Witan's Andrew Bell: Why it is wrong to give up on active funds

2nd June 2017 14:20

by Kyle Caldwell from interactive investor

Share on

A run of five consecutive years of outperformance ground to a halt for the in 2016. Not since 2011, when Europe was close to imploding, have the third-party active fund managers that Witan employs slipped behind their respective markets.

But rather than rest on his laurels, manager Andrew Bell moved to reduce the 'underperformance gap' by taking full advantage of the tools he has at his disposal, namely gearing and share buybacks.

Over the course of 2016, Witan's gearing level was around the 10% mark, but at times of market stress, such as after the Brexit vote, the tap was loosened further, with Bell handing extra money to the UK and global fund managers Artemis and Lansdowne Partners. This proved to be the right call, as markets largely took Brexit in their stride, swiftly shaking off an initial two-day hangover.

Tactical give and take pays off

"They were the two managers who posted the worst performance last June," Bell points out. "Having some money on the table to play with was helpful, as at the time I thought the general sentiment was too bearish. High-calibre fund managers will always go through hot and cold periods, and I feel it is my job to back managers that are going through a bad period, because they will make it back. Similarly, on the other side of the coin, it is prudent at times to take money away from managers that have performed well."

Not only did Bell tactically make the right call around Brexit, but he also successfully timed dips that occurred in Japan and the emerging market regions. He bought index futures for both markets, and in both cases benefited when they climbed higher.

A run of five consecutive years of outperformance ground to a halt for the Witan Investment Trust in 2016. Not since 2011, when Europe was close to imploding, have the third-party active fund managers that Witan employs slipped behind their respective markets.

Overall, the gearing calls added 2% to the trust's performance. Elsewhere, an additional 0.5% of performance was generated by share buybacks. At present the discount (at the end of April) stands at 2.2%, below its 12-month average figure of 5.9%. All in all, Witan produced a total return of 22.9% for 2016 - 0.1% behind its benchmark, a composite of the , All-World North America, All-World Asia Pacific, All-World Europe (ex UK) and All-World Markets indices.

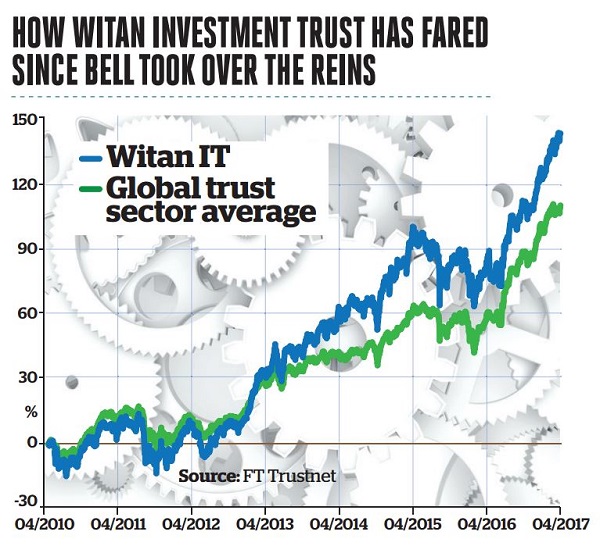

Since taking the chief executive hot seat in 2010, Andrew Bell has revitalised the trust's fortunes. On a five-year view, its share price is up 130%, comfortably ahead of its peers: the average global trust has risen by 90% over the same period.

He has made sweeping changes to make the fund more actively managed, jettisoning fund managers that he felt were not adding sufficient value and moving to clear out passive funds, which before he took the helm accounted for around 22% of the trust. The tracker exposure was mainly reserved for the US stock market, which is a tough nut for fund managers to crack.

Bell agrees, which is why none of the 11 external fund managers in the portfolio have a remit only to buy US shares. Instead, Bell prefers managers to "go wherever they see fit"; hence five of the managers have a global remit.

Similarly, he prefers to hand money to a regional Asian or emerging market manager and avoids constraining them to sticking solely to "a market they hate such as Japan, which they have probably spent the last 25 years getting wrong".

The UK equity weighting is 30%, the biggest country allocation overall, but half what it was at the turn of the millennium. Bell says this is a reflection of the UK market becoming "less relevant", particularly with the rise of fast-growing economies in the emerging market regions. Indeed, this is an area he has been shifting more money towards, recently hiring GQG Partners, an emerging market specialist.

Overall, Bell has 13% of the trust in the Far East. Over time he expects this portfolio segment to become more substantial. "In 2016 emerging markets had been in a bear market for five years. Today I think they are still relatively cheap, despite enjoying a strong run over the past year. For me this is a long-term theme for the trust. It is a vibrant and exciting area; collectively, the emerging market economies' rate of growth is two or three times that of their western counterparts," he says.

He adds: "But it is not a homogeneous asset class, as countries and companies within the universe often possess quite different investment characteristics. We therefore took our time when searching for a manager, as we wanted to find an emerging market specialist that has a focus on picking high-quality companies."

