Names to watch as IPO pipeline hots up

20th June 2017 12:48

by Neal Underwood from interactive investor

Share on

Initial public offerings (IPOs) often bring interesting small companies in niche areas to wider attention. Today, superyacht painting, supply and maintenance company GYG (Global Yachting Group) announced plans for a £47 million AIM float.

Based in Spain, a major superyacht refit hub, GYG has operations across the Mediterranean, Northern Europe and the US. Its clients include 25 of the 50 largest superyachts, and the company has a 17% market share.

It is aiming for an initial yield of 3.2%, rising to 6.4%, calculated on the placing price, which could make it an attractive investment from an income perspective.

After a relatively subdued 2016, the IPO pipeline is showing increasing signs of strength, according to Ernst & Young (EY), which produces a quarterly Global IPO Trends report.

"Volatility in currency and political uncertainty have continued to hold back activity within the IPO market, in particular on main market listings outside of the investment industry," says Scott McCubbin, EY's IPO Leader for UK and Ireland.

"Now that the UK government has triggered Article 50 we are expecting a number of companies to list within the two-year negotiating period to take advantage of the European passporting regulations, as well as the greater access to European investors that they offer.

"As a result, we expect to see a larger number of IPOs taking place in the last quarter of 2017 and early 2018."

Overall in the first half of 2017 to date there have been 37 IPOs (25 on the main market and 12 on AIM), raising a total of £3.4 billion. In Q2, £2.2 billion was raised from 20 deals, of which 13 were main market and 7 on AIM. Eddie Stobart Logistics is the largest IPO in Q2, with £393 million raised.

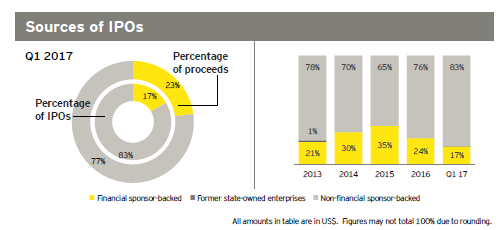

Source: Ernst & Young Global IPO Trends Q1 2017

By comparison, the second quarter of 2016 had only 13 listings, 4 main and 9 AIM, raising £553 million. EY notes this was largely driven at the time by the impending European Union referendum slowing market activity.

In addition to GYG, Supermarket Inc REIT, which intends to buy a portfolio of supermarket real estate assets in the UK, has announced its intention to float on the main market. And yesterday, special purpose acquisition company Rockpool, based in Northern Ireland, said it would list on the main market in July before buying a local company.

And, like the weather, IPO activity in June is hotting up.

Other market wannabees include Israeli technology company Ethernity Networks, investment companies Eurocastle and Residential Secure Income, Verditek, a clean technology business, oil & gas outfit i3 Energy, and DP Eurasia, the master franchisee of the Domino's Pizza brand in Turkey, Russia, Azerbaijan and Georgia.

EY tells Interactive Investor that appetite for larger premium listing IPOs can be slower in an environment where the FTSE is rising rapidly. However, an overall increase in the market value also ensures investors are watching closely, which helps new IPO candidates gain greater exposure.

There are typically 'windows' at certain times of the year when IPOs are more likely to take place. These remain key drivers in activity, says EY.

"Whilst it is increasingly possible to list outside of these, the availability of the advisors and, in particular, the banks to deliver is much harder. The windows are likely to remain a key feature of the IPO market for many years to come."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.