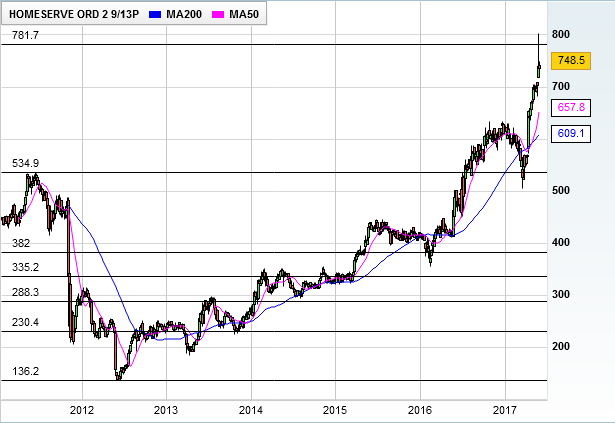

Homeserve set to surge to all-time high

2nd June 2017 13:32

by David Brenchley from interactive investor

Share on

There's no stopping , it seems. Analysts continue to call the home emergency repairs business up correctly. We heard that some were tipping the stock to above £7 after a trading update back in April with shares then at 639p.

Leading up to full-year results, Homeserve saw a 10% uptick above that £7 level as confidence in the business grew and, after expectations-beating results on 23 May they shot up a further 14% overnight to a record high 803p.

That's when, unsurprisingly, the profit-takers showed their hand and banked some pretty healthy gains.

To take a real-life case study, we reported back in November that senior independent director Mark Morris bought around £70,000 worth of shares at just 599p each. Today, they would be worth over £87,000. Similarly, fellow board member Chris Havemann's £48,000 spent at 583p would now be worth over 60 grand.

Shares are up 29% already year-to-date as the stock has steadied in the past fortnight to trade in a range between 760p and 730p, but now, according to brokers at Barclays, an all-time high could once more be on the horizon - and this time it will stick, they say.

The company provides emergency repair services to more than 7.8 million homes worldwide, its website boasts. Now, UK operations account for just under half of its revenues in the year ended 31 March 2017 and it's branching out into the continent, with both Spain and France growing much faster than its home market is at 33.5% and 18% respectively.

However, it's Homeserve's US branch that is getting Barclays excited. Revenues in North America grew by 49% last year to £227.8 million; that's an 82% improvement from 2015. Adjusted operating profit jumped 75% year-on-year to £21.2 million, or 231% in the past two years.

And Jane Sparrow, analyst at Barclays, expects that momentum to continue into full-year 2018 and beyond. "Our long-term model [is] forecasting North America becoming Homeserve's largest profit contributor within five years and delivering 10-year profit compound annual growth rate (CAGR) of 18%," she added.

Recent acquisitions have boosted its offerings in both the UK, via Checkatrade, and Spain, via Habittisimo; and beyond that, its July 2016 purchase of Utility Service Partners, which now gives it access to a market of smaller, municipal partners in the States, that really excites. Its maiden contribution to profit in 2018 is due to be around $15 million.

Sparrow continued: "If we apply similar metrics to US peers, there looks to be a significant revenue and profit opportunity, to which we currently ascribe no value." She hikes the broker's price target 19% to 828p, suggesting potential upside of 10.5%.

This value, she says, reflects a combination of three factors: "Rolling forward to March 2019 forecasts; a modest upgrade to our profit assumptions in the US and UK following outperformance in FY17; and an increase in the operating profit multiples we apply to the U and International operations."

While the base case outlined above surely looks good to shareholders, its upside case is even more tasty. According to Sparrow, a return to even modest customer growth in the UK could bring further operational efficiencies and drive mid-single-digit UK profit growth.

Combine this with over 600,000 new customers per annum in the US and a 20 times EBIT multiple to International could result in a target price of £9.51!

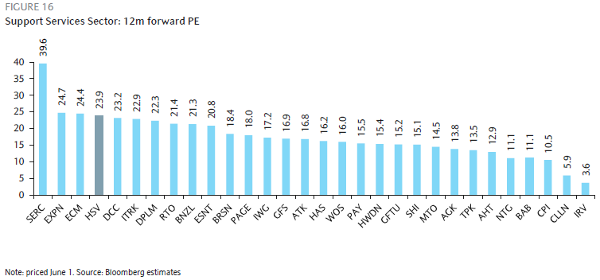

On a 12-month forward price/earnings multiple of 23.9, Barclays says Homeserve is currently trading at the top end of both its historic valuation range - on both an absolute and relative basis - and the support services sector.

"However, with a three-year forecast earnings per share CAGR of 11%, which has minimal cyclical risk attached to it and potential upside from a number of sources, we view this premium valuation as merited," they add.

The valuation ascribed previously is a sum-of-the-parts one. On a discounted cash flow model, shares could be worth almost a tenner, they add.

Clearly the senior board members got in at the right kind of level - and kudos to those savvy enough to follow - but there looks to be plenty more juicy gains in line for investors going forward.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.