Buy, hold, sell: Property company shares

11th May 2017 12:00

by Marina Gerner from interactive investor

Share on

Marcus Phayre-Mudge has been the lead manager of this Money Observer Rated Fund since 2011. The majority of the portfolio is in continental shares, led by holdings in Germany and France. The trust can also invest in physical property, all of which is based in the UK.

The 10-year average of its direct UK holdings has been in the region of 7-15% of the portfolio; it currently stands at 9%, as the manager sees "more value in the equity market than in the physical market, because the equity market is trading at large discounts."

The trust's yield is in line with the sector average at 4%, but the manager aims to pay a progressive dividend yield. "Our reserves are equal to about 10 months' worth of income," Phayre-Mudge adds. "You can pay out income from capital but we don't do that; all dividends are fully covered."

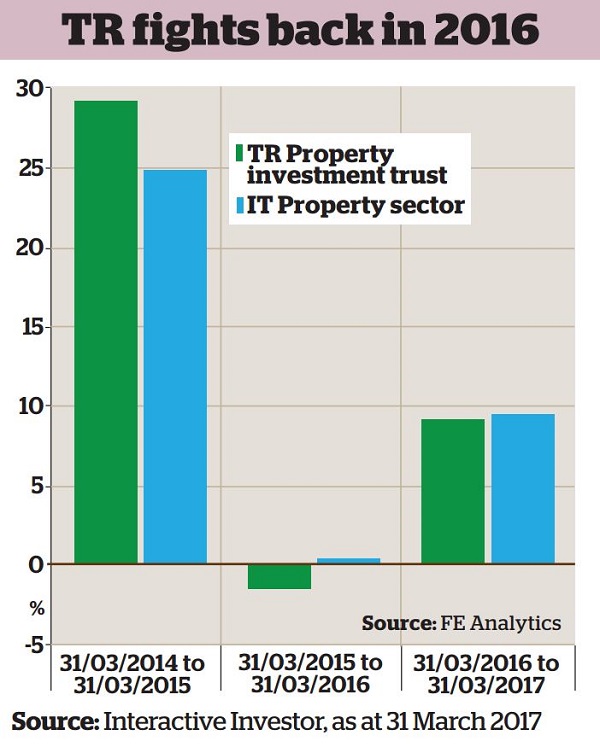

Over one year returned 10.8% and over 10 years it has gained 137.3%. Recently it has "benefited from more than half of its assets being in non-sterling, and the strength of European currencies".

Phayre-Mudge adds that low interest rates have been a valuable tailwind. Further, while London office rents are not rising and Brexit is a risk, office rents in Berlin are on the up. The trust currently trades on a discount of 10.3%.

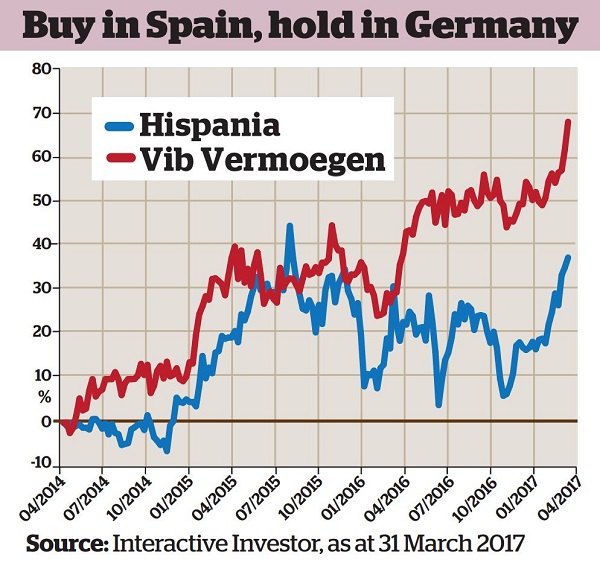

BUY: Hispania

One stock Phayre-Mudge has been buying over the past three years is Hispania, a Spanish SOCIMI (with a structure similar to a real estate investment trust). He first bought Hispania at IPO at €10 (£8.50) per share in March 2014, and the total return since then is 29%. The company invests primarily in hotels as owner and manager, but also in residential and office buildings.

It is externally managed by private property company Azora, and once Azora's management contract expires in 2020, the business will be wound up. That announcement knocked back Hispania's share price, providing Phayre-Mudge with an opportunity to buy into Spain's strengthening economy; it currently has the highest GDP growth in the eurozone.

Phayre-Mudge says Hispania's sale in 2020 "merely means we will crystallise the net asset value at that time -but we believe that this will coincide with a period of improvement in the broader Spanish economy, which is already well under way."

It has done well, due to a structural shift towards 'safecationing' in Western Europe -tourists prefer Spain to countries such as Egypt or Tunisia. In addition 'the land is already built on or protected, so they've been renovating and upgrading hotels'.

HOLD: Vib Vermoegen

Phayre-Mudge is 'holding' Vermoegen, a small German owner-developer business based in Ingolstadt, Bavaria. It develops, buys and lets commercial properties, including logistics properties, industrial property and shopping centres, in southern Germany. Its portfolio spans about 10 million square feet and 100-odd buildings.

"The dividend growth over the last five years has been 40%," says Phayre-Mudge. The company uses a lot of long-term mortgage finance through regional banks; it has longstanding arrangements and an efficient debt structure. It also had a smooth transition from the founding chief executive to its new incumbent.

Phayre-Mudge values the company's local focus and adds that it has a growing fan base of institutional investors. The share price is 'relatively full'; however, the business is expanding.

SELL: Hammerson

has a share in designer outlet centre Bicester Village and a part of Brent Cross shopping centre in north west London, among other holdings. "We have owned this company for a long time," says Phayre-Mudge, "but my job is to have relative exposure."

He explains that UK large-cap property companies all look cheap today because they're standing on 20% discounts to net asset value. Why is he negative about them then? "It's not that I expect them to have hugely negative performance from here, it's merely that on a relative basis there are better places for my capital."

Online shopping sales figures are growing at 15% a year, while physical sales are growing at a tenth of that pace - 1.5%.

Hammerson is to be applauded for its strategy of branching out beyond its core business, says Phayre-Mudge; but he thinks the business will not have the earnings growth that the management team is forecasting. "They're not doing a bad job; they're just up against it."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.