Why this portfolio just sold half its US holding

30th June 2017 15:13

by Ceri Jones from interactive investor

Share on

Can nothing derail the stockmarket? continued to rise the day after the general election, in the face of the hung parliament result that commentators had warned would precipitate a widespread sell-off, a downgrade of the UK's credit rating and ultimately even a bailout from the International Monetary Fund.

The All-Share ended the day up 0.9%, while the , which tracks larger stocks, rose 1.1%.

Even before the election, the FTSE had gained ground despite the political uncertainty coupled with two other destabilising events scheduled to take place on the same day: the potentially explosive testimony of former FBI director James Comey before the Senate Intelligence Committee, and the European Central Bank (ECB) monetary policy meeting.

The next few weeks will be critical, as we begin to gauge whether the newly formed government lacks the cohesion and decisiveness to tackle major issues. So far, stocks have held up remarkably well: such is the weight of money on the sidelines waiting for a bargain and happy to shrug off some pretty vicious political infighting. Just as in the aftermath of Brexit, any market turbulence is quickly finding a floor.

Plenty of thorny problems require action, however, such as a funding system for social care, on which prime minister Theresa May was forced to make such an embarrassing U-turn, and the long-term national debt. Recent PMI figures have also been disappointing, and may become the new norm as services firms shift their activity abroad in the wake of Article 50.

The traditional advice in the event of a hung parliament has been to buy blue chips and gold, and to sell gilts, corporate bonds and small company investments.

This is because as sterling weakens the exchange rate boosts the UK's largest companies, which are typically exporters and overseas earners. Astonishingly, however, the pound has also shown resilience and at time of writing had already begun to climb back after its sharp fall on election night.

Smaller, domestically focused companies in the and small-cap indices are still best avoided for now, as they depend on domestic earnings and could also be damaged by rising inflation, while they typically lack the resources to see them through lean times.

As for the argument to dump gilts and corporate bonds, that is based on the longer-term concern that any pressure on UK's credit rating would force down gilt prices, and the boost in yield would have a knock-on effect for corporate bonds which compete with gilts for investors' cash. That is not going to happen in the medium term.

The rest of Europe is also looking stoic. Growth in the eurozone has crept up to 0.6%, and the region is recovering from the debt crisis that pushed some countries, notably Greece, to the brink of bankruptcy.

The main frustration is inflation, which remains weak; the low level there is owed largely to a resurgence in oil prices. The ECB's meeting has successfully avoided panic by signalling the tapering of the stimulus effort, and keeping interest rates unchanged.

In France, president Emmanuel Macron, having beaten Marine Le Pen by 32%, is confident of support to push through his agenda. However, the French electoral system, with its two rounds, makes it hard to translate national vote projections into seats in the National Assembly; moreover the local profile of candidates has a powerful influence, which could work against the less well-established members of the République en Marche party.

In the US, too, the market has been upbeat with poor economic news failing to dampen investors' appetite for stocks. Jobs data has been disappointing, with 138,000 new jobs added last month - well below predictions - while the unemployment rate fell to 4.3%, the lowest level since 2001.

Underlying corporate earnings continue to be quite strong, so even Donald Trump's failure to make good on his policy promises is being shrugged off, for the time being at least.

However, despite their resilience, Europe and the US are pushing against the fundamental tide. US valuations in particular are so heady that the best that may be hoped is that the market will move sideways over the summer.

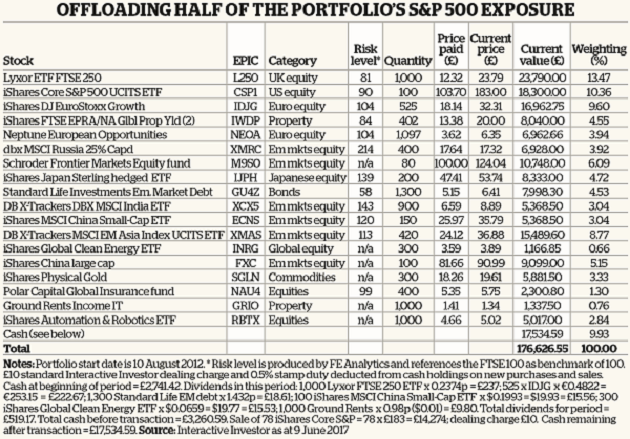

While a Trump impeachment remains unlikely, the government's instability is unnerving and could quickly create some kind of unexpected blow-up. With this in mind, we are going to sell down half of the US holding, the , which will also release a cash fund for any unexpected opportunities that may be thrown up over the holiday season.

Given a choice, investors should be looking farther afield to avoid the dangers of overpriced stocks. Japanese companies have experienced strong earnings growth but are still on relatively cheap valuations compared with the US and UK, and corporate earnings and household spending are both improving.

As an outward-facing country, Japan quickly catches any contagion, and so, for instance, the Nikkei fell on Trump rhetoric on the halt of globalisation, but it does not suffer from the problems found elsewhere such as stretched banks or the prospect of deflation.

Prime minister Shinzo Abe's use of negative interest rates and unusual ¥4.6 trillion ($45 billion) fiscal stimulus, launched last August, show real commitment to reviving the economy.

In India the BSE Sensex, the main Indian stockmarket, has passed 30,000 and returned over 22% a year since Narendra Modi became prime minister in May 2014. Although Modi caused a sell-off last year by demonetising all 500 and 1,000 rupee notes, his reforms by and large continue to please investors.

Their focus is on industrialisation and investment in infrastructure, and on efforts to cut through red tape such as the Goods and Services Tax Bill so as to harmonise regional levies into a single unified VAT system.

GDP growth is over 7% and the government has been gradually opening various sectors of the economy such as construction, cable, agriculture to foreign investors.

In demographic terms, India is perfectly placed in the cycle with an average age of around 30, of whom 99% now have a bank account - twice the number two years ago. On a forward price/earnings (PE) ratio of 17.7, India is more expensive than other emerging markets, but piffling compared with developed countries such as the US.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.