Chart of the week: Be wrong and still make money

10th July 2017 11:19

by John Burford from interactive investor

Share on

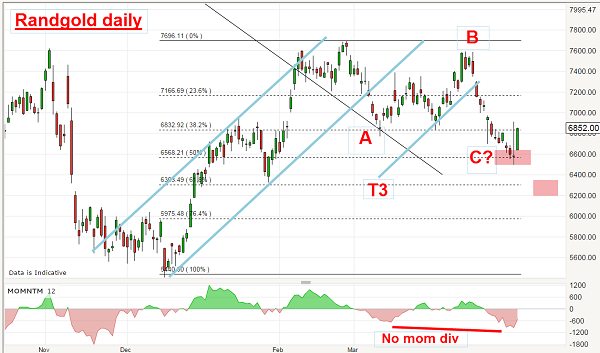

Randgold is on a knife-edge

With gold in a strong downtrend, I thought I would update my coverage of which I last analysed three weeks ago on June 19. The recent severe gold weakness has naturally impacted on the company shares negatively - and today I have a lesson in how to avoid big losses when the market moves adversely.

As a trader, your main concern should be how to stay out of major trouble (not so much how to hit a home run). It only takes one major big hit to your account to place you in serious hot water. You must use strategies to avoid this such as using stop losses and other more sophisticated methods such as the one I outline here.

Believe me, paying more attention to managing your trades after you are in them is far more valuable than your original trade decision.

I operate the VIP PRO SHARES service where I track many UK and overseas shares and trade them using my unique Tramline Trading methods. For a three-week Free Trial, click here.

Recall on June 19, I had bought the shares on a Fibonacci support line at the £66 area in early May. This was the chart I used to guide my decision:

I noted the potential A-B-C pattern (but without the confirming momentum divergence) and the bounce off the £66 level seemed to confirm the uptrend had resumed. As forecast, the market did rally above the B wave high, and I was looking for a place to take partial profits to lock in at least some gains.

This is what I wrote then: "So the market staged a very sharp rally to the £77 level to match the old high back in March. Short term traders would have captured a very tidy £11 (+15%) gain."

And with that little profit in the bank, I moved my stop loss on the open long position to break-even using my Break Even Rule. This is a very handy money management rule that ensures at least some profit is retained on the campaign. If the market does the unexpected and moves lower, I would be stopped out on the last part with zero loss and have a profit in the bank on the first part. Nifty, huh?

And guess what, the market did indeed move lower into June and this is the current position:

On Friday, the shares have come back to the £66 area and lie right on the lower trendline. How about that? My promising A-B-C pattern I suggested last time has been completely wiped off the board. That happens sometimes. Your best guess forecast at any particular time has the potential to be totally wrong.

But the lesson here is that even if you are wrong, you can still make money! What could be better than that? As I maintain, the First Rule of Trading is this: "Lose no money. If you do, make the loss as small as possible".

So now, with the shares testing the lower trendline, what is our strategy? We are close to being stopped out on the remaining long position and if we are taken out, at least we have a profit.

With the metal price falling, odds are that if gold can stage a rally from near here, the shares should follow. So, what is the outlook for gold prices here?

One factor I closely watch is the market sentiment picture of the metal. This is fairly easy to track. I use the Daily Sentiment Index (DSI) and that shows a bullish figure of only 10%, which is near a record low. That means only 10% of financial advisors are bullish (90% are bearish) on a gold rally.

As a contrarian, that is like a red rag to a bull (or a bear!). When an extreme plurality has moved to one side of the boat, it invariably capsizes. And I believe this will occur with gold and the miners pretty soon. Then, a short squeeze of some magnitude will develop.

I shall be looking for another buying opportunity, but using my established tramline trading methods.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.