What to expect from the stockmarket in July

3rd July 2017 10:07

After traditional weakness in June, share prices often bounce back in July, making this month a short period of strength in an otherwise weak six-month spell (May to October).

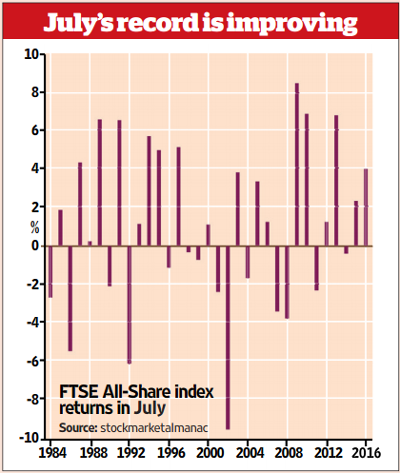

Since 1970, the has returned an average of 0.8% in July, and positive returns have been seen in 53% of years. This makes July the fifth strongest month of the year for shares.

As the chart shows, in recent years the market has exceeded its longer-term performance. In the past eight years the market has fallen in July just twice, and the average return has been 3.3%. July is currently on a roll.

On average, the month begins robustly: the first week of July is among the top 10 strongest in the year. The market then tends to drift lower for a couple of weeks before finishing strongly in the month's final week.

July is one of just three months (the others being September and October) when the tends to outperform the mid-cap , although the outperformance is small.

In sterling terms, July is the second-best month for the FTSE 100 relative to the S&P 500: the UK index has outperformed the US index by an average of 1 percentage point this month since 1984.

Shares that have done well in July include , , and - all three shares yielded positive returns in July in nine of the past 10 years.

Shares that have historically performed weakly in July include and .

July is also a busy month for companies announcing their interim results.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks