How property funds have changed since last year's crash

11th July 2017 13:39

by Neal Underwood from interactive investor

Share on

A year ago, many property funds including and suspended dealing following a marked rise in investor redemptions, caused by the high levels of uncertainty in the UK commercial property market following the Brexit vote.

Other funds managed to stay open for business, but applied "fair value adjustments" of varying levels to stem redemptions, 15% in the case of and 17% on .

These were designed to prevent investors selling, with properties in the portfolio at artificially high prices and to protect existing investors. If property prices were subsequently downgraded, remaining investors in the fund would have been at a disadvantage.

At the time M&G said: "Redemptions have now reached a point where M&G believes it can best protect the interests of the funds' shareholders by seeking a temporary suspension in trading. This will allow the fund manager time to raise cash levels in a controlled manner, ensuring that any asset disposals are achieved at reasonable values."

Fund manager Fiona Rowley sold a number of properties from the portfolio to raise the cash allocation. Up to 19 October 2016, 58 properties were sold, exchanged or placed under offer for a total of £718 million, at an average discount of 3.5% to their value at 23 June 2016. That, M&G believed, gave the fund sufficient cash to meet likely redemptions. The fund's suspension was finally lifted on 4 November.

L&G and Aberdeen removed their fair value adjustments in September last year. Many of the funds have retained elevated cash levels in case of redemptions, which can create a "cash drag" on performance. They have also been more defensive in terms of their positioning, selling lower quality assets with shorter leases. Holding smaller properties can also be a way of addressing potential liquidity issues.

, for example, invests at least half the portfolio in smaller, largely regional properties valued between £10 million and £30 million.

The situation raised the question of the appropriateness of open-ended funds with daily liquidity for an essentially illiquid asset class. It's not clear why daily pricing is necessary for bricks and mortar property funds. Property, in general, takes months to sell, but funds promise investors their money back at a day's notice. This seems a big anomaly. And the issue these funds ran into was that this promise can't be kept if too many people want their money back at the same time.

Investors could consider other ways of accessing property, for example through property equity funds, or closed ended-vehicles such as investment trusts or real estate investment trusts (REITs).

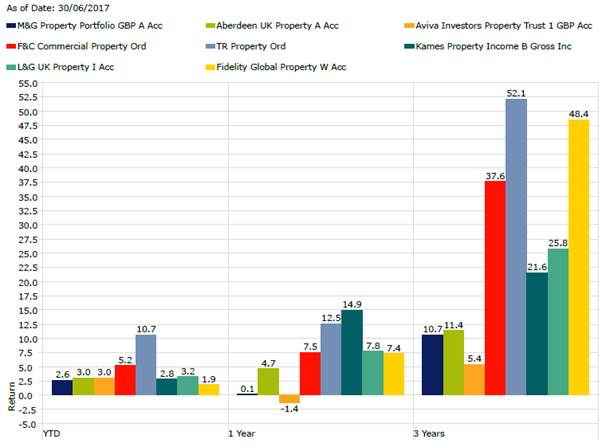

A year on, how have property funds fared? You can see from the chart below that two closed-ended funds, and , have performed well year-to-date as they haven't had to deal with the redemption issues which their open-ended counterparts have suffered. The two investment trusts are also in the top three of these selected property funds over three years.

Meanwhile, of the funds which suspended trading last July, M&G Property Portfolio has been more or less flat over the last year, while Aviva Investors Property Trust has fallen 1.4%.

F&C Commercial Property, TR Property, Kames Property Income, L&G UK Property and are Money Observer Rated Funds.

When property funds become forced sellers, it is bad for their investors and bad for the property market in general. We saw that in 2008 when UK commercial property values fell by more than a third, and regulators remain concerned about the risks of open-ended property funds.

Although the situation is calm at present, with the suspended funds trading as normal once again and redemptions within manageable levels, there is always the potential for a mismatch between what property funds offer investors and what they can actually deliver.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.