The 10 investment trusts I have picked for my pension portfolio

16th June 2017 16:32

by Heather Connon from interactive investor

Share on

Should my retirement fund have any cash in it? What about an exposure to bonds and property? Are emerging and frontier markets too risky for a pension? These are the questions I am grappling with in the final stage of my retirement planning.

I have spent more than 30 years selecting investment funds and shares and assembling specimen portfolios as a journalist, and I now have to put this into practice in a SIPP to finance my own retirement.

Regular readers will know that this is the fourth stage of my financial preparations for retirement. First, I worked out that I will have around £550,000 in money purchase pots from three previous employers, and looked into the different ways I could start drawing down my pension.

Secondly, I approached financial advisers to see what they recommended - and concluded that they were mainly charging a lot for something I should be able to do on my own.

Thirdly, I compared the charges and investment choice of a range of providers of do-it-yourself self-invested personal pension (SIPP) plans; I concluded that although Fidelity initially looked one of the more expensive providers, its special rates for investment trusts make it the best value, given that I intend to use primarily trusts. The final stage is to decide how much tax-free cash to take and how to invest the balance.

No annuity required

I am fortunate as my husband has an index-linked final salary scheme from his career as a teacher, which covers our living expenses and means that I do not need certainty of income. That means not only that I can rule out buying an annuity, but also that I can be a bit more adventurous with my choice of investments, rather than buying bonds or other investments with a predictable income.

I have decided I need about £2,000 a month, or £25,000 a year. I have spent a long time debating whether to take the 25% tax-free cash: although I do not need a lump sum to pay off a mortgage, travel the world or any similar project, I could use the £130,000 or so this would raise to fund five or six years of living expenses, thereby delaying drawing income from my SIPP until I am closer to state pension age. This could have tax advantages.

Additionally, I will still do some freelance writing and have around £4,000 in income from a rental property, but this combined extra income is likely to be quite low and could well be below the £11,500 personal allowance.

I would invest some of the £130,000 rather than leaving it all in cash, so assuming a very generous return of 5% on the lump sum overall (including both invested funds and cash on deposit), this would produce income of around £6,500. As far as investments are concerned, the first £5,000 of dividend income this year would be tax-free (although that allowance falls to £2,000 next year), and tax on the remainder would be at a low rate of 7.5% as I will be a basic-rate taxpayer.

As well as the personal allowance of £11,500 and the personal savings allowance of £1,000 of interest, low income earners also benefit from a 0% "starting rate" of tax on up to £5,000 of savings interest. So if my total taxable income is below £17,500 - which it probably would be - there would be no tax on interest earned by any cash left in the bank. I could also use my Isa allowance to shelter £20,000 of the lump sum, so taken together that means the effective tax rate on this option would be quite low.

On the other hand, if I do not take a lump sum but start drawing down my pension straightaway, I would incur income tax at 20% on anything above the £11,500 personal allowance. Financial advisers have also warned that with drawdown, the taxman can take 40% tax on payments, leaving me to claim the excess back when I fill in a tax return. Taking the lump sum therefore seems the best option - and the remaining fund can carry on growing, assuming a fair wind for financial markets, for another five or six years.

The next issue is asset allocation: how should I spread my fund between equities, bonds, cash and other assets such as property? I looked at the Wealth Management Association website, which has a range of portfolios depending on the amount of risk investors want to take, and at other suggestions for the best spread of assets for those approaching retirement.

Using a model portfolio

While some model portfolios would recommend having a significant portion of a retirement fund in cash and lower-risk assets such as property and bonds, the size of my fund and the fact that I will not have to depend on it exclusively for income and that I will not start accessing it for at least five years, means I feel I can be a bit more adventurous.

I will not hold any cash at the moment as the lump sum will give me plenty of liquid funds, although I will consider having a cash buffer when I am finally drawing down on the fund. While I acknowledge the security of income that gilts and blue-chip corporate bonds give, I am concerned about their very low yields and high prices due to the quantitative easing programmes and abnormally low interest rates across the world. Likewise, I think that property yields are looking quite stretched at the moment - although equities too have had a fantastic run.

My instinct has always been more for income than growth funds, even though I will not actually be taking any income from the fund now; I have spent years advising readers that income forms a key part of total returns and, as I will be reinvesting the income for now, I want to make the most of this compounding.

Money Observer has a range of model portfolios (see the May issue or go to moneyobserver.com for the latest update on their performance), and I have taken a few investment ideas from these.

I want to use mainly investment trusts for a range of reasons: the charges tend to be lower; they can use gearing to boost returns; they can pay dividends out of reserves, which means they can use those reserves to keep income growing even in lean years - something unit trusts and other open-ended funds cannot do; and the charges all SIPP providers levy on investment trust portfolios are lower than those for open-ended ones. Fidelity, where I intend to open my SIPP, caps its charges for investment trust portfolios at just £45.

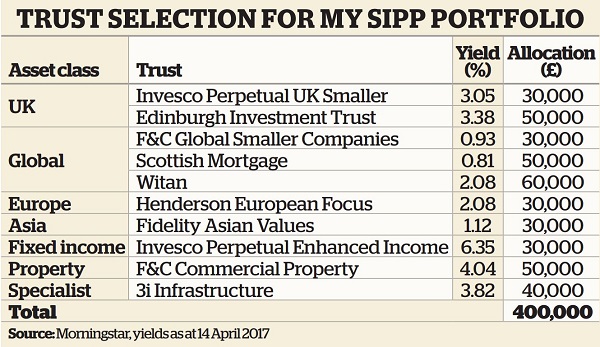

I will have around £400,000 in my fund after taking out my tax-free lump sum, and I plan to invest it in a range of UK and global funds. In choosing the funds for my pension, I drew not only on the income Model Portfolios but also on a portfolio I compiled for Money Observer's November 2016 investment trust supplement, comprising 10 funds which have increased their dividends in each of the past 15 years, and on Money Observer's investment trust portfolios. While my portfolio will have a majority of equity income funds, I will also have some property, fixed interest and infrastructure exposure.

Brexit means go global

I have selected 10 funds for the portfolio. Only a fifth of the portfolio is in UK holdings, as I am worried about the impact of Brexit on the economy and am keen to tap into more global growth potential. Here, I have opted for Mark Barnett's , a longstanding solid performer, and , chosen because history shows that, over the longer term, smaller companies do better than their bigger counterparts, and this trust has an excellent track record and skilled managers.

I have selected three global funds: the relatively conservative , where manager Andrew Bell has proved adept at allocating assets between his stable of managers; , a long-term favourite of mine with a very individual style, and to add some growth spice.

There will also be a further two regional specialists: , as I feel that the European market offers good value at the moment, and , to get exposure to some of the world's fastest-growing economies. There is not a huge choice of fixed income investment trusts, but I am happy to plump for , run by the formidable team of Paul Causer and Paul Reed.

Property is provided by , and I have also chosen to include - despite its high premium - as I think this is a very attractive asset class.

I can, of course, switch funds at any time should any of these falter or other attractive areas crop up, although I do not intend to make frequent changes. When my tax-free lump sum runs out, I will switch to more reliable income producers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.