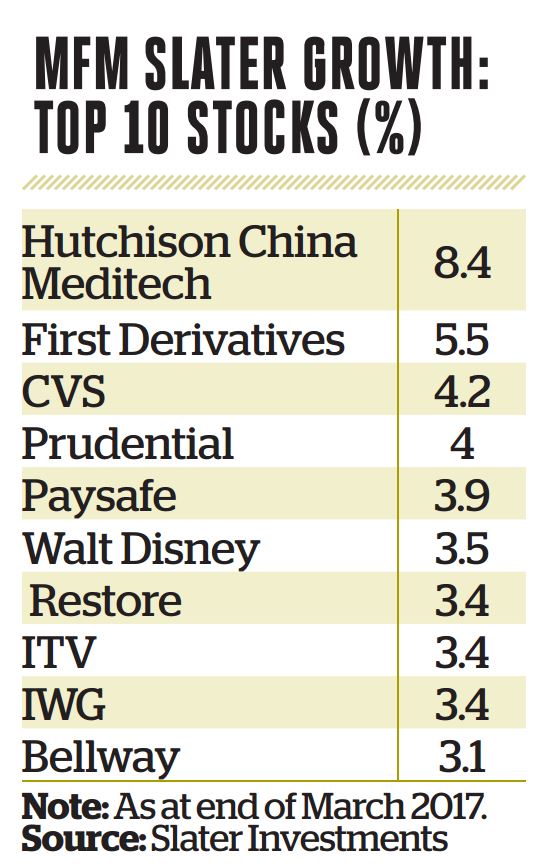

"Once the market opened on 24 June, some really big companies such as the housebuilders fell 30% rapidly. Pretty much any business that was geared towards the UK consumer and did not have a strong foothold internationally was heavily hit. Some of the moves were random. For instance, one share that I recall fell sharply was CVS, the UK's largest vet; let's be honest, Brexit is not going to stop people taking their dogs for a walk."

For the biggest blue-chip names in the it was merely a two-day hangover, thanks to the declining pound, which has the effect of making exports more competitive by weakening sterling and thereby boosting overseas earnings. But for those outside the top 20 or 30 names, Slater notes, there was "an awful lot of dislocation for some time".

By Slater's own admission, it is not part of his day job to "try and predict market events", but during times of turbulence it is part of his job to react to them. Indeed, market corrections hand Slater the opportunity to top up or add new positions in 'good growth businesses' at the 'reasonable prices' he craves.

The Slater Growth fund put a 10% cash position to work following the Brexit vote, adding to existing holdings in , , PR firm and document storage business , to name a few. His Slater Income Fund was fully invested in order not to dilute the dividend yield (one of the highest among its peers at around 4.8%), but he has more recently added a couple of new holdings, most notably , which is the first bank Slater has bought 'in a very long time'.

"As a stock-picker I feel that if I cannot identify new ideas then it is an indication, to me at least, that the market is overbought. Compared to last summer there are fewer opportunities, but I am still able to find new ideas that meet my criteria," he comments.

Slater, son of Jim Slater, who pioneered the PEG ratio - a measure widely used to find cheap growth shares that may soon benefit from a re-rating - looks for a number of attributes before investing.

First he scours companies that are growing their earnings at an above-average rate. Then he takes a look at the valuation, discarding those that have expensive price tags. "This can pretty much straight away eliminate 95% of the market. The reason is simple - most companies fail the growth test, while those that pass have been ludicrously overpriced by the market." The manager than assesses whether the growth drivers in place today are sustainable down the road. "Ultimately what I like to see is a company in charge of its own destiny: real companies doing real things," he adds.

Bank profitability to improve

In the case of Lloyds, the tougher regulatory environment has arguably made banks a less risky prospect, particularly from an income perspective. In the next couple of years Slater expects Lloyds to become more profitable as the June 2019 deadline for protection insurance (PPI) claims draws near.

"When the money the bank has set aside for payment protection insurance (PPI) provisions drops off the bank's pre-tax profit, growth will become more significant. The dividend yield (7.9% on a forward price/earnings ratio) is obviously attractive."

Another area he thinks over the next couple of years will reward investors handsomely, whether they are of a growth or an income persuasion, is the housebuilding sector. He owns , , and AIM -listed .

