How to avoid being tricked by high dividend yields

9th June 2017 15:58

by Fiona Hamilton from interactive investor

Share on

Most UK equity income trusts and quite a few global trusts pride themselves on paying out attractive and rising dividends. The ability of trusts to keep their dividends rising more smoothly than those of their unitised counterparts is widely seen as a key attraction to investors, and the Association of Investment Companies (AIC) celebrates those that have succeeded in raising their dividends every year for the past 20-50 years as 'dividend heroes'.

However, investors who treat those rising dividends as spending money, and do not keep a watch on what is happening to the capital value of their holdings, could be in for a shock when they eventually need to raise some capital from their portfolios or decide it is time to shift their investment focus to a new area.

This is because reinvested dividends contribute substantially to the long-term total returns quoted in most performance tables, and capital-only returns can be substantially lower.

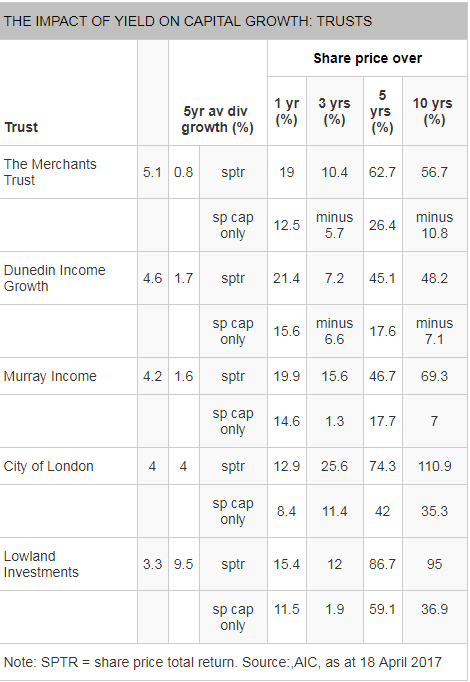

The consequences of spending rather than reinvesting dividends are illustrated by comparing the share price total and capital-only returns on the . As the table below shows, over five years the capital-only returns (i.e. what is left if dividends are not reinvested) are 45% lower than total returns and over 10 years they are 75% adrift.

To confirm that this is not a UK-only problem, we also show the share price total and capital-only returns on the MSCI Europe and MSCI AC Asia ex Japan indices over the same four periods. The disparity is not quite as great, but it is still significant, with share price capital-only returns lagging share price total returns by 22% over five years on the European index and by 40% on the Asia ex Japan index.

| The impact of yield on indicies' capital growth | |||

|---|---|---|---|

| Index | One year (%) SPTR | One year (%) SP capital only | Ten year (%) SPTR |

| FTSE All-Share In | 17.2 | 13 | 67.4 |

| MSCI AC Asia Pacific ex Japan | 30.4 | 26.4 | 136 |

| MSCI Europe | 22.2 | 19.2 | 118.1 |

| FTSE 350 High Yield Index | 19.1 | 13.2 | 49.6 |

Note: SPTR is the share price total return. Source: Association of Investment Companies, as at 18 April 2017.

Returns disparity

Trusts with total return mandates seem likely to demonstrate a similar disparity between share price total and capital-only returns to their benchmark indices, which of course they seek to outperform, while for growth-oriented trusts which pay out negligible dividends the disparity should be less.

However, for income-oriented trusts the disparity is liable to be wider, because their income bias encourages the trusts to invest in companies which are themselves paying out quite a lot of their cash flow in dividends rather than investing it back into their businesses, and this can reflect or adversely affect the investee company's growth prospects.

The relatively poor performance of the FTSE 350 High Yield index over the past three, five and 10 years (as shown in the table) lends support to this thesis, and it is noteworthy that the share price capital-only returns on the High Yield index have lagged even further behind the share price total returns than they have on the FTSE All-Share index.

Another consideration is that some of the higher-yielding trusts among the AIC's dividend heroes have had to resort to a variety of measures in order to maintain that status, as have other income-oriented trusts that are struggling to keep raising their dividends.

These measures typically include progressively raising the proportion of fees and charges allocated to capital rather than income; charging most of the interest on their borrowings to capital when all the income on the investments purchased with those borrowings is allocated to revenue; and dipping increasingly regularly into revenue reserves to boost dividends.

Such ruses will inevitably exacerbate the gap between total and capital returns, as will asking shareholder permission to start supplementing earnings per share from capital in order to bolster dividend cover.

If we look at those trusts that offer the highest yields in the UK equity income sector, the contrast between their total share price total returns (which is the figure featured most prominently in most comparative tables and advertising literature) and their capital only share price returns (which are seldom mentioned) is sobering.

is a prime example. The yield on its shares is the highest in the UK equity income sector and undoubtedly much-treasured by some investors, and it is an AIC dividend hero, having raised its distributions every year for 35 years.

But its average dividend growth over the past five years has been a paltry 0.8% a year, and although its share price total returns have been better than the FTSE 350 High Yield index over five and 10 years, they have been among the weakest in the UK equity income sector. As a result its share price has actually fallen over the past three and 10 years, and over the past five years it is up by just 26.4%.

Merchants' yield has been bolstered by taking on the highest gearing into equities in the UK equity income sector, and allocating 65% of fees and finance costs to capital on the grounds that this "reflects the board's investment policy and prospective split of capital and revenue returns".

The latter statement sits oddly with chairman Simon Fraser's statement in Merchants' latest report and accounts that "we are committed to generous dividends and dividend growth and this was reaffirmed as a key objective as the recent annual strategy session by the board".

Despite their miserly growth, Merchants' dividends have exceeded earnings per share in six of the past eight years, and as a result revenue reserves are down to 10.6p per share, equal to 43% of last year's total distribution.

and are the next-highest yielders in the UK equity income sector, and Murray Income ranks eighth highest in the AIC's dividend heroes list, having raised its dividend in each of the past 43 years. Both are managed by Aberdeen Asset Management's UK equity income team. Over the past five years their share price total returns have been the worst in the UK equity income sector, while their annual dividend growth has been around half the sector average.

DIG deploys gearing of 14%, and charges 60% of management fees and interest to capital. Investors in DIG who have taken and spent all their dividends have seen the capital value of their shares fall over three and 10 years, and rise only 17.6% over five years. Murray Income has lower gearing and its supporters have achieved slightly better, but nonetheless deplorable, three-, five- and 10-year capital-only share price returns.

By way of contrast, ranks top in the AIC's dividend heroes list, having raised its dividend every year since 1967, and it is proof that aiming for a consistently above-average and growing yield can be combined with respectable capital returns.

Commendable yield

CTY's shares boast a 4% yield despite trading at a slight premium. Its dividend has grown by an average of 4% a year over the past five years. Its longstanding manager, Job Curtis, deserves considerable praise for having also achieved better capital-only share price total returns than the FTSE All-Share index over the past three, five and 10 years.

Its charges are exceptionally low and its gearing is modest at 6%, so allocating 70% of fees and interest costs to capital has had a relatively limited impact. However, CTY's capital value might have held up better, and its dividends might have grown even faster, if it had started the period with a lower yield.

This is demonstrated by a comparison with , which has a more volatile 10-year history than CTY, thanks in part to manager James Henderson's persistent inclusion of a lot of medium and smaller companies in the portfolio.

LWI offers a lower yield than CTY, but its average dividend growth over the pastfive years has been an impressive 9.5%. None of its fees or interest charges are allocated to capital, and the disparity between its share price total and capital-only returns over most periods is usefully tighter.

The message is that investors who want to spend all their dividends but grow their capital at the same time need to think hard about how to balance those objectives. Focusing too much on higher-yielding trusts seems liable to damage your wealth.

This article was first published by our sister magazine Moneywise, available online here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.