10 of the best High Flyer shares around

17th May 2017 13:58

by Ben Hobson from Stockopedia

Share on

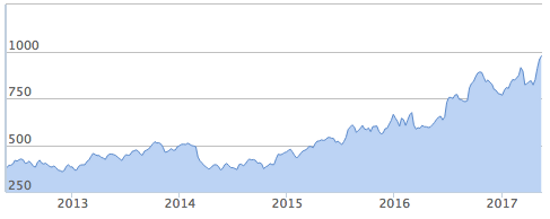

Shares in the biotech company have risen in price by 117% over the past two-and-a-half years. In that time, it's always been a high quality business that was popular with investors. The only problem was that its share price was high enough to bring most value investors to tears.

Abcam has the same investment profile as a select a group of companies in the stockmarket known as High Flyers. They are stocks capable of compounding strong returns over many years - but you have to pay up for the privilege of owning them.

Features of a stockmarket high flyer

A key feature of High Flyers is their financial and franchise quality. Often they have strong brands or services that their customers simply can't do without. This is exactly what we've seen at Abcam, which has built a large catalogue of protein research tools that are used by scientists in the study of cells.

Six years of financial results shows that this is a consistently profitable business. It generates very large operating margins of 27% and equally eye-catching return on capital of 16.9%. Only niche, well-defended firms can command this level of pricing power and profitability over prolonged periods.

A blend of quality and momentum

Consistently profitable, fast-growing firms are adored by the stockmarket. Often they attract attention by constantly forcing analysts to ratchet up their earnings forecasts with better than expected results. Again, these types of earnings surprises have underpinned the price momentum in Abcam's shares. As a result, it has been regularly breaking new highs over the past two years.

High flyers can appear pricey

Back in December 2014, when shares in Abcam were trading at 450p, the stock had a trailing price-to-earnings ratio of 26.5 times. That meant it was very much in territory inhabited by speculative growth stock investors. Indeed, shares in Abcam have rarely looked cheap on traditional valuation metrics in recent years.

Yet, what one investor sees as expensive, another may well view as a good deal. If Abcam can keep growing at this pace, then it might be reasonably priced at the current valuation. But like all High Flyers, the momentum factor is prone to reversals if growth slows and expectations are dashed.

Abcam isn't the only company on the stockmarket with this type of profile. Scanning the market for high quality, high momentum shares reveals some well-known names...

| Name | Market Cap £m | Forecast PE Ratio | Quality / Momentum Rank | Stock Style | Sector |

|---|---|---|---|---|---|

| Pagegroup | 1,634 | 19.1 | 99 | High Flyer | Industrials |

| Fevertree Drinks | 1,965 | 60.2 | 99 | High Flyer | Consumer Defensives |

| Electrocomponents | 2,390 | 23.3 | 99 | High Flyer | Industrials |

| Abcam | 1,980 | 32.3 | 97 | High Flyer | Healthcare |

| Micro Focus | 5,562 | 17.1 | 95 | High Flyer | Technology |

| Croda International | 5,169 | 22.3 | 95 | High Flyer | Basic Materials |

| Unilever | 118,304 | 21.5 | 95 | High Flyer | Consumer Defensives |

| Just Eat | 4,016 | 30.8 | 95 | High Flyer | Technology |

| Burberry | 7,412 | 20.8 | 94 | High Flyer | Consumer Cyclicals |

| JD Sports Fashion | 4,438 | 20.3 | 93 | High Flyer | Consumer Cyclicals |

This approach picks up some of the market's most consistent success stories of recent years, including well-known, long-running momentum plays like , , and .

But they're not all household names. High Flyers exist right across the market, and include the likes of , which is a major distributor of electronic components, , a large-cap software group, and , a chemicals producer.

The appeal of this High Flyer approach is that it targets some of the best quality, fastest-moving shares in the market. The philosophy behind it is that paying up for high quality firms with investor sentiment behind them can be very powerful - even when they appear at first sight to be expensive.

One of the key risks with these shares is that if they disappoint the market, the momentum in them can plummet. So they need to be watched carefully. But the attraction is that the combination of two factors in quality and momentum can lead to companies that are capable of compounding investment returns over many years.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.