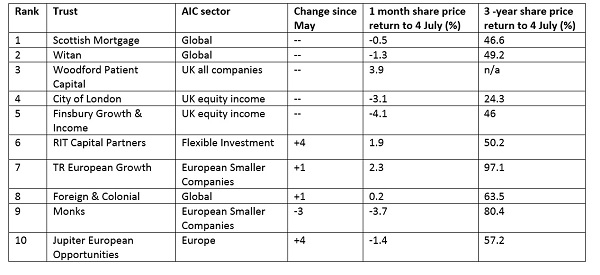

Top 10 investment trusts - June 2017

7th July 2017 10:12

The most popular investment trust bought among investors on Interactive Investor continues to be . James Anderson's technology-slanted global trust continues to enjoy huge popularity. Further, it won Best Global Growth trust at Money Observer's 2017 investment trust awards.

There has been little movement in the top 10 list, as the top five investment trusts have firmly remained in place and unchanged from last month.

took second place. The multi-manager trust outsources its portfolio to external fund managers, who invest in different regions and it is also a Money Observer Rated Fund.

has taken the third spot in May. Initially disappointing, the trust's performance has picked up recently, and it returned 3.9% over one month to date.

came fourth, followed by , winner of the Money Observer Best UK Income trust award.

The biggest riser in June was , which climbed four spots to be the sixth most-bought trust in May.

The multi-asset trust is described as a wealth preservation fund because it invests in a cautious manner. Its popularity is perhaps no surprise given that it has returned over 50% over three years, despite its defensive stance.

Two European trusts have also climbed up the list. took seventh place. It invests in smaller European companies and returned an impressive 97.1% over three years and 2.3 over one month.

Added to that, , which has 33% in UK equities and 26% in Germany equities, climbed four spots to enter the list in 10th. It returned 25.5 % over six months, but over one month the Europe sector shed 0.4% and the fund lost even more at 1.4%.

experienced the biggest fall from grace in the list, as it went down by 10 spots from seventh to 17th spot. It shed 2.5% over the last three months and gained 30.2% over one year. Given the stark ups and downs in commodity fortunes this trust is not one for the faint-hearted.

The eight spot was taken by , managed by Paul Niven. The trust, which has 45.9% in North American equities and 20.2 in Europe ex UK, returned 0.2% over one month and 33.1% over one year. , which took the ninth spot, has 46.6% in US equities. It lost 3.7% over one month, and returned 58.7% over one year.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks