Best mixed asset funds of 2017

12th July 2017 16:48

by Andrew Pitts from interactive investor

Share on

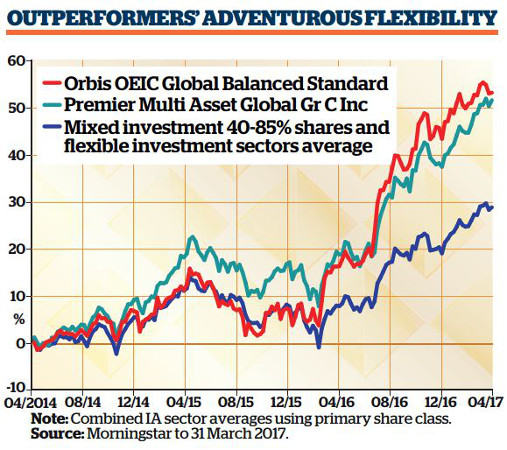

Best Higher Risk Mixed Asset Fund

Orbis Global Balanced Standard

1-year return: 32%; 3-year return: 53.6%

Our awards require winning funds to have a minimum track record of three years, and the has taken the title of Best Mixed Asset Higher Risk fund just three years after it launched in 2014. Managed by Alec Cutler, the fund is a top-quartile performer over one and three years.

Orbis takes a contrarian approach to investing, looking for good-value stocks with a view to holding them for the long term. The group has just two actively managed funds and this one is the lower-risk of the two. The firm's approach is to try and invest in companies the managers believe are worth a lot more than their current share price. Orbis says it aims not to follow the crowd, and that the best opportunities are in companies which are out of favour with other investors.

The Balanced Standard fund can invest in a range of assets, but currently has the majority - some 85% - in equities, with fixed income investments making up just 14% of the portfolio. Almost half of its assets are invested in the US, with 22% in Asia and 13% in the UK. Some 18% of the fund is in financial stocks such as US healthcare insurer , and 15% in healthcare companies such as biotech research firm .

Orbis says its approach means its funds may be out of sync with the rest of the market and may underperform at times, so investors should therefore invest for the long term.

Highly commended highly risk mixed asset fund

Premier Multi Asset Global Growth

1-year return: 27.6%; 3-year return: 51.5%

One of five multi-asset, multi-manager funds offered by Premier Asset Management, the fund is for "more adventurous investors". It aims to provide long-term capital growth by investing in a mix of equities, bonds and alternative assets in both developed and emerging markets - at least 75% of the fund's assets must be in equities and the portfolio can also include property and commodities.

The team, led by David Hambidge, currently favour emerging markets, Asia Pacific and Japan equities, where share prices are more attractively priced; together these three regions account for more than 35% of the fund's £131 million of assets under management. Just 4.5% of the portfolio is in the US, where the team thinks company valuations look expensive.

A first-time Money Observer Rated Fund this year, the team's brief is to provide returns while limiting volatility by investing in funds with varying strategies and styles. Its largest holdings are in GLG Undervalued Assets and Hermes Asia ex Japan Equity.

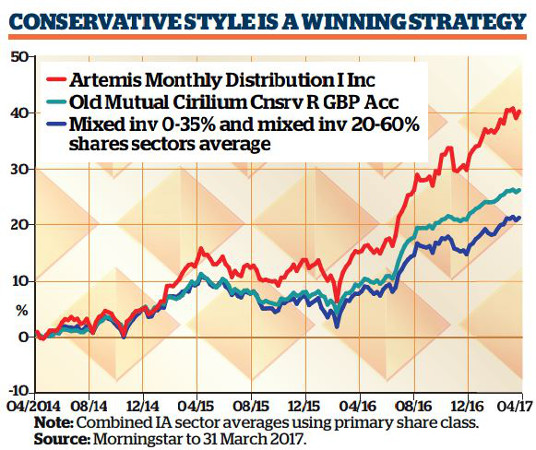

Best lower risk mixed asset fund

Artemis Monthly Distribution

1-year return: 22%; 3-year return: 40%

The fund aims to generate a healthy lower-risk yield by picking companies that pay solid, sustainable dividends. Currently the £467 million fund yields a chunky 4.2%. Managed by Jacob de Tusch-Lec and James Foster since its launch in 2012, the fund aims to deliver some capital growth while limiting volatility and providing predictable income, which is paid out monthly.