"In previous cycles the sector has made a habit of cutting its own throat, but this time around it is different. I prefer to focus my sights on the companies that are increasing volumes rather than the housebuilders that are not looking to grow and are instead retaining capital."

Slater's current preference for favouring names outside the FTSE 100 heavyweights is due to the fact that 'smaller names are still playing catch-up' after suffering from the Brexit blues. Two of his three funds - and Slater Income - also have ground to make up, having slipped behind their respective sector averages over the past year.

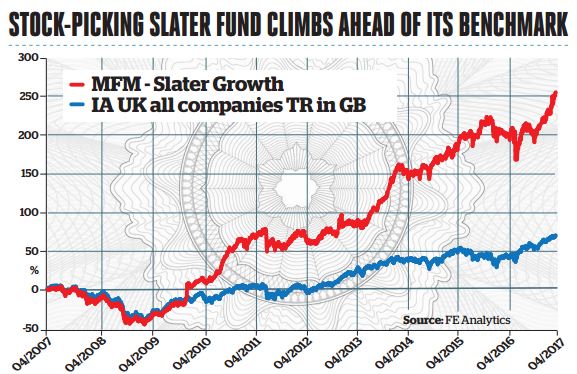

Slater acknowledges that "2016 was a tough year in general for growth businesses', and that the 'growth approach cannot outperform every day or month or quarter'; but he maintains that 'over time the approach is extremely effective". His longer-term performance figures back this up, and then some. All three funds are comfortably ahead of sector rivals and the wider UK stockmarket over three- and five-year time frames.

Looking ahead, Slater thinks one of the silver linings to come out of the Brexit vote is a better environment for income-seekers, which for an 18-month period from the start of 2015 had become tougher, particularly in regards to sourcing income at a sensible price.

"It had become more challenging; I recall that in the summer of 2015 it was difficult to find dividend yields around the 3 to 3.5% mark without paying over the odds. But today I am finding plenty of opportunities, although we need to look more outside the FTSE 100. We do invest in large-cap big names, typically a quarter or a third of the fund, but this is much less than other UK equity income funds, where there is a high level of index awareness."

Slater adds that in order to achieve one of the highest yields in the Investment Association's UK equity income sector he does not need to 'play any dividend games', such as jumping in and out of stocks before they go ex-dividend. He also avoids writing call options.

"I don't aim to have one of the highest-yielding funds in the sector - it is more an outcome. The yield is a reflection of the composition of the portfolio, and in addition I am looking to grow the overall dividend of the fund each year."

The income portfolio is divided into three buckets, targeting different types of income shares. The first is growth stocks with a good yield, with Slater naming and as two stocks that he is currently favouring. The second segment focuses on dividend stalwarts such as Imperial Brands. Last November the tobacco company, whose brands include Lambert & Butler, raised its dividend by 10% for the eighth consecutive year. The third bucket is reserved for cyclical high-yielders, including new holding Lloyds Banking Group.

At a time when pressure is growing on active fund managers to demonstrate value, Slater's career track record speaks for itself. Over the past decade he has delivered annualised average return of 12.6%, a feat that no other fund UK fund manager has achieved.

While disclaimers on fund management marketing literature warn that "past performance us no guide to future returns", Slater has consistently stood out from the crowd and added value through a mix of outperformance and reliability.

Slater in six

1) My best investment was...

, an oil services company. My lowest purchase price was 17p a share, at which I managed to buy a decent chunk of the company in March 2009. I sold out a few years later as the shares rose, selling large numbers of them at 30-35 times that price.

2) My worst investment and lesson learnt was...

Bullers back in 1994 or 1995, predating the launch of our funds. It was meant to be an acquisition vehicle. I bought a substantial stake for my personal finances. Sadly, the business was as bad as the management team. I put far too much emphasis on what the company might become, as opposed to what it actually was.

3) My alternative career would have been...

A financial journalist, which I enjoyed when I did it before founding Slater Investments.

4) In my spare time I like to....

Spend time with my family - having three boys takes up a lot of spare time. I enjoy salmon fishing; I also took up tennis five years ago and play several hours every weekend with a coach.

5) The one thing I would like to see change in financial services is...

I would make the Financial Conduct Authority a department of government. Parliamentary review would slow down the volume of new rules, which is currently a runaway train.

6) Do you invest in all three funds…

Yes, heavily. I am by far the largest investor in our funds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.