On the whole, Bell is mindful of equity valuations, which are trading higher than their historical averages, partly as a consequence of the record low interest rate environment. This makes it a trickier hunting ground for fund managers to find "value", but nonetheless Bell thinks it would be unwise to show active fund managers the red card. Some investors in recent years have already voted with their feet, with passive funds selling like hot cakes.

Difficulties for active managers

For investors who like to base their decisions on hard evidence, the fact that nearly nine in 10 fund managers failed to beat their benchmarks last year does not make positive reading for the active fund management industry.

On reflection, Bell points out, "active managers found the going difficult in 2016", but he adds that high index levels, most notably in the US and UK, indicate there are "few windfalls" remaining for index investors. "I am optimistic that the managers I have chosen will continue to exploit valuation anomalies in their respective markets," he remarks.

Bell, a tennis fan, adds that "not everyone is going to end up a Wimbledon champion", but the most skilled, such as British star Andy Murray, rise to the top. "Not every active fund manager is going to win, but there will be winners, and it is my job to find them," he says.

While the active versus passive debate will continue to rumble on, in Witan's case Bell has proved that it is worth paying up for talent. In addition, he has made a conscious effort to keep a lid on costs - Witan's ongoing charge figure for 2016 came in at 0.75%. When stripping out the performance fee (owing to some external fund manager underperformance in 2016), the charges dropped to 0.65%. This compares favourably with Witan's open-ended multi-manager rivals, who tend to charge around the 1.25 to 1.5% mark, reflecting the double layer of charges incurred through the use of other funds.

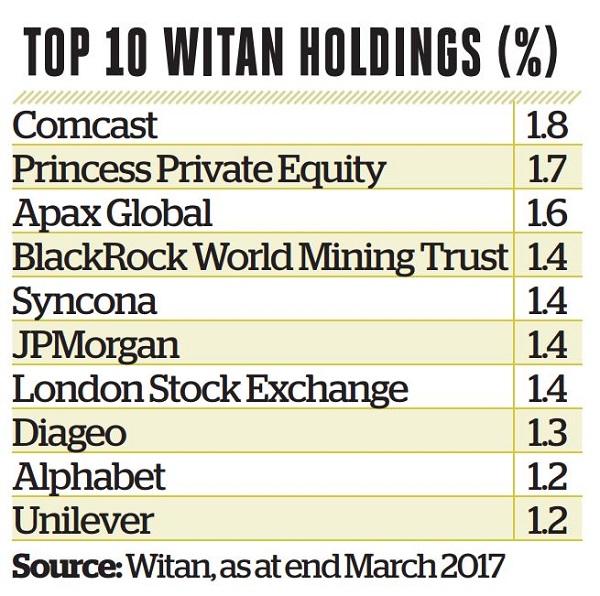

Bell runs his own segment of the portfolio, which comprises around 10% of assets. He looks to invest in areas where the external fund managers would not invest, such as private equity, and he keeps a close eye on "special situations" such as investment trusts that are out of favour.

This prompted him to take a position in two-and-a-half years ago, admittedly a year or so too early. A more recent purchase last year in the form of was timed better. Bell bought on the grounds that the trust was being mistreated by the market as a pure UK property play, when in fact the majority of the trust's property shares are listed on European exchanges.

Witan is a favourite with both long-term ISA savers and financial advisers, and a big reason for this is the trust's impressive and reliable dividend track record, amounting to 42 years of consecutive annual rises. In 2016 the dividend increase of 11.8% to 19 pence a share was more than double the level paid a decade ago.

In addition, the trust is viewed as a solid starter fund for first-time investors, due to its multi-manager structure, which Witan switched to in 2004. So far there's been little in the way of direct competition for Witan in the investment trust sector, but this is no longer the case, with switching to a multi-manager structure.

Bell, however, seems very relaxed - and he has good reason to be, given that he has rejuvenated Witan's fortunes, whereas Alliance Trust's turnaround attempt has only just begun.

Bell in six

My best investment was: my family, which pays dividends every day.

My worst investment and lesson learnt was: Independent Insurance about 15 years ago, which went bust. Don't buy things just because they look cheap, and make sure you understand the complexities of Financial companies such as banks and insurers.

Alternative career would have been: politics, although I'd be much less tempted now, even if I was still 30, than I might have been in the 1980s.

In my spare time I like to: ski, cycle, play tennis and drink wine.

The one thing I would like to see change in financial services is: investment management fees that reflect the cost of doing the job rather than being linked to the size of the assets under management. It doesn't cost 10 times as much to manage £1 billion as £100 million, so growing funds should share the lower unit costs with investors. As a payer of such fees Witan would benefit from such a change, but clearly fund management companies have an established interest in the status quo.

Do you invest in the trust: yes, I have bought shares in Witan worth several times my annual salary.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.