The duo look for quality businesses in a robust financial position, which should help them fund future dividend payouts. The fund invests across a mix of government, investment-grade and highyield bonds, choosing companies based on their ability to pay their debt and those which offer the most value for the risk that is being taken.

To provide capital growth, almost half of the fund is invested in equities across the globe; currently its biggest weightings are in the UK and US, which account for 22% and 14% of the portfolio respectively. Largest holdings include UK household products firm and Italian internet service provider El Towers.

The managers say government bonds have performed well recently, with slowing global economic growth spurring demand for surety among investors. High-yield bonds, meanwhile, have been affected by a fall in commodity prices, which has also dampened demand slightly for bonds issued by energy companies.

De Tusch-Lec and Foster add that bank and insurance bonds have also done well recently, which will have benefited the fund as it has almost 37% of its assets in the financial sector.

The fund is a top-quartile performer over one and three years, and was highly commended in our awards in 2015, though this is the first time it has taken top spot.

Highly commended lower risk mixed asset fund

Old Mutual Cirilium Conservative

1-year return: 16%; 3-year return: 26.1%

Old Mutual's Cirilium range of funds is managed according to different risk bands; the is the lower-risk option. With a focus on reducing the likelihood of significant short-term losses, it has almost three-quarters of its assets in cash and fixed interest investments.

Manager Paul Craig, who has run the fund since its 2012 launch, says that while he isn't expecting financial Armageddon anytime soon, he would not be surprised to see a short-term setback in the stockmarket after months of gains. As such, he has been reducing the risk of the portfolio recently and introducing some "alternative income" investments such as specialist credit funds and reinsurance funds.

The fund invests in other funds: some of its alternative income holdings include and . Some 6.5% of the fund is invested in property.

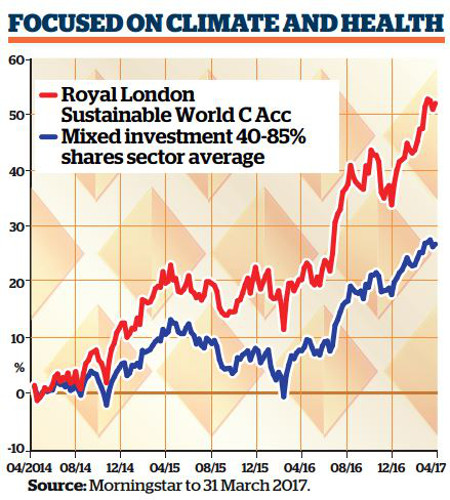

Best ethical mixed asset fund

Royal London Sustainable World

1-year return: 13.6%; 3-year return: 28.6%

A Money Observer Rated Fund since 2013, invests in a mixture of equities, corporate bonds and government bonds. The £339 million fund, which has been managed by Mike Fox since its launch in 2009, focuses on high-quality stocks across the globe, such as and .

It has some 38% of its assets in the US and a further 37% in the UK. Some of those UK bluechips have had a setback recently as sterling has strengthened, but the team aim to tap into the sustainable growth of investing in some of the world's best-known companies. Some of its biggest holdings include , and pest control company .

The Royal London team have a sustainable, rather than ethical, approach to investing and focus on themes such as climate change and healthcare.

While the fund has the freedom to invest across a range of asset classes, historically the majority of the portfolio has been in equities. Currently only around 15% of assets are in fixed interest and just over 2% is in cash.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.