James Henderson: Picking the Brexit winners

12th July 2017 11:29

by Marina Gerner from interactive investor

Share on

Was Henderson Global Investors' James Henderson, highly regarded manager of the Lowland investment trust, in that camp? He says: "Yes, I was definitely surprised, and shocked and worried. We always worked knowing the rules, but now it's unclear what the rules are going to be. I really like the open market in Europe. I believe in the European ideal and that it has actually worked, but this story was never really told in the campaigning."

However, two things helped Henderson feel less pessimistic after the Brexit vote. The first was the thought that UK companies have always faced difficulties.

He says: "They've dealt with big recessions, and lots of manufacturing has had to go overseas, but they have survived." Sterling fell following the vote, which was useful for exporters because their exported products became cheaper; Henderson has a weighting to industrials.

So what was the other consideration that helped him get over the Brexit result? Henderson says: "My son is a junior stockbroker, and after I'd been drinking lager, absorbing the outcome of the referendum and feeling down, he said to me: "Wake up Dad, change your shirt, put on a new suit and wait for all the opportunities about to be thrown up."

When 52% of those who voted in the referendum of June last year on EU membership chose to leave the EU, most people in the financial industry were caught by surprise, while the racked up two days of painful losses before recovering.

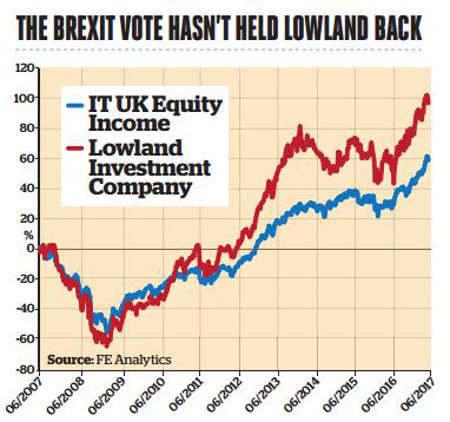

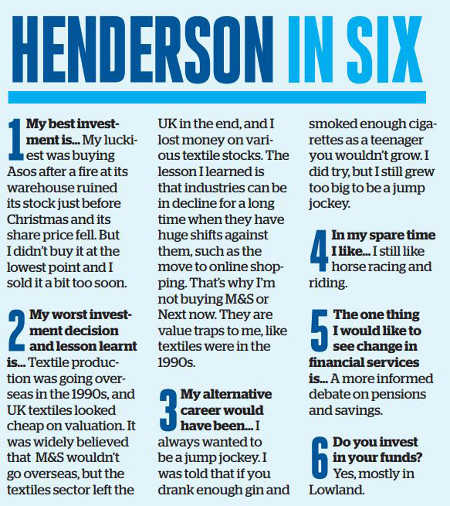

Indeed, the post-Brexit vote period has been a good time for the multi-cap so far: over the year to 9 June it returned 21.4%, compared with 20.4% from the AIC UK equity income sector. Henderson also manages the , which he describes as a one-stop shop.

He says: "It's in bigger stocks, has less in small-cap and AIM stocks, and invests 30% overseas [compared with the Lowland trust]." , his third charge, has 45% in AIM stocks. He says: "It goes after the next generation of small-caps, and it is the highest-risk fund [among the investments I manage]."

But while markets seem to have taken the Brexit vote and Donald Trump's presidency in their stride so far, Henderson is cautious. "You've got to be careful. This is a bull market that has been going on since March 2009. It's eight years old, and it is getting more mature," he says.

He is clearly also uncomfortable about the impact of the Brexit vote for many industries. He cites the example of a firm that presses steel. It buys raw material on the Continent, presses it in the UK and sends it back. "How is that going to work with tariffs?" he asks. Having said that though, he adds: "There will be a way through it."

Flexible firms will find their feet again

So how would a hard Brexit be likely to affect the exporters Henderson owns? "The World Trade Organisation (WTO) tariff rules are so different from one industry to another - even within product classes there are different rates - so it's difficult to generalise about what [signing up to] these rules might mean for companies. But 80% of our exports go to the Continent, so it doesn't look too clever if we're following WTO rules."

However, Henderson says: "There will be disasters because of Brexit, but most firms [I hold] will find a way forward, even if it means leaving the UK. Hopefully, it won't come to that, but if it does, the costs are not so high, because they are capital-light and technology-led."

By capital-light he means they are able to move their production fairly easily because they are not the heavy industries that once typified UK manufacturers. He invests, for example, in a chemical company, , which makes ingredients for hand creams made by big brands such as . Intellectual property now makes the fortunes of chemical companies, and a successful firm is one that provides vital ingredients for the next generation of products.

Henderson says: "In the old days, UK chemical firms made ingredients for the paint industry - it was all about volume. They had a lot of capital tied up in plant that they couldn't move cheaply."

Today it's more flexible, and production can be done in a research laboratory elsewhere. He adds: "You're making a low-volume ingredient that is important to the end product. When things get difficult, these companies have more flexibility to move production elsewhere."

Value to be found

Small caps were sold off following the Brexit vote on fears of a slowdown in the UK economy, and Henderson used this as an opportunity to top up existing holdings. "I'm value-oriented," he says. "When companies get cheap in terms of basic metrics, you should be interested."

He adds: "Six months before the referendum, I never thought I would buy a motor distributor such as . There are lots of new cars out there, but Marshall fell a long way, trading below its asset value, and we were able to buy stock cheaply. Luckily, the consumer kept buying in the aftermath of the vote, which shouldn't be a surprise, as 52% [of voting] consumers were happy with the result."

However, he cautions that there are medium-term problems on the horizon for the UK economy. "There will be a pretty big slowdown in the UK in the second half of this year, because wages aren't going up fast enough, while prices are going up. Consumer debt levels are already high, and that will lead to a fairly nasty squeeze."

While the stockmarket is already pricing some of that in, Henderson, "as a recovery guy who likes recovery shares", finds it difficult to buy recovery stocks until after recession has hit and the extent of the pain is more quantifiable. He says: "[There is] a lot of noise around the general election, and it's blamed for people not shopping, when what's actually happening is a nasty slowdown."

Troubling picture for retail

Henderson believes retail stocks in the UK will continue to face difficulties, no matter what happens, because of the shift from buying in shops to online purchasing. For that reason, he is underweight in retailers.

He does like some specialist retailers, for example furniture retailer - because "it tends to come out of recessions well and it generates lots of cash because it builds to order" - but he believes conditions will remain difficult for general retailers as inflation begins to rise faster than wages.

The problems retailers face are typified by those affecting , which Henderson considers a value trap. He says: "It's the same price as it was 15 years ago, and once a year it gets rid of the person who does ladies fashion. Its share price has gone up and down, but it can't buck the trend towards change on the high street."

There is a saying, he adds: "If a good manager meets a bad industry, it's usually the industry that keeps its reputation."

As a result of the pressures on the high street, Henderson is underweight in consumer stocks. He considers consumer brands to be expensive, while brand life cycles are getting shorter, partly due to the internet, because new competing brands can be established quicker.

and have become bigger positions in the large-cap area of Henderson's portfolio recently. He says: "The management changes at both companies are coming through." Among smaller companies, he has been buying .

Henderson is known as a manager whose funds suffer sometimes protracted periods of underperformance. He says: "There will always be periods of underperformance. I'm happier when there are, because that's when you can refresh your holdings. When shares are going up, you should be wary - start to slice and look for new things."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.