The 10 most popular funds - June 2017

5th July 2017 09:48

by Marina Gerner from interactive investor

Share on

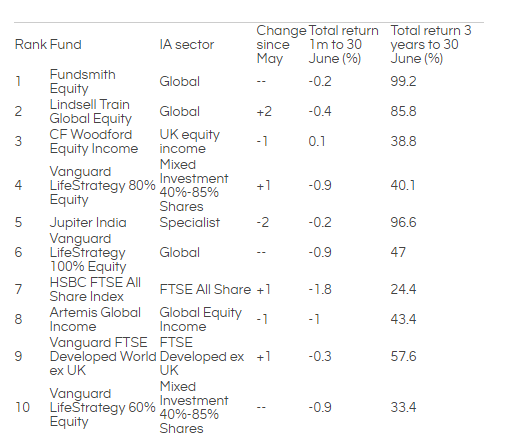

Once again, took the top position in the most-bought funds on our website in June.

The fund has over half its assets in US equities and is managed by highly regarded investor Terry Smith. Ever since it toppled over a year ago, it has been the most-bought fund in our list.

Money Observer Rated Fund climbed two spots to be second on the list. Jointly managed by Michael Lindsell and Nick Train, the fund returned 15.5% over six months and 27.1% over one year.

Neil Woodford's eponymous open-ended fund - CF Woodford Equity Income - took third place in June. The UK equity income fund gained 0.1% over one month to and it gained 16% over one year.

Woodford hopes that sectors such as biotech will eventually pay off, and thanks to his popularity the fund remains hugely popular despite underperforming the Investment Association's UK equity Income sector, which gained 19.3% over one year.

Half of the top 10 most-bought funds were passive ones, which indicates a wider trend to opt for low-cost tracker funds.

The fourth place in the list, for instance, was taken by , which focuses on North American equities, UK equities and European ex UK equities as well as global bonds.

It was closely followed by , which went down two spots to be the fifth most-bought fund in the list. The fund gained 32.6% over the last month and an astonishing 96.6% over the last three years.

With the UK's impending messy divorce from Europe and unfulfilled expectations in relation to Trump's policies, investors have been turning to emerging market funds. In India specifically, new tax reforms are seen as a positive development for the economy.

The sixth spot was taken by another passive fund, . It was closely followed by passive fund , which took seventh spot and gained 1.7% over three months.

was the eight most-bought fund in June. It benefits from a global spread as one third of its holdings are in US equities, 14.8% in Italian equities and 7.6% in German equities.

The ninth spot was taken by , which has 61% in US equities and 9.7% in Japanese equities.

And finally, the tenth place was taken by another tracker, , which has 26.4% in US equities, 19.3% in global bonds, and 14.9% in UK equities.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.