Should you invest in Shell or BP?

17th May 2017 14:20

by David Brenchley from interactive investor

Share on

It's an age-old question that frequently divides opinion amongst investors: which of the high-yielding blue-chip oil majors should you invest your money in, or ?

Now, a lot of the time the answer will be both, especially for fund managers – according to research by Neptune Investment Management in February, 39% of UK equity income funds rely on the pair to deliver more than 10% of the yield they pay.

This is unsurprising, seeing as BP and Shell currently yield 6.7% and 7.1% respectively. They are two of the most generous companies on the London Stock Exchange.

But if you only have room for one or the other in your diversified portfolio, which should you buy? Well, Panmure Gordon thinks it has the answer.

In an initiation note sent to clients Wednesday, the broker sets out its stall on BP. "We initiate with a 520p target price and a 'buy' recommendation," it announced. That's a decent potential share price appreciation of 10.6% to add to the equally tasty dividend.

"However," it added, "we prefer Shell, which has similar upside but should have more than double the cash yield from next year and has a more robust business mix to low oil prices."

We reported a couple of weeks ago when Shell published first-quarter results that Panmure was a fan. Its recently upgraded target price of £25 implies potential upside of 12%.

Digging deeper on BP, Panmure believes the firm will see growth in upstream production - the division responsible for its oil and gas exploration activities - of 5.4% per annum to 2021, "boosted by deals done at year-end".

That should help earnings per share (EPS), which in 2016 stood at 13.8 US cents, almost quadruple. It pencils in 45.9 cents for 2019 and reckons this will drive a sharp improvement in multiple ratings and returns. Impressive.

But, like many, the broker remains sceptical about whether BP can deliver its ambitious 'getting back to growth' strategy that was thought to be a resetting of its investment proposition. While it looks an attractive plan, and its volume growth targets are likely to be exceeded, "delivery of the financial performance under real world conditions is less certain".

Panmure also doubts Shell's ability to deliver its targets, but does believe any tangible evidence of an improvement in underlying financials is more likely to come from Shell. Should an improvement materialise from either, it "should be taken positively".

Generous payouts

The dividend is likely to be the main consideration when weighing up the pros and cons of both companies.

Shell's payout has frequently been questioned by fund managers, including Neil Woodford. However, it is important to remember Shell has not cut its dividend since World War II – and that's likely to continue.

Conversely, BP suspended and then slashed its dividend after the Gulf of Mexico oil disaster back in 2010. Analyst Colin Smith is not worried, though. He believes the dividend is secure.

"But, with gearing currently towards the top end of the 20-30% band and only just below 20% by 2020, managing the balance sheet is likely to take priority over neutralising dilution."

He expects BP's scrip option, popular with its large investor base as it allows them to receive their dividend as new shares, to continue. In contrast, Shell is expected to be in a position to end its scrip this year and restart share buybacks in 2018.

At the time of the initiation note, the upside on Panmure's target prices for both stocks was 14%. BP has since ticked up slightly. Still, Shell looks much more attractive, Smith says.

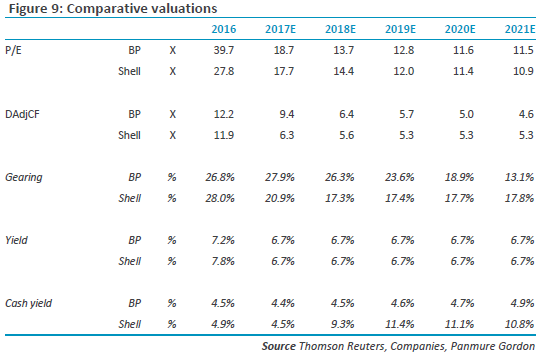

While BP's valuation multiples should "fall sharply" from this year, its price/earnings (PE) ratio is not expected to fall below 12 times before 2020. Meanwhile, its debt adjusted cash flow (DACF) does not fall below 6 times before 2019.

Shell, meanwhile, trades on lower multiples, but is already deleveraging. A return of buybacks next year "would put Shell on more than double the cash yield of BP". While BP's cash yield is forecast to stay flat at just under 5%, Shell's could double year-on-year to 10.8%.

Further, Shell's business mix – notably its higher exposure to downstream and chemicals – means it should be more robust to any oil price concerns.

Share price-wise, there's not much in it, with both outperforming the since the opening bell of 2016. Early 2016 saw both stocks slide to multi-year lows.

Looking at other broker targets for the pair, UBS has very similar views to Panmure. In fact, they are both on the same page regarding Shell, at 2,500p, while UBS is 5p more bullish on BP. Barclays, meanwhile, is far more positive on both, with targets of £27.50 and £6.25 respectively.

Clearly, the City sees further to go for both on their roads to recovery.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.