Tech funds to outperform global equities

8th June 2017 10:50

by Neal Underwood from interactive investor

Share on

Technological innovation is constantly driving new products and services. It's slashing costs and improving the functionality of existing tech, too. With the added tailwind of demographics, technology has the potential to continue to be an investment growth area.

And technology is a big driver of returns globally. The so-called FANG stocks - , , and - have driven the US market to new highs - they're up between 25 and 30% so far in 2017, while the S&P 500 has risen a more modest 8% (in local currency terms).

These stocks are so dominant as their combined market cap is almost equivalent in size to our . This part of the market should also be hugely stimulated by Trump's spending spree, assuming it happens.

It is also playing an important role in the area of climate change, with technological developments in renewable energy, electric vehicles and battery storage shifting the transition to a lower carbon economy away from government policy, and into the realm of innovation and the market.

Stuart O'Gorman, director of technology equities at Henderson Global Investors and lead portfolio manager on , highlights a number of reasons why technology can deliver long-term growth.

Moore's Law

Coined in 1965 by Intel co-founder Gordon E. Moore, Moore's Law is the ability to roughly double the number of transistors which can fit onto a chip every two years. At the same time the cost is rapidly reducing. 1mb of dynamic random access memory (DRAM) in 1974 cost over $81,000. Today it costs 1 cent. As their capability increases and the price falls we are consuming more tech products.

Demographics is another key driver. Younger people generally consume significantly more technology than their grandparents. Over coming years technology is likely to become increasingly pervasive in people's lives as the rising number of 'digital natives' use more technology from autonomously-driven vehicles to healthcare and e-commerce.

Long-term trends

There are also powerful secular themes at play. You can see the long-term trends the Henderson fund is currently focusing on below. While growth in the highly penetrated PC and smartphone markets is expected to be slower than in the past, there are plenty of other trends, such as cloud computing and AI, which are disrupting traditional technology companies. When disruption hits, investment opportunities usually abound.

Source: Henderson Global Investors

Robotics is one area of technology which is seeing a rapid expansion. In its 2015 paper "The Robotics Revolution" Boston Consulting Group (BCG) projected the prices of hardware and enabling software would drop by more than 20% over the next decade.

This, combined with continual performance enhancements for robotics systems, is leading to a huge increase in the use of robots and automation, and causing widespread disruption across a broad range of industries.

While the innovations in robotics are hugely exciting to follow it should be cautioned that we are still in the fairly early stages of being able to invest in the story. This innovation will be the fuel of growth going forward, but there are some concerns about valuations looking expensive at present.

The future is happening now: robots can…

Source: Pictet Asset Management

The technology sector has some different characteristics to other parts of the market. It can be more volatile, but specialist investors can benefit from the strong growth profile of this innovative and continuously evolving sector.

Many technology companies are highly cash generative, which allows them to reinvest in the business, as well as growing dividends. , for example, has cash reserves of more than $200 billion, much of it held offshore. Changes to taxation on foreign cash could allow the company to repatriate much of it, which would be a positive for the sector.

There is also crossover into other sectors. Amazon, which began life as an online bookseller, now has around a third of the global cloud computing market via Amazon Web Services (AWS).

Technology companies dominate stock markets in terms of their size; Apple and are now the two largest constituents of the MSCI All Country World Index (ACWI), with Facebook the seventh largest.

There are a number of options if you want to invest in the technology sector. Funds which invest in technology in addition to the Henderson fund mentioned above include , , and .

Several exchange traded funds (ETFs) are also available, offering passive exposure. invests in a global basket of technology companies. and also offer exposure to specific areas of the technology sector, albeit we view them as highly speculative given their current high valuations.

Fund structure restrictions

It is worth nothing that funds investing in the sector, particularly those with a large-cap bias, have a structural issue related to the market capitalisation of some of the larger stocks such as Apple.

Apple's weighting in the benchmark MSCI ACWI Information Technology index, for example, is frequently in excess of 10%, which gives fund managers a headache in that they are restricted by regulations around UCITS funds (mutual funds based in the European Union) to a maximum 10% position size in any stock.

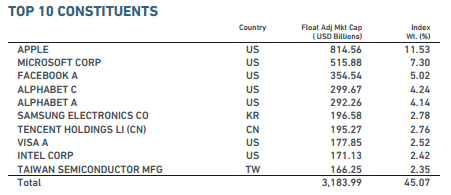

This means if a company such as Apple performs strongly technology funds' performance suffers in relative terms. You can see from the table below how highly concentrated the index is.

Source: MSCI. MSCI ACWI Information Technology index as at 31 May 2017

Long-term story continues

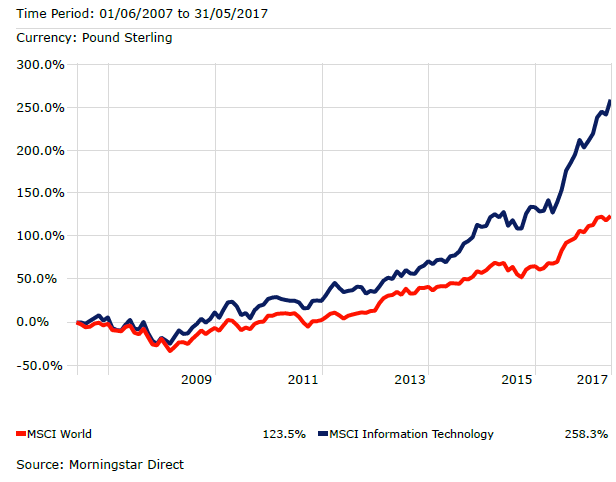

Whether you decide to go down the active or the passive route, the long-term story for investing in technology remains intact.

Despite some potential near-term headwinds such as protectionist policies in the US, Henderson believes the technology sector could outperform global equities over the medium term. As tech gets cheaper and faster, it will continue to take market share in the global economy.

10 year performance of MSCI World Information Technology index vs MSCI World index

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.