Best global equity funds of 2017

11th July 2017 12:25

by Andrew Pitts from interactive investor

Share on

Exposure to US equities has driven returns for many of the winning global funds at this year's Money Observer fund awards. Andrew Pitts and Holly Black analyse the winners.

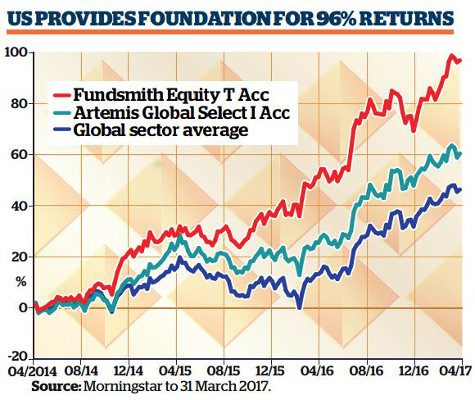

Best larger global growth fund

Fundsmith Equity

1-year return: 30.0%; 3-year return: 96.1%

is by now well known. It is unswervingly to buy good companies at the right price and do nothing. It's a philosophy that has seen the fund return to win our Best Larger Global Growth Fund award for a second year running, having previously been highly commended in 2015, and has ensured it has been listed among our Rated Funds every year since 2013.

Fundsmith Equity has returned 30% over the past year and is top quartile over three years with a stonking return of 96%.

Managed by industry stalwart Terry Smith, the fund looks to invest in high-quality businesses which have a high degree of certainty of growth and advantages that are difficult to replicate. He likes companies that are resilient to change and are not over-leveraged; established firms with big brands whose shares, in an ideal world, he can hold forever.

Smith says it is virtually impossible to predict stockmarket movements, so instead he aims to hold companies that are strong enough to continue to grow their intrinsic value regardless.

There are just 29 holdings in the £10.8 billion behemoth of a fund, and around 34% of its assets are in consumer staples companies, with a further 28% in healthcare stocks. Its largest investments include household names such as , and . Only a handful of holdings have been changed since the fund's inception.

Smith's eponymous fund was launched in 2010 after the veteran manager decided to go it alone, having worked in the City since he started out with Barclays Bank in 1974. The fund continues to grow at an exponential rate, having almost doubled its assets under management from £5.8 billion in the year since our last awards were decided.

Best Smaller Global Growth Fund

Artemis Global Select

1-year return: 29.3%; 3-year return: 60.7%

aims to find companies across the globe with strong positions in their chosen market, which have robust balance sheets and pricing power. It has been managed by Simon Edelsten since its launch in 2011; he believes that regardless of the economic environment, companies with these qualities should be able to continue to grow. Edelsten runs the fund with Alex Illingworth and Rosanna Burcheri.

The team look at long-term themes to help them pick their stocks, but also use an element of value discipline to ensure they are not overpaying for opportunities. They say they exercise patience and will only invest at the right price. Up to 20% of the fund's assets can be held in cash if the managers wish to provide some protection in uncertain times, though currently only around 5% is in the money market.

With the ability to invest across the globe, only about 5% of the portfolio - which is just shy of £68 million in assets under management - is currently in UK companies, with more than half in US stocks such as Microsoft and , and a further 7% in China.

Such a high exposure to US companies has paid off over recent months, as the stockmarket across the pond has soared and many firms have reported strong results. Edelsten says and have been particularly strong holdings, with sales growth of 22% and 23% respectively in the first three months of the year.

He adds that he is less cautious about share price valuations than he was a year ago, despite the fact that many global equity funds have produced strong returns for investors over recent years.

Highly commended larger global growth fund

Artemis Global Growth

1-year return: 29.3%; 3-year return: 67.0%

looks for companies around the world that it thinks are attractively valued because they may be out of favour, but that have the potential to grow.

The team uses in-house software to screen a firm's finances, to help spot winners and keep decision-making objective; the aim of the exercise is to draw the manager's attention to important financial information and stop information overload.

The fund spreads its assets thinly - its biggest holding, , accounts for just over 2% of the portfolio. Around a third of its £672 million of assets under management is in US stocks, with 8% in China and 7% in Japan.

Fund manager Peter Saacke, who has been at the helm since 2004, has been reducing his holdings in oil companies such as Woodside Petroleum and , as he thinks the fundamentals of the industry have deteriorated; instead he is overweight in construction, banking and auto companies.

The fund is in the second quartile over the past year, but has produced top-quartile performance over three years.

Highly commended smaller global growth fund

Premier Global Alpha Growth

1-year return: 26.7%; 3-year return: 63.2%

invests in companies across the globe; launched in 2008, it has been managed by Jake Robbins since 2011.

The fund's biggest weightings are in the financial and consumer discretionary sectors, which each account for 18.6% of its £103 million of assets under management. It invests primarily in large and medium-sized companies across both developed and emerging markets, and screens some 5,000 businesses in its investable universe, giving each a score for quality, value and growth.

The scores are combined to provide a clear ranking for each possible stock, which Robbins uses to help construct his portfolio. He looks for firms that don't have too much debt, can grow their earnings consistently and outperform over the long term.

Currently, almost half of the fund's assets are in US stocks, with 19% in Europe and 13% in Asia. Its biggest investments are in credit card company and semiconductor company .

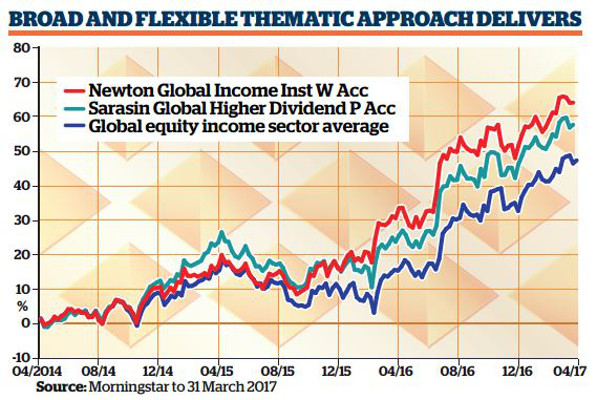

Best global equity income fund

Newton Global Income

1-year return: 25.0%; 3-year return: 62.3%

is a first-timer winner in our awards but has been a Money ObserverRated Fund since 2013. Launched in 2005, the fund was taken over two years ago by Nick Clay and has maintained its strong track record since. Clay had worked on the fund for more than three years before he took the helm.

The £5.5 billion fund aims to provide investors with income as well as long-term capital growth and is currently yielding around 3%. Clay is strict when it comes to generating an income, and every one of the fund's holdings has to meet a minimum requirement of yielding at least 25% more than the FTSE World index at the point at which he invests in the stock. He will sell the share if its yield falls below that of the index, which is currently yielding around 2.4%.

Clay follows Newton's thematic approach, which analyses major areas of change in the world to find investment ideas. The strategy aims to give a long-term perspective on stockmarkets and economies, and to make sure fund managers are considering investments in a broader context.

While the fund has the flexibility to invest across the globe, currently it has 45% of its assets in US company shares and 20% in UK stocks. Its biggest investments include Microsoft, and .

But the manager also has a cautious outlook; he has been concerned that this year will be a mirror image of 2016, which had a strong second half following a disappointing first six months.

Highly commended global equity income fund

Sarasin Global Higher Dividend

1-year return: 26.7%; 3-year return: 56.2%

is back among our award winners after a year's hiatus, having won the title of Best Large Global Equity fund in both 2014 and 2015. It has also featured among our Rated Funds for the past two years.

Guy Davis and Guy Monson have now been with the fund for two years and one year respectively, and have delivered a second-quartile return over the past 12 months. Monson, who returned to the fund after having previously run it from 2007 to 2012, pioneered Sarasin's thematic approach to investment. This looks to identify global trends - such as ageing populations - and the companies most likely to benefit from them; that's likely why one of the fund's largest positions is in pharmaceutical giant .

The £408 million fund also invests in large insurance groups and .

The fund aims to deliver an income 50% greater than that of the MSCI World Index; currently it is yielding around 3%, compared to 2.4% for the index.

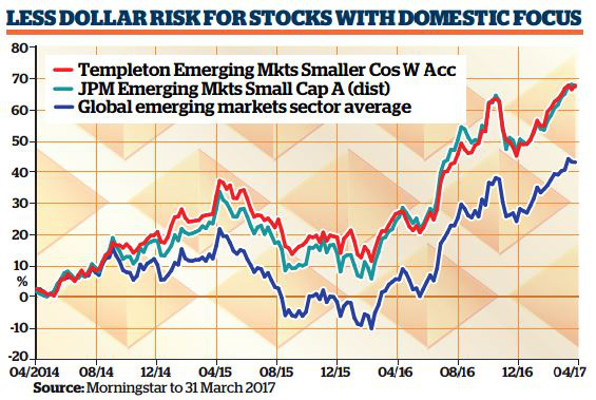

Best global emerging markets fund

Templeton Emerging Markets Smaller Companies

1-year return: 34.1%; 3-year return: 66.7%

Chetan Sehgal, who took over the running of the fund in April this year, is already director of global emerging market and small cap strategies at Franklin Templeton, and also runs the .

He has inherited a fund with a strong legacy. The has stormed to success in these awards for a third consecutive year, bagging the accolade of Best Emerging Markets fund in both 2015 and 2016. The awards stalwart is also a Money Observer Rated Fund.

In his first few weeks at the helm, Sehgal said Turkey, Poland and the Czech Republic were leading performance, while smaller companies in Brazil and Chile had also done well. Stronger earnings and economic growth have helped boost sentiment around Latin America in recent months, and Sehgal thinks smaller, domestically focused businesses are set to outperform their larger counterparts as they are less vulnerable to global macro factors such as the strength of the dollar.

Veteran investor Mark Mobius continues to be involved across the Templeton emerging markets suite, as well as a large team of analysts providing support from various locations worldwide.

Some 21% of the £721 million fund is in Indian equities, 11% in Korea and 8.5% in Taiwan; its biggest positions currently include Indian tyre manufacturer Apollo Tyres and South Korean pharmaceutical firm Medytox.

Highly commended global emerging markets fund

JPM Emerging Markets Small Cap

1-year return: 35.9%; 3-year return: 65.8%

spreads its investments primarily across companies in emerging markets which have a market capitalisation of between $1 billion (£770 million) and $10 billion; around a quarter of the fund is in companies that are smaller than this. Its largest weighting is to China, where 19% of its assets are invested, with Taiwan, India and South Africa also among its greatest regional weightings.

Manager Amit Mehta has steered the £1.27 billion fund since its launch in 2007, joined by comanager Austin Forey in 2015. The duo currently have a bias towards consumer discretionary companies such as Colgate-Palmolive, with some 28% of the fund invested in this sector.

The past year hasn't been the strongest for the fund, which is in the third quartile with a return marginally below the sector median of 36.5% over that period. Over three years, however, it is in the top quartile, ranked sixth among its peers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.