Why Lloyds Bank shares are a post-election 'buy'

14th June 2017 12:41

by David Brenchley from interactive investor

Share on

was most definitely flavour of last month, with a number of high-profile investors driving its share price up 5.5% to its 25 May high of 73.5p. It was also the month the government completed the sale of its remaining stake, signalling a new chapter for the high street lender.

We've already mentioned those backers, the likes of Neil Woodford and Mark Slater who have taken stakes, and even broker Barclays talked up prospects, adding Lloyds shares to its European Top Picks portfolio.

But since hitting a one-year high three weeks ago, the stock has pulled back and now stands 2p lower than the start of May at a shade under 68p.

Clearly the election has played a part - shares had ticked up ahead of polling day, but fell back in the aftermath. And there's a technical reason for the retreat, described in detail by our technical analyst John Burford last week.

However, domestically oriented stocks have weathered the storm reasonably well, with the bouncing back to 20,000 and more.

Now, broker Investec, one of Lloyds' biggest cheerleaders, reiterated Wednesday its positive view on UK-focused banks in general, with the only lenders on its 'sell' list the pair with largest exposure to overseas markets - and .

"Following share price falls, it gives us fresh cause to take an overtly positive stance on UK domestic banks," said analyst Ian Gordon. "In our view, tail risks are receding and the outlook is set fair."

On Lloyds, its investment thesis is unchanged and he reaffirmed his 'buy' recommendation and 75p target price. "We continue to believe that Lloyds' consensus upgrade cycle is unfinished."

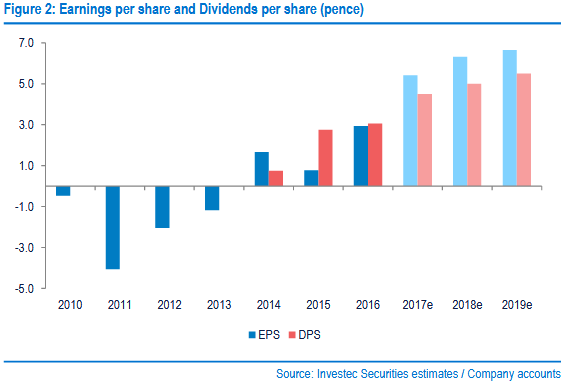

Gordon admits that, as Lloyds advanced on his target price late May he thought there was limited upside on price. However, then, the main investment case was built around the dividend, which he has long expected to step up from 3.05p per share in 2016 to 4.5-5.5p through 2017-2019.

At 5.5p in 2019, its prospective yield would stand at a colossal 8%. On a more bullish view of the divi, Gordon reckons guided capital generation of about 200 basis points with an unchanged core equity tier 1 (CET1) target of 13% could, theoretically, support 6p per share.

With prime minister Theresa May currently negotiating a potential deal with Northern Ireland's Democratic Unionist Party (DUP), Gordon believes any perception of increased economic risks due to no overall majority government will subside in time.

"While not necessarily providing the same strength and durability as a formal coalition, we believe that the proposed 'confidence and supply' arrangement can still deliver a beneficial outcome for the United Kingdom," he explained.

In general, Gordon has 'buy' ratings on , , and , and a 'hold' on .

Gordon has been busy this morning, also sending through a note to clients on OneSavings, which has also pulled back slightly since hitting an all-time high 477p on 23 May.

It's currently 16% lower at 403p, but Investec has a target of 455p - not quite a record level, but still offering potential upside of 13% over the next 12 months.

Dividend is key here, too. OSB has an increasing capital surplus, so a step up in what is already a generous payout is "highly likely" at full-year 2017. "We forecast 14-20p per share through 2017-2019, a prospective 2019 yield of 5%."

HSBC and Standard have negative views due to a recovery in the GBP-USD exchange rate being a "likely headwind".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.