Buy, hold, sell: High income share trades

16th June 2017 10:16

by Marina Gerner from interactive investor

Share on

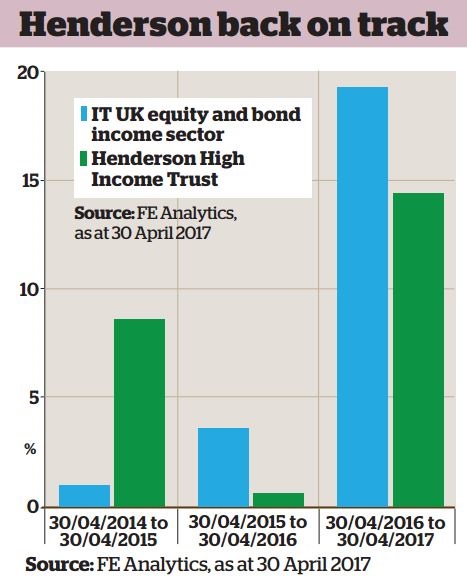

David Smith has been the lead manager of since 2014. Most of the portfolio is in equities, but Smith is also able to hold up to 20% in bonds. Currently, the split is 90:10 in favour of equities, a historic low in terms of the portfolio's bond holdings.

The trust has a dividend yield of 4.9%, and the dividend grew by 3% over the past year. Smith aims to "provide investors with a high dividend income stream while also maintaining the prospect of capital growth".

The trust is 21% geared. It has almost a third in financials and a further 35% in consumer goods and services. More than 90% of its portfolio is concentrated in the UK. It returned 8.3% over three months and 14.9% over one year.

BUY: Pets At Home (LSE:PETS)

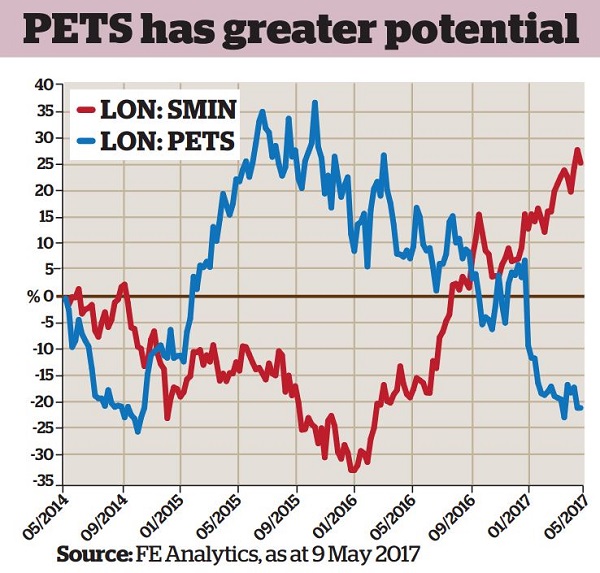

Smith first bought this mid-cap stock in December 2016 at £2.10. He added more to his portfolio when its price went down to £1.80 in January, and added to it once again in February.

The company is the UK's largest provider of pet supplies. "It is a clear market leader," says Smith. "Its share of the retail market is bigger than the combined share of the next five companies." In addition, Smith argues that pet supply tends to remain strong, even in down times, so it is a good backstop for the portfolio.

He explains that is tapping into a trend towards "better-quality, more-natural, grain-free food that is better for pets". He adds: "It's a very cash-generative business, and 80% of its profits are on the retail side."

The other side of the business is services, which he finds most interesting as a growth opportunity. That aspect of the business focuses on vets and grooming for pets. It has joint ventures with some 450 vets, where it provides their back office services and takes a fee from their profit. "It is capital-light and low-risk," says Smith.

He adds that veterinary practices take about seven years to reach profitability and that 11% of these joint ventures have already reached this stage, while the earnings growth looks promising for those who are yet to reach maturity. The company has a dividend yield of 4.5%.

HOLD: Smiths Group (LSE:SMIN)

At the end of last year, bought this general industrial company at around the £14 mark. There are three main divisions in the business. The first one provides mechanical seals to the oil and gas industry.

He says: "That division has been under pressure over the past few years, given the recession we've seen in commodity prices, especially oil and gas, but I think we are at a turning point. There's a slow increase in production and a gradual increase in capital expenditure, which should support what is a really good business."

The second division produces medical equipment for hospitals. There hasn't been much innovation or research and development in this division recently. However, Smith says: "The new management team that has come in is doing a lot more product development. That should boost growth."

The third division produces items such as airport scanners. Smith says: "Unfortunately, there is only going to be an increase in security." He adds that the company is a global market leader and is acquiring the number two, Morpho Detection, a takeover which already has Financial Conduct Authority approval.

"Morpho is a faster-growing business with higher margins, and you've got the potential for cost synergies." The new management team is focused on improving operational efficiencies and cash flows too, says Smith.

SELL: Tui AG (LSE:TUI)

Smith recently sold . "I got nervous about the UK division. Given sterling's weakness, it's going to be harder for UK families to go on holidays overseas. I think that will restrict the trading of the company, certainly in the UK division," he says.

He adds that it's quite a capital intensive business, as the company has been building new hotels on the Continent and new cruise ships to drive growth. "That is constraining cash flow growth at the moment, which has implications for dividend growth."

He continues: "You can't grow the dividend unless you've got sufficient cash flows. So there are a few reasons why I was happy to look for opportunities elsewhere, given the sterling weakness and the cash intensity of the business." He bought the stock, which was Tui Travel at the time, at £3.42 in July 2014. Later that year, Tui Travel merged with its German parent company, Tui AG, so the stock's current price is no longer representative of the company originally bought.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.