Why big youth vote has major ramifications for financial markets

12th June 2017 13:09

by Lee Wild from interactive investor

Share on

Financial markets remain predictably nervous Monday as Theresa May clings to her job amid ongoing attempts to guarantee a parliamentary majority. It means Friday's stockmarket recovery has partially unravelled, with problems elsewhere causing further concern around the UK economy.

Arguments around the approach to Brexit rumble on, and credit card giant has just reported the first fall in consumer spending in nearly four years.

Year-on-year spending on Visa debit, credit and prepaid cards fell by 0.8% in May, the first reduction since September 2013. Much of that was due to the quickest decline in spending on the high street since early 2012.

And there's further fallout from last Thursday's election, with a snap poll by the Institute of Directors (IoD) revealing "a dramatic drop in business confidence and huge concern over political uncertainty, and its impact on the UK economy".

A poll of almost 700 business leaders showed a negative swing of 34 points in confidence in the UK economy from the IoD's survey in May - 20% are optimistic and 57% are either quite or very pessimistic. That -37 read compares with -3 last month.

"It is hard to overstate what a dramatic impact the current political uncertainty is having on business leaders, and the consequences could - if not addressed immediately - be disastrous for the UK economy," said Stephen Martin, director general of the IoD.

And it is with the election in mind that makes some interesting observations Monday.

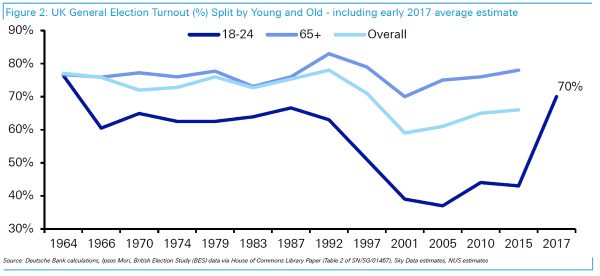

Jeremy Corbyn's surprise success was driven largely by younger voters - early data suggests a turnout among 18-24-year-olds of around 70%. That's potentially the highest in at least two generations, says Deutsch strategist Jim Reid.

In every election since 1964, between 70% and 80% of those aged 50-plus turned out to vote. By contrast, 18-24-year-olds appeared to lose interest after 1992.

Until then, turnout among the younger age group was steady at 60-68%. But in 1997 it fell to 54%, then 40% in 2001, 38% in 2005, and 52% in 2010.

"If [latest data is] confirmed this has major ramifications for politics and financial markets over the next few years in the UK and possibly further afield," argues Reid.

Nothing was ever going to change while the young - loaded with debt and unable to get on the housing ladder - failed to make their voice heard at the ballot box.

"However, if the youth are now waking from their apathetic slumbering then policy surely has to be more redistributionary," says Reid. "Given that you can't alienate the grey vote then the real difficulty is that politicians will struggle to tax the old but need to give the young more of a helping hand.

"This is not a recipe for austerity and debt reduction - both are looking increasingly like political suicide."

And Reid thinks we're at an inflexion point.

"In short, governments can possibly be forced to spend more across the developed world until bond markets rebel at the high level of debts that this implies, and then central banks would be forced to monetise this debt."

That means helicopter money more likely, according to Reid. "This is different from QE as its central banks buying bonds that are attached to fresh spending rather than independent of it."

We'll get a better idea of the level of support May enjoys tonight when she addresses the 1922 Committee of Conservative backbenchers